Answered step by step

Verified Expert Solution

Question

1 Approved Answer

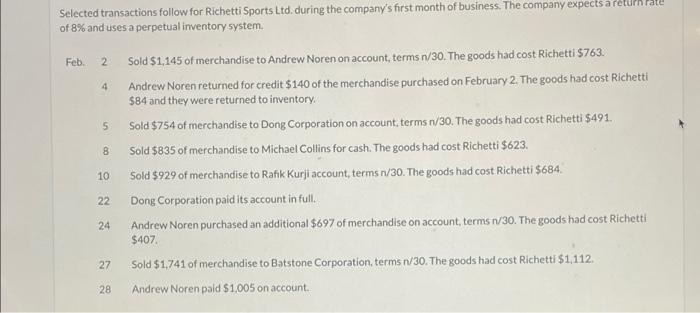

please do only if you 100% sure about the answer Selected transactions follow for Richetti Sports Ltd. during the company's first month of business. The

please do only if you 100% sure about the answer

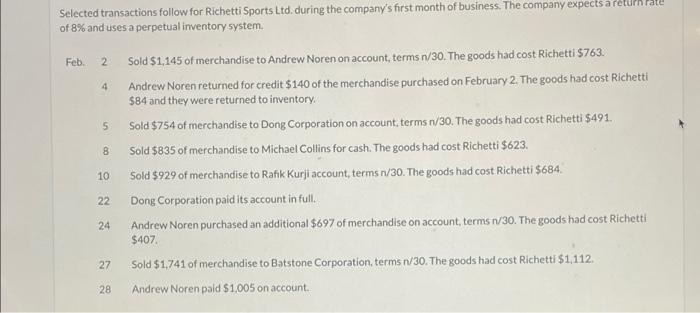

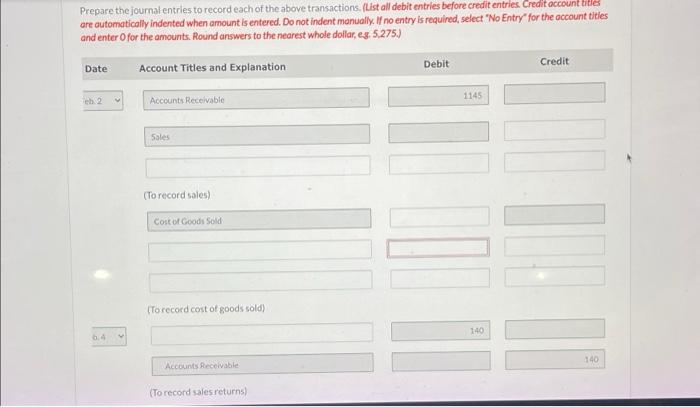

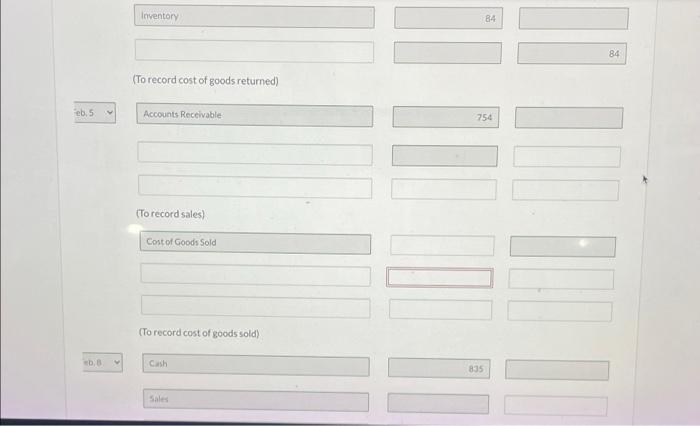

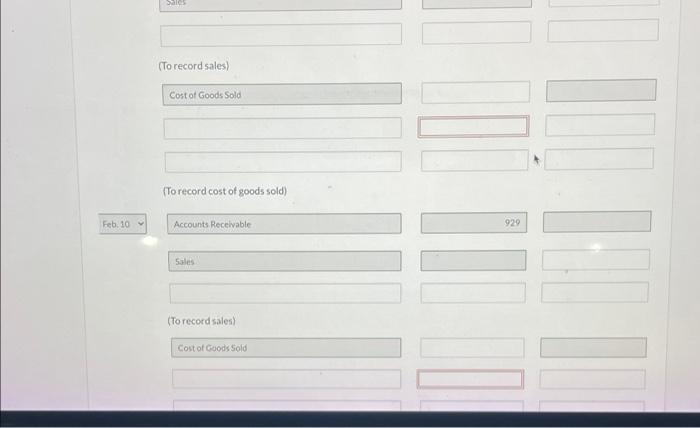

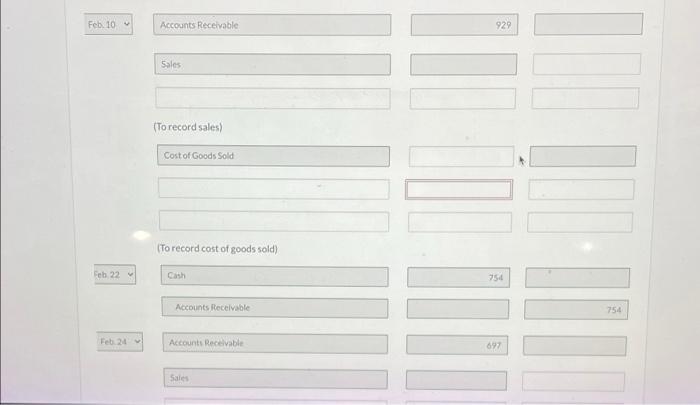

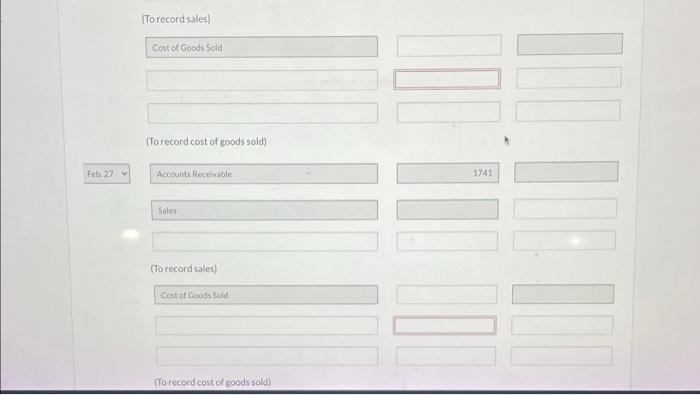

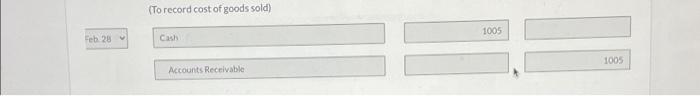

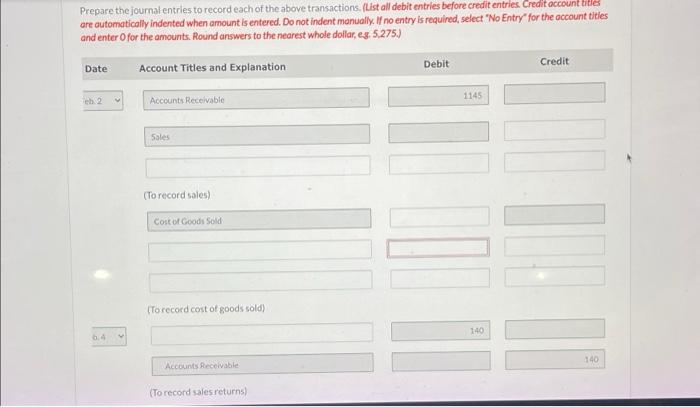

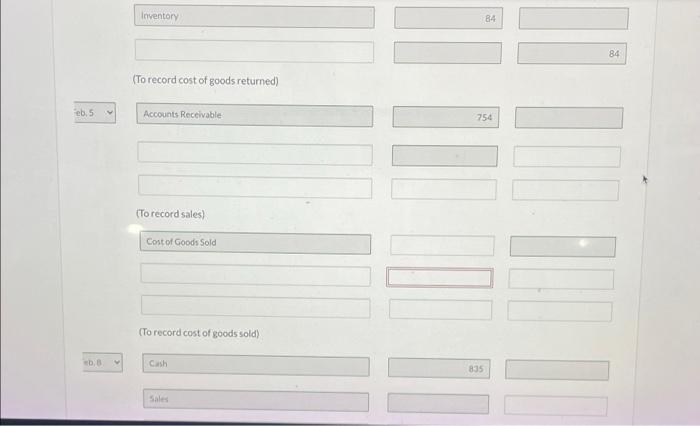

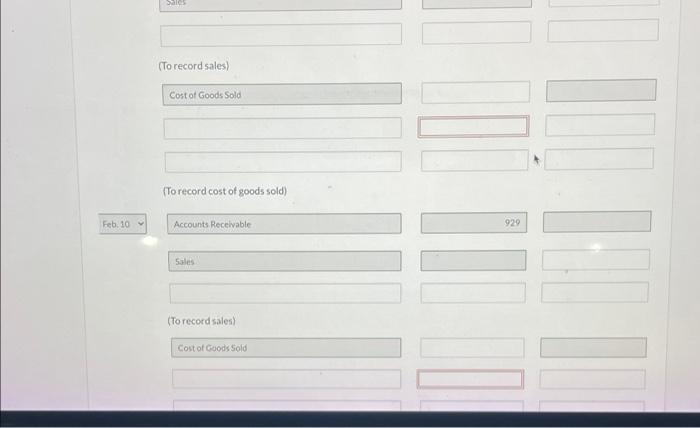

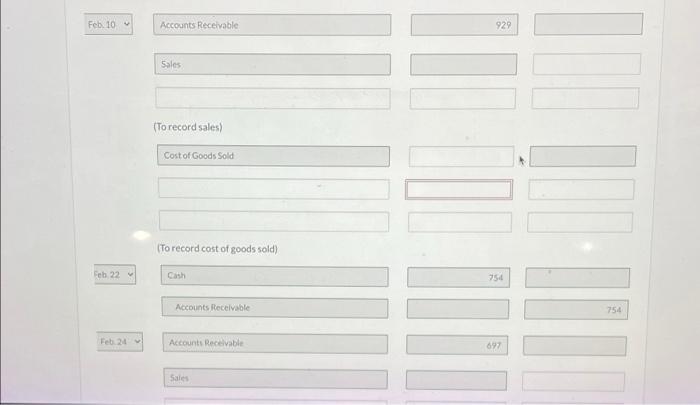

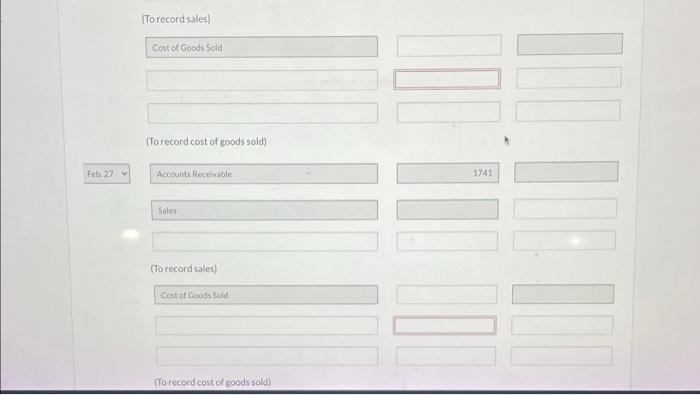

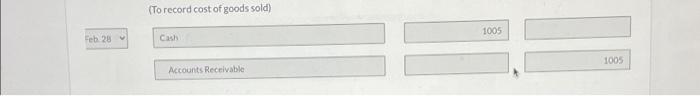

Selected transactions follow for Richetti Sports Ltd. during the company's first month of business. The company expects a return of 8% and uses a perpetual inventory system a Feb. 2 4 5 8 Sold $1,145 of merchandise to Andrew Noren on account, terms n/30. The goods had cost Richetti $763 Andrew Noren returned for credit $140 of the merchandise purchased on February 2. The goods had cost Richetti $84 and they were returned to inventory Sold $754 of merchandise to Dong Corporation on account, terms /30. The goods had cost Richetti $491. Sold $835 of merchandise to Michael Collins for cash. The goods had cost Richetti $623. Sold $929 of merchandise to Rafik Kurji account, terms n/30. The goods had cost Richetti $684 Dong Corporation paid its account in full. Andrew Noren purchased an additional $697 of merchandise on account, termsn/30. The goods had cost Richetti $407 Sold $1,741 of merchandise to Batstone Corporation, terms n/30. The goods had cost Richetti $1,112 10 22 24 27 28 Andrew Noren paid $1,005 on account. Prepare the journal entries to record each of the above transactions. (List all debit entries before credit entries. Credit account bible are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts. Round answers to the nearest whole dollar, es. 5.275.) Date Debit Credit Account Titles and Explanation 1145 Accounts Receivable Sales (To record sales) Cost of Goods Sold To record cost of goods sold) 140 140 Accounts Receivable (To record sales returns) Inventory 84 84 (To record cost of goods returned) eb5 Accounts Receivable 754 (To record sales) Cost of Goods Sold (To record cost of goods sold) | . Cash 835 Sales Sacs (To record sales) Cost of Goods Sold I To record cost of goods sold) Feb 10 Accounts Receivable 929 Sales (To record sales Cost of Goods Sold Feb. 10 Accounts Receivable 929 Sales (To record sales) Cost of Goods Sold To record cost of goods sold) Feb. 22 v 754 Accounts Receivable 754 Fet21 Accounts Receivable 697 Sales To record sales) Cost of Goods Sold . To record cost of goods sold) Feb. 27 Accounts Receivable 1741 Sales (To record sales) Cost of Goods Sold To record cost of goods sold (To record cost of goods sold) 1005 Feb. 28 Cash 1005 Accounts Receivable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started