Please do part d and e. Solution is provided. Its just theory.

Q1. Part a:

Statement of first 12 months

Sales Revenue(80,000x4.85) 388,000

Forecasted Food Cost

Cost of panini fillings(80,000x1.92) (153,600)

Cost of drink(80,000x.04) (32,000)

Cost of panini(80,000x0.3) (24,000)

Contribution 179,000

Packaging cost(80,000x0.2) (16,000)

Packaging cost of drink(80,000x0.36) (28,800)

salary cost(4100x12) (49,200)

Sundry Expenses(1900x12) (22,800)

Annual Rent (24,000)

Advertising Cost (15,000)

Profit 23,200

Q1. Part b:

Marging of safety:

Margin of safety is the difference between break-even point and expected profitability.

MOS= 388,000 - 178400 x100

388,000

MOS= 54%

Breakeven Point (Units):

Total Fixed Cost= 155,800

Contribution per unit (4.85-1.92-0.4-0.3)= 2.23

BEP= 155,800

2.23

BEP= 69,865 units

Breakeven Point ():

Contribution Margin= 2.23/4.485= 0.46

BEP= 155,800

0.46

BEP= 338,000

Q1. Part c:

Expected anuual sale (16,000x0.98) = 15,680

Total Raw Material Cost (16,000x0.07) = 1120

Packing Cost (16,000x0.13) = 2080

Breakecen point (units):

BEP= 2080

(0.98-0.07)

BEP= 2,286 units

Breakecen point ():

Contribution margin = 0.98-0.07 = 0.93

0.98

BEP= 2080

0.93

BEP= 2,236

Margin of safety:

MOS= 15,680 - (15680-1,120) x100

15,680

MOS= 7%

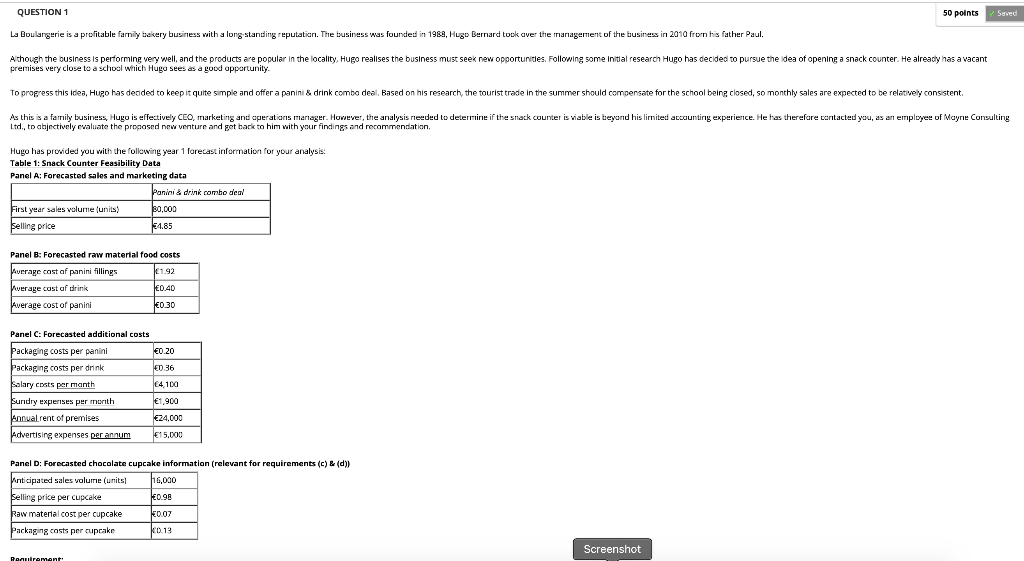

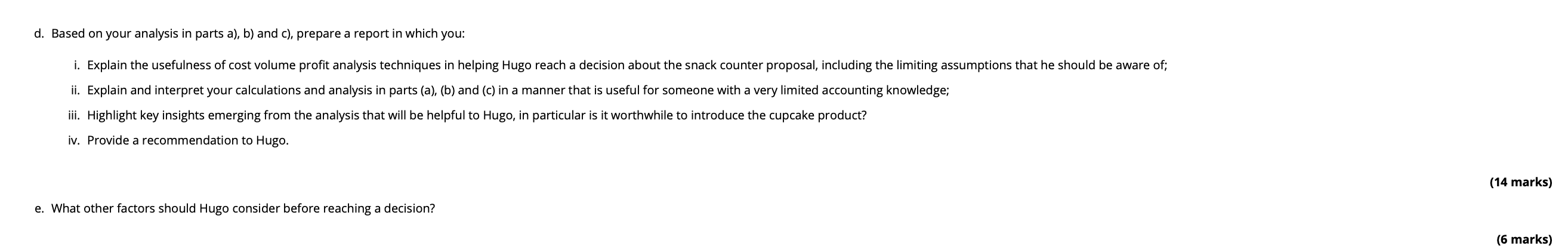

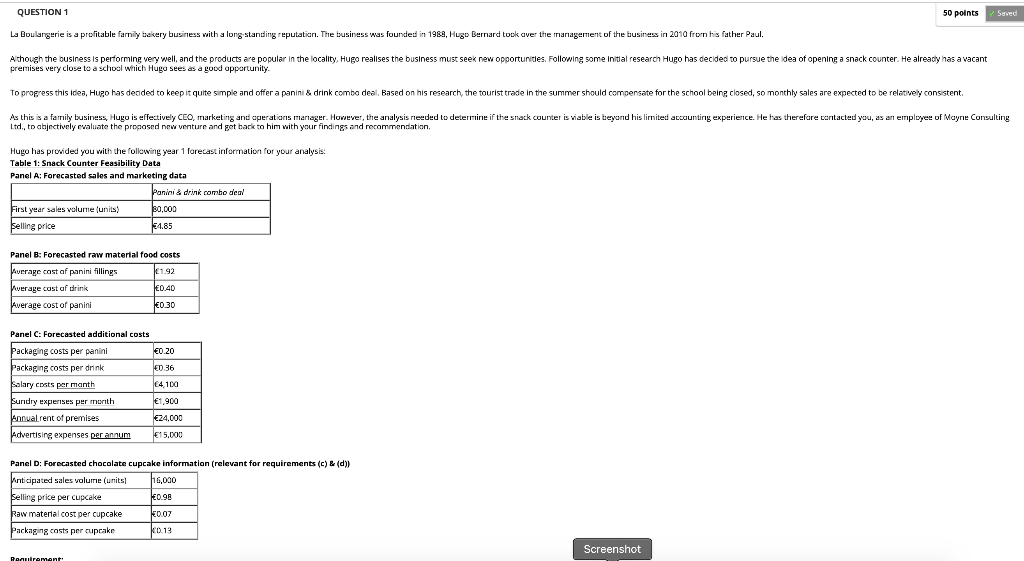

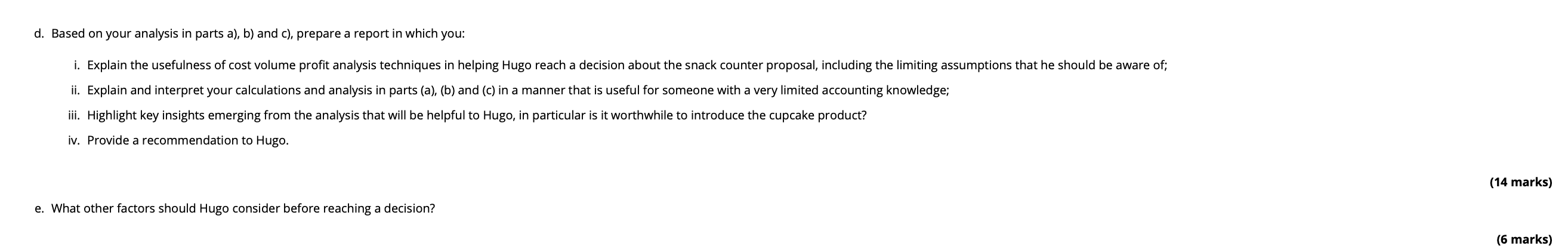

QUESTION 1 50 points Surved La Boulangerie is a profitable farnily bakery business with a long standing reputation. The business was founded in 1989, Hugo Bernard took aver the management of the business in 2010 from his father Paul. Although the business is performing very well, and the products are popular in the locality, Hugo realises the business must seek new opportunities. Following some Initial research Hugo has decided to pursue the idea of opening a snack counter. He already has a vacant premises very close to a school wirich Hugo sees a good opportunity To progress this idea, Hugo has decided to keep it quite simple and offer a panini & drink combo deal. Based on his research, the tourist trade in the summer should compensate for the school being closed, so monthly sales are expected to be relatively consistent. As this is a family business Hugo is effectively CEO, marketing and operations manager. However, the analysis needed to determine if the snack counter is viable is beyond his limited accounting experience. He has therefore contacted you, as an employee of Mayne Consulting Ltd., to abjectively evaluate the proposed new venture and get back to him with your findings and recommendation, Hugo has provided you with the following year 1 forecast information for your analysis: Table 1: Snack Counter Feasibility Data Panel A: Forecasted sales and marketing data Panini & drink combo deal 30,000 First year sales volume (units) Selling price 54.85 Panel B: Forecasted raw material food costs paverage cast af panini fillings 1.92 pwerage cost of drink 0.40 Average cost of panini 0.30 Panel C: Forecasted additional costs Packaging costs per panini 0.20 Packaging costs per drink 1.36 Salary costs per manth 14,100 Sundry expenses per month 1,900 Annual rent of premises 24.000 Advertising expenses per annum 15,000 Panel D: Forecasted chocolate cupcake information (relevant for requirements (C) & (d)) Anticipated sales volume (units h6.000 Selling price per cupcake 0.98 Raw material cost per cupcake 0.07 Packaging costs per cupcake 0.13 Screenshot Requirements d. Based on your analysis in parts a), b) and c), prepare a report in which you: i. Explain the usefulness of cost volume profit analysis techniques in helping Hugo reach a decision about the snack counter proposal, including the limiting assumptions that he should be aware of; ii. Explain and interpret your calculations and analysis in parts (a), (b) and (c) in a manner that is useful for someone with a very limited accounting knowledge; iii. Highlight key insights emerging from the analysis that will be helpful to Hugo, in particular is it worthwhile to introduce the cupcake product? iv. Provide a recommendation to Hugo. (14 marks) e. What other factors should Hugo consider before reaching a decision? (6 marks)