Please do page 9 only based on the followong chart that is given

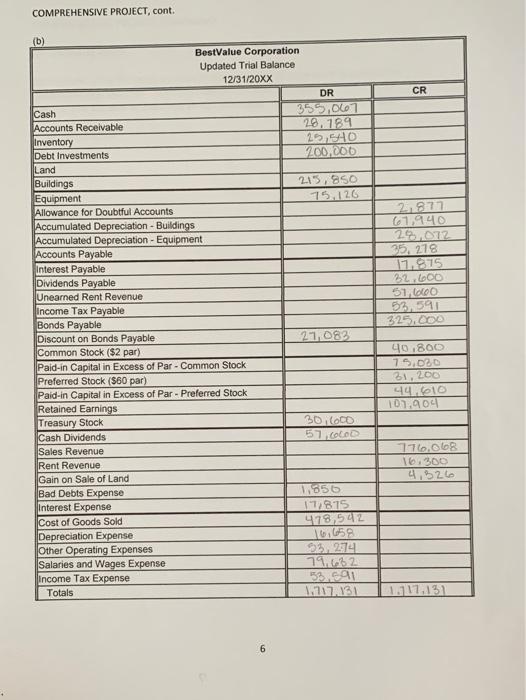

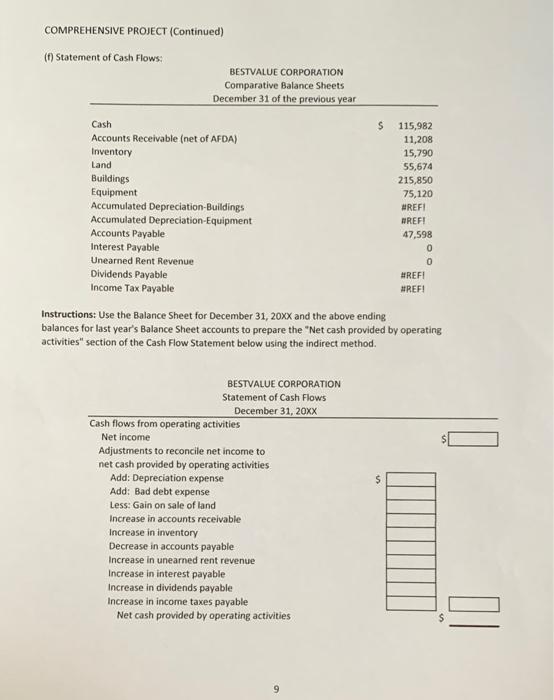

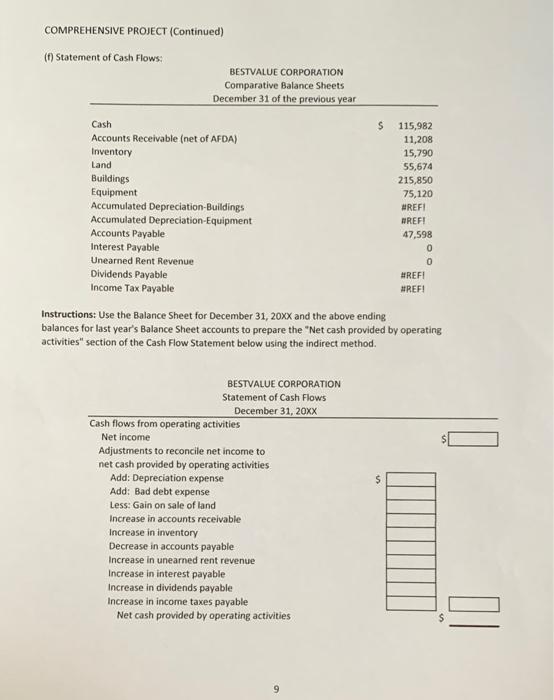

COMPREHENSIVE PROJECT (Continued) (1) Statement of Cash Flows: BESTVALUE CORPORATION Comparative Balance Sheets December 31 of the previous year Cash S 115,982 Accounts Receivable (net of AFDA) 11,208 Inventory 15,790 Land 55,674 Buildings 215,850 Equipment 75,120 Accumulated Depreciation-Buildings #REFI Accumulated Depreciation Equipment WREFI Accounts Payable 47,598 Interest Payable Unearned Rent Revenue Dividends Payable HREFI Income Tax Payable #REFI Instructions: Use the Balance Sheet for December 31, 20XX and the above ending balances for last year's Balance Sheet accounts to prepare the "Net cash provided by operating activities" section of the Cash Flow Statement below using the indirect method. 0 0 $ BESTVALUE CORPORATION Statement of Cash Flows December 31, 20XX Cash flows from operating activities Net Income Adjustments to reconcile net income to net cash provided by operating activities Add: Depreciation expense Add: Bad debt expense Less: Gain on sale of land Increase in accounts receivable Increase in inventory Decrease in accounts payable Increase in unearned rent revenue Increase in interest payable Increase in dividends payable Increase in income taxes payable Net cash provided by operating activities COMPREHENSIVE PROJECT, cont. CR (b) BestValue Corporation Updated Trial Balance 12/31/20XX DR Cash 355,061 Accounts Receivable 28.189 Inventory 22,50 Debt Investments 200,000 Land Buildings 215,850 Equipment 15.126 Allowance for Doubtful Accounts Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Accounts Payable Interest Payable Dividends Payable Unearned Rent Revenue Income Tax Payable Bonds Payable Discount on Bonds Payable 21.082 Common Stock ($2 par) Paid-in Capital in Excess of Par - Common Stock Preferred Stock ($60 par) Paid-in Capital in Excess of Par-Preferred Stock Retained Earnings Treasury Stock 30 Loco Cash Di nds 57COLOD Sales Revenue Rent Revenue Gain on Sale of Land Bad Debts Expense 1,856 Interest Expense 171875 Cost of Goods Sold 478,542 Depreciation Expense Other Operating Expenses 33, 274 Salaries and Wages Expense 79032 Income Tax Expense 53.491 Totals 2,877 61,440 28.012 35, 218 17.15 32 00 51 ooo 52,591 325.000 90.800 75.020 31, 200 49.610 101.904 171,68 1,300 4,326 AL\,\ 1.11.131 6

Please do page 9 only based on the followong chart that is given

Please do page 9 only based on the followong chart that is given