Please do part 2 only urgently. Business has started with $5000 cash balance before this forecast(just 1 transaction).

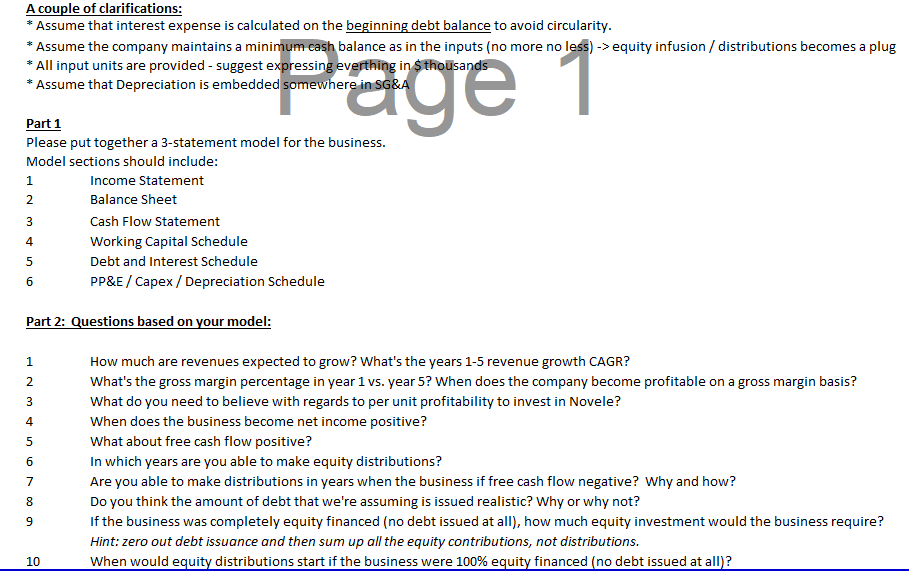

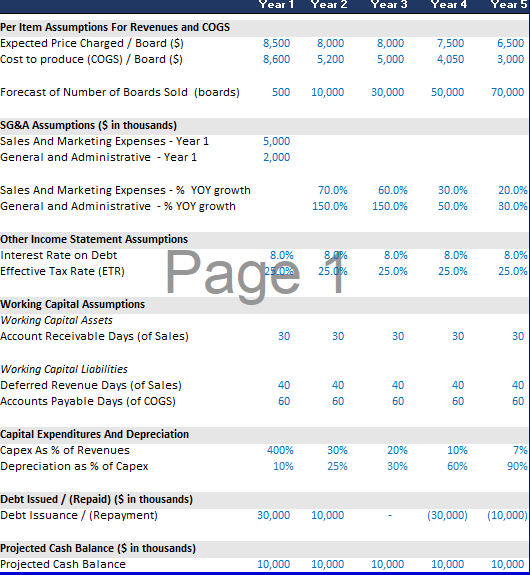

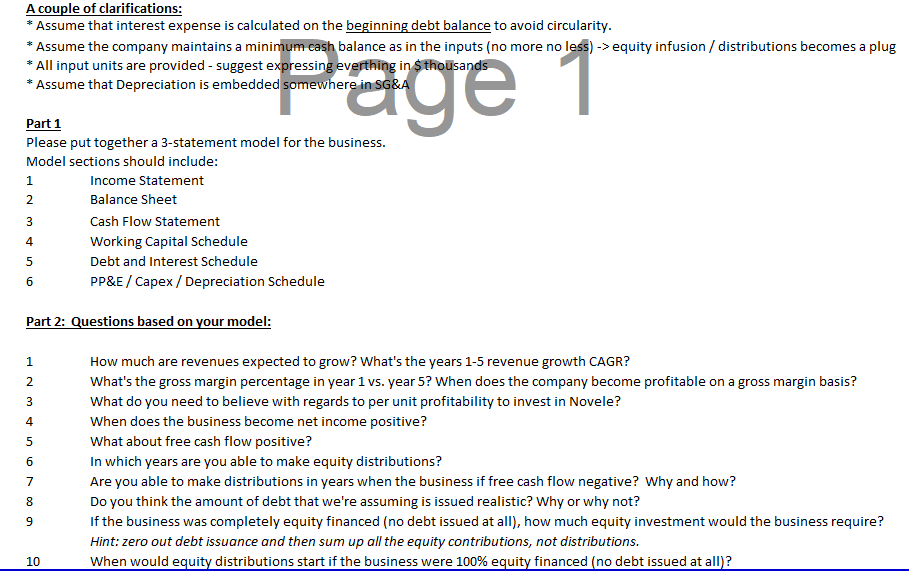

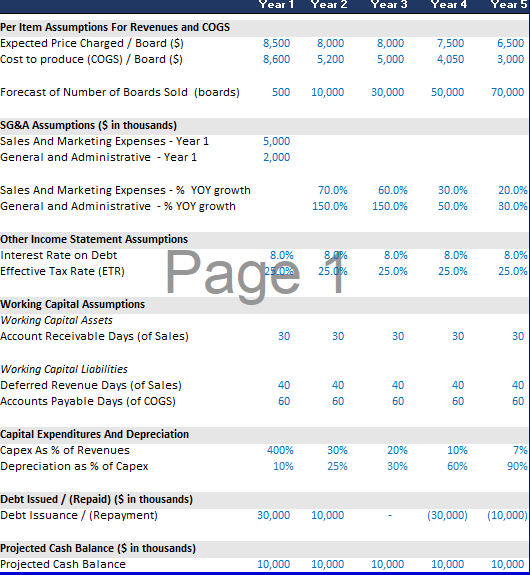

A couple of clarifications: * Assume that interest expense is calculated on the beginning debt balance to avoid circularity. * Assume the company maintains a minimum cash balance as in the inputs (no more no less) -> equity infusion / distributions becomes a plug * All input units are provided - suggest expressing everthing in $thousands * Assume that Depreciation is embedded somewhere in SG&A Page 1 N Part 1 Please put together a 3-statement model for the business. Model sections should include: 1 Income Statement Balance Sheet Cash Flow Statement Working Capital Schedule Debt and Interest Schedule PP&E / Capex / Depreciation Schedule 3 mi 4 5 6 Part 2: Questions based on your model: 1 2 3 4 5 Nmin 0001 6 How much are revenues expected to grow? What's the years 1-5 revenue growth CAGR? What's the gross margin percentage in year 1 vs. year 5? When does the company become profitable on a gross margin basis? What do you need to believe with regards to per unit profitability to invest in Novele? When does the business become net income positive? What about free cash flow positive? In which years are you able to make equity distributions? Are you able to make distributions in years when the business if free cash flow negative? Why and how? Do you think the amount of debt that we're assuming is issued realistic? Why or why not? If the business was completely equity financed (no debt issued at all), how much equity investment would the business require? Hint: zero out debt issuance and then sum up all the equity contributions, not distributions. When would equity distributions start if the business were 100% equity financed (no debt issued at all? 7 8 9 10 Year 1 Year 2 Year 3 Year 4 Year 5 Per Item Assumptions For Revenues and COGS Expected Price Charged / Board ($) Cost to produce (COG) / Board (5) 8,500 8,600 8,000 5,200 8,000 5,000 7,500 4,050 6,500 3,000 Forecast of Number of Boards Sold (boards) 500 10,000 30,000 50,000 70,000 SG&A Assumptions ($ in thousands) Sales And Marketing Expenses - Year 1 General and Administrative - Year 1 5,000 2,000 Sales And Marketing Expenses -% YOY growth General and Administrative - % YOY growth 70.0% 150.0% 60.0% 150.0% 30.0% 50.0% 20.0% 30.0% Other Income Statement Assumptions Interest Rate on Debt Effective Tax Rate (ETR) % 8.0 25.0% 8.0% 25.0% 8.0% 25.0% 8.0% 25.0% Page 1 Working Capital Assumptions Working Capital Assets Account Receivable Days (of Sales) 30 30 30 30 30 Working Capital Liabilities Deferred Revenue Days (of Sales) Accounts Payable Days (of COGS) 40 60 40 60 40 60 40 60 40 60 Capital Expenditures And Depreciation Capex As % of Revenues Depreciation as % of Capex 400% 10% 30% 25% 7% 20% 30% 10% 60% 90% Debt Issued / (Repaid) ($ in thousands) Debt Issuance / (Repayment) 30,000 10,000 (30,000) (10,000) Projected Cash Balance ($ in thousands) Projected Cash Balance 10,000 10,000 10,000 10,000 10,000 A couple of clarifications: * Assume that interest expense is calculated on the beginning debt balance to avoid circularity. * Assume the company maintains a minimum cash balance as in the inputs (no more no less) -> equity infusion / distributions becomes a plug * All input units are provided - suggest expressing everthing in $thousands * Assume that Depreciation is embedded somewhere in SG&A Page 1 N Part 1 Please put together a 3-statement model for the business. Model sections should include: 1 Income Statement Balance Sheet Cash Flow Statement Working Capital Schedule Debt and Interest Schedule PP&E / Capex / Depreciation Schedule 3 mi 4 5 6 Part 2: Questions based on your model: 1 2 3 4 5 Nmin 0001 6 How much are revenues expected to grow? What's the years 1-5 revenue growth CAGR? What's the gross margin percentage in year 1 vs. year 5? When does the company become profitable on a gross margin basis? What do you need to believe with regards to per unit profitability to invest in Novele? When does the business become net income positive? What about free cash flow positive? In which years are you able to make equity distributions? Are you able to make distributions in years when the business if free cash flow negative? Why and how? Do you think the amount of debt that we're assuming is issued realistic? Why or why not? If the business was completely equity financed (no debt issued at all), how much equity investment would the business require? Hint: zero out debt issuance and then sum up all the equity contributions, not distributions. When would equity distributions start if the business were 100% equity financed (no debt issued at all? 7 8 9 10 Year 1 Year 2 Year 3 Year 4 Year 5 Per Item Assumptions For Revenues and COGS Expected Price Charged / Board ($) Cost to produce (COG) / Board (5) 8,500 8,600 8,000 5,200 8,000 5,000 7,500 4,050 6,500 3,000 Forecast of Number of Boards Sold (boards) 500 10,000 30,000 50,000 70,000 SG&A Assumptions ($ in thousands) Sales And Marketing Expenses - Year 1 General and Administrative - Year 1 5,000 2,000 Sales And Marketing Expenses -% YOY growth General and Administrative - % YOY growth 70.0% 150.0% 60.0% 150.0% 30.0% 50.0% 20.0% 30.0% Other Income Statement Assumptions Interest Rate on Debt Effective Tax Rate (ETR) % 8.0 25.0% 8.0% 25.0% 8.0% 25.0% 8.0% 25.0% Page 1 Working Capital Assumptions Working Capital Assets Account Receivable Days (of Sales) 30 30 30 30 30 Working Capital Liabilities Deferred Revenue Days (of Sales) Accounts Payable Days (of COGS) 40 60 40 60 40 60 40 60 40 60 Capital Expenditures And Depreciation Capex As % of Revenues Depreciation as % of Capex 400% 10% 30% 25% 7% 20% 30% 10% 60% 90% Debt Issued / (Repaid) ($ in thousands) Debt Issuance / (Repayment) 30,000 10,000 (30,000) (10,000) Projected Cash Balance ($ in thousands) Projected Cash Balance 10,000 10,000 10,000 10,000 10,000