please do part a b c

please do part a b c

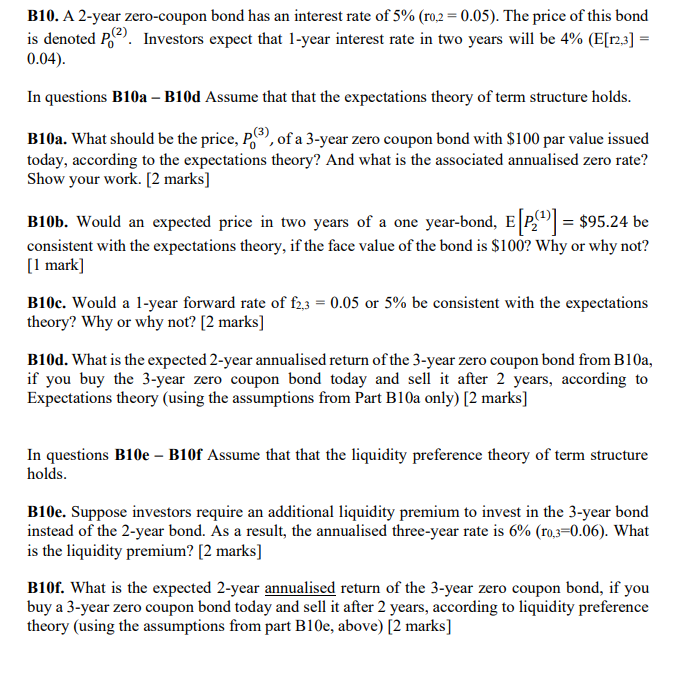

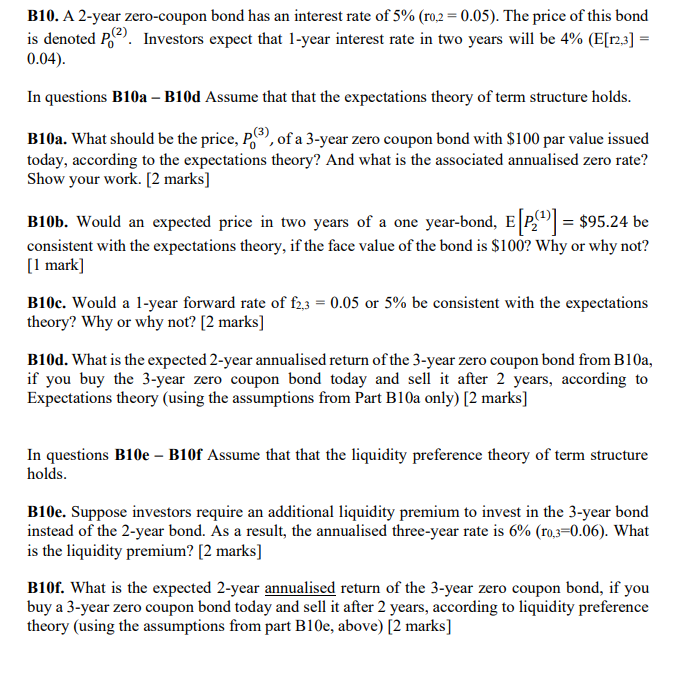

B10. A 2-year zero-coupon bond has an interest rate of 5% (10,2 = 0.05). The price of this bond is denoted P. 2). Investors expect that l-year interest rate in two years will be 4% (E[r2,3] = 0.04). In questions B10a - B10d Assume that that the expectations theory of term structure holds. B10a. What should be the price, p.), of a 3-year zero coupon bond with $100 par value issued today, according to the expectations theory? And what is the associated annualised zero rate? Show your work. [2 marks] B10b. Would an expected price in two years of a one year-bond, E [P:{"}] = $95.24 be consistent with the expectations theory, if the face value of the bond is $100? Why or why not? [1 mark] B10c. Would a 1-year forward rate of f2,3 = 0.05 or 5% be consistent with the expectations theory? Why or why not? [2 marks] B10d. What is the expected 2-year annualised return of the 3-year zero coupon bond from B10a, if you buy the 3-year zero coupon bond today and sell it after 2 years, according to Expectations theory (using the assumptions from Part B10a only) [2 marks] In questions B10e - B10f Assume that that the liquidity preference theory of term structure holds. B10e. Suppose investors require an additional liquidity premium to invest in the 3-year bond instead of the 2-year bond. As a result, the annualised three-year rate is 6% (r0,3=0.06). What is the liquidity premium? [2 marks] B10f. What is the expected 2-year annualised return of the 3-year zero coupon bond, if you buy a 3-year zero coupon bond today and sell it after 2 years, according to liquidity preference theory (using the assumptions from part B10e, above) [2 marks] B10. A 2-year zero-coupon bond has an interest rate of 5% (10,2 = 0.05). The price of this bond is denoted P. 2). Investors expect that l-year interest rate in two years will be 4% (E[r2,3] = 0.04). In questions B10a - B10d Assume that that the expectations theory of term structure holds. B10a. What should be the price, p.), of a 3-year zero coupon bond with $100 par value issued today, according to the expectations theory? And what is the associated annualised zero rate? Show your work. [2 marks] B10b. Would an expected price in two years of a one year-bond, E [P:{"}] = $95.24 be consistent with the expectations theory, if the face value of the bond is $100? Why or why not? [1 mark] B10c. Would a 1-year forward rate of f2,3 = 0.05 or 5% be consistent with the expectations theory? Why or why not? [2 marks] B10d. What is the expected 2-year annualised return of the 3-year zero coupon bond from B10a, if you buy the 3-year zero coupon bond today and sell it after 2 years, according to Expectations theory (using the assumptions from Part B10a only) [2 marks] In questions B10e - B10f Assume that that the liquidity preference theory of term structure holds. B10e. Suppose investors require an additional liquidity premium to invest in the 3-year bond instead of the 2-year bond. As a result, the annualised three-year rate is 6% (r0,3=0.06). What is the liquidity premium? [2 marks] B10f. What is the expected 2-year annualised return of the 3-year zero coupon bond, if you buy a 3-year zero coupon bond today and sell it after 2 years, according to liquidity preference theory (using the assumptions from part B10e, above) [2 marks]

please do part a b c

please do part a b c