Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do question 4 and 6( there is no additional information) 4. Has cash increased or decreased during the year? (consider cash as a percent

please do question 4 and 6( there is no additional information)

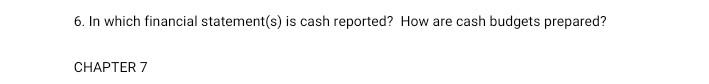

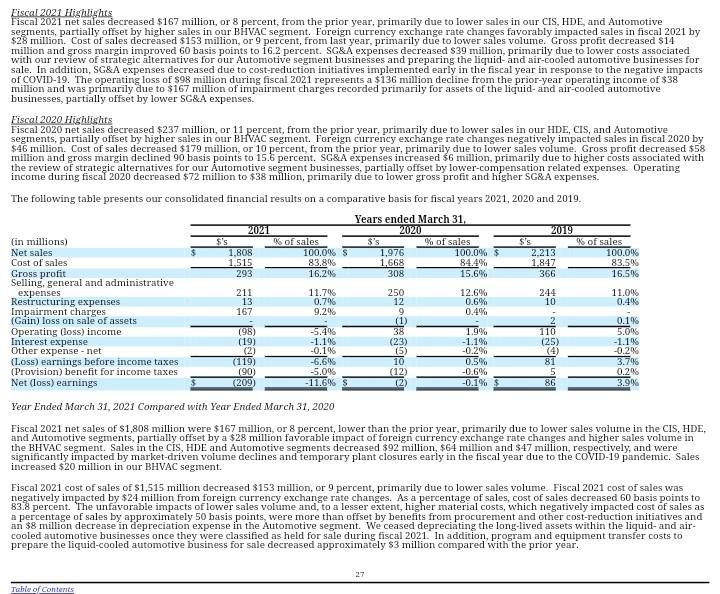

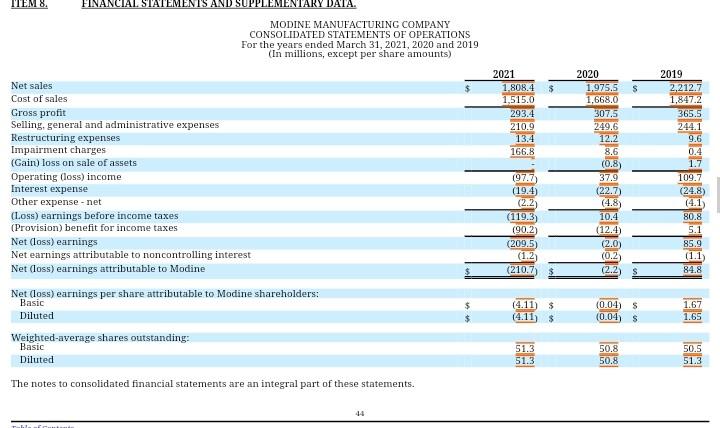

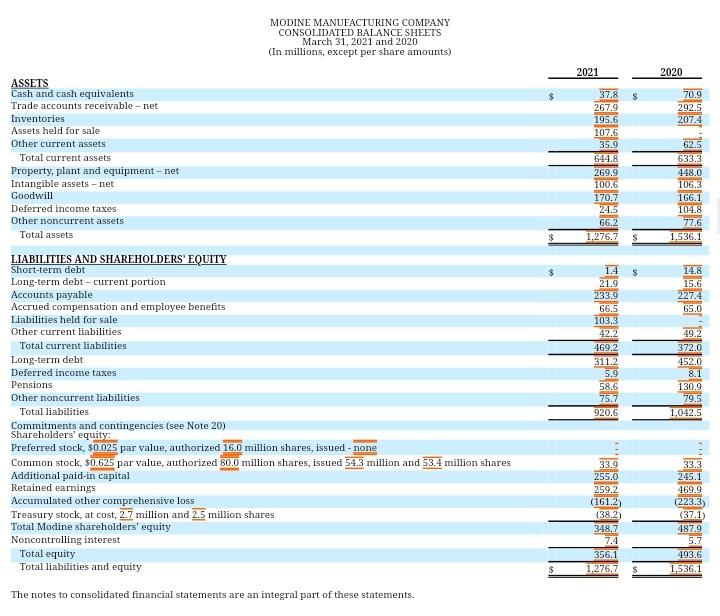

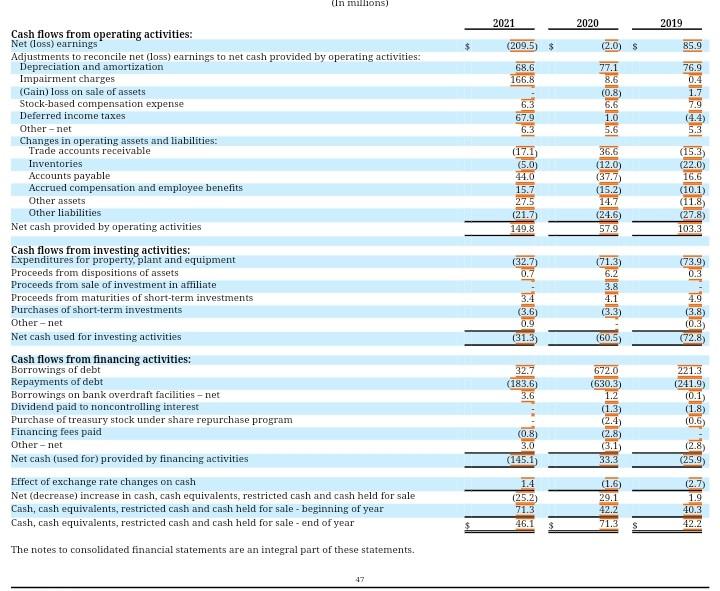

4. Has cash increased or decreased during the year? (consider cash as a percent of current assets and total assets as well as absolute dollars). Does management provide any discussion of the cash position? 6. In which financial statement(s) is cash reported? How are cash budgets prepared? CHAPTER 7 The Company classified the assets and liabilities of the liquid and air-cooled automotive businesses as held for sale on the March 31, 2021 consolidated balance sheet. The major classes of assets and liabilities held for sale were as follows: March 31, 2021 ASSETS Cash and cash equivalents 8.0 Trade accounts receivables - net 54.4 Inventories 24.7 Other current assets 12.8 Property, plant and equipment - net 164.0 Other noncurrent assets 8.8 Impairment of carrying value (165.1) Total assets held for sale 107.6 LIABILITIES Short-term debt 5.0 Accounts payable 46.3 Accrued compensation and employee benefits 15.5 Other current liabilities 12.2 Pensions 17.8 Other noncurrent liabilities 6.5 Total liabilities held for sale 103.3 The Company will reassess the liquid-cooled disposal group's fair value less costs to sell at each reporting period that it is held for sale until the transaction is completed. The Company expects to record a loss on sale of approximately $20.0 million to $30.0 million upon transaction completion. The loss on sale recorded will be impacted by changes in working capital, costs to sell, net actuarial losses in accumulated other comprehensive loss related to the disposal group's pension plans, and cumulative translation adjustments. It is possible that the loss on sale recorded could differ materially from the Company's estimate Not Tonnities Fiscal 2021 Highlights Fiscal 2021 net sales decreased $167 million, or 8 percent, from the prior year, primarily due to lower sales in our CIS, HDE, and Automotive segments, partially offset by higher sales in our BHVAC segment. Foreign currency exchange rate changes favorably impacted sales in fiscal 2021 by $28 million. Cost of sales decreased $153 million, or 9 percent, from last year, primarily due to lower sales volume. Gross profit decreased $14 million and gross margin improved 60 basis points to 16.2 percent. SG&A expenses decreased $39 million, primarily due to lower costs associated with our review of strategic alternatives for our Automotive segment businesses and preparing the liquid- and air-cooled automotive businesses for sale. In addition, SG&A expenses decreased due to cost-reduction initiatives implemented early in the fiscal year in response to the negative impacts of COVID-19. The operating loss of $98 million during fiscal 2021 represents a $136 million decline from the prior-year operating income of $38 million and was primarily due to $167 million of impairment charges recorded primarily for assets of the liquid- and air-cooled automotive businesses, partially offset by lower SG&A expenses. Fiscal 2020 Highlights Fiscal 2020 net sales decreased $237 million, or 11 percent, from the prior year, primarily due to lower sales in our HDE, CIS, and Automotive segments, partially offset by higher sales in our BHVAC segment. Foreign currency exchange rate changes negatively impacted sales in fiscal 2020 by $46 million. Cost of sales decreased $179 million, or 10 percent, from the prior year, primarily due to lower sales volume. Gross profit decreased $58 million and gross margin declined 90 basis points to 15.6 percent. SG&A expenses increased $6 million, primarily due to higher costs associated with the review of strategic alternatives for our Automotive segment businesses, partially offset by lower-compensation related expenses. Operating income during fiscal 2020 decreased $72 million to $38 million, primarily due to lower gross profit and higher SG&A expenses. The following table presents our consolidated financial results on a comparative basis for fiscal years 2021, 2020 and 2019. Years ended March 31, 2021 2020 2019 (in millions) s's % of sales S's % of sales S's % of sunles Net sales 1,808 100.0%S 1,976 100.0% 2.213 100.0% Cost of sales 1515 83.8% 1.668 84.4% 1.847 83.5% Gross profit 293 16.2% 308 15.6% 366 16.5% Selling, general and administrative expenses 211 11.7% 250 12.6% 244 11.0% Restructuring expenses 13 0.7% 12 0.6% 10 0.4% Impairment charges 167 9.2% 9 0.4% (Gain) loss on sale of assets (1 2 0.1% Operating (loss) income (98) -5.4% 38 1.9% 110 5.0% Interest expense (19) -1.1% (23) - 1.1% (25) -1.1% Other expense - net (2) (5 -0.29 (4) -0.296 (Loss) earnings before income taxes (119) -6.6% 10 0.5% 81 3.7 (Provision) benefit for income taxes (90) -5.0% (12 -0.6% 5 0.2% Net (Loss) earnings (209) - 11.6% S 12) -0.1% 86 3.9% Year Ended March 31, 2021 Compared with Year Ended March 31, 2020 Fiscal 2021 net sales of $1,808 million were $167 million, or 8 percent, lower than the prior year, primarily due to lower sales volume in the CIS, HDE, and Automotive segments, partially offset by a $28 million favorable impact of foreign currency exchange rate changes and higher sales volume in the BHVAC segment. Sales in the CIS, HDE and Automotive segments decreased $92 million, $64 million and $47 million, respectively, and were significantly impacted by market-driven volume declines and temporary plant closures early in the fiscal year due to the COVID-19 pandemic. Sales increased $20 million in our BHVAC segment. Fiscal 2021 cost of sales of $1,515 million decreased $153 million, or 9 percent, primarily due to lower sales volume. Fiscal 2021 cost of sales was negatively impacted by $24 million from foreign currency exchange rate changes. As a percentage of sales, cost of sales decreased 60 basis points to 83.8 percent. The unfavorable impacts of lower sales volume and, to a lesser extent, higher material costs, which negatively impacted cost of sales as a percentage of sales by approximately 50 basis points were more than offset by benefits from procurement and other cost-reduction initiatives and an $8 million decrease in depreciation expense in the Automotive segment. We ceased depreciating the long-lived assets within the liquid- and air- cooled automotive businesses once they were classified as held for sale during fiscal 2021. In addition, program and equipment transfer costs to prepare the liquid-cooled automotive business for sale decreased approximately $3 million compared with the prior year. -0.1% 27 Table of Contents ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA MODINE MANUFACTURING COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS For the years ended March 31, 2021, 2020 and 2019 (in millions, except per share amounts) $ s 2021 1.808.4 1,515.0 293.4 210.9 13.4 166.8 Net sales Cost of sales Gross profit Selling, general and administrative expenses Restructuring expenses Impairment charges (Gain) loss on sale of assets Operating doss) income Interest expense Other expense - net (Loss) earnings before income taxes (Provision) benefit for income taxes Net (loss) earnings Net earnings attributable to noncontrolling interest Net (loss) earnings attributable to Modine Net doss) earnings per share attributable to Modine shareholders: Basic Diluted Weighted average shares outstanding: Basic Diluted 2020 1,975.5 1,668,0 307.5 249.6 12.2 8.6 (0.8 37.9 (22.7 (4.8) 10.4 (12.4) (2.0) (0.2 (2.2 2019 2,212.7 1,847.2 365.5 244.1 9.6 0.4 1.7 109.7 (24.8 (4.1 80.8 5.1 85.9 (1.1 84.8 (977) (19.4) (2.2) (119.3) (90.2 (209.5) (1.2 (210.7 $ (4.11 (4.11) $ $ (0.04 (0.04 S $ 1.67 1.65 51.3 51.3 50.8 50.8 50.5 51.3 The notes to consolidated financial statements are an integral part of these statements. 44 MODINE MANUFACTURING COMPANY CONSOLIDATED BALANCE SHEETS March 31, 2021 and 2020 (In millions, except per share amounts) 2021 2020 s 70.9 292.5 207.4 37.8 267.9 195.6 107.6 35.9 644.8 269.9 100.6 170.7 24.5 66.2 1.276.7 62.5 633.3 448.0 106.3 166.1 104.8 77.6 1.536.1 $ S 14.8 15.6 227.4 65.0 ASSETS Cash and cash equivalents Trade accounts receivable-net Inventories Assets held for sale Other current assets Total current assets Property, plant and equipment-net Intangible assets-net Goodwill Deferred income taxes Other noncurrent assets Total assets LIABILITIES AND SHAREHOLDERS' EQUITY Short-term debt Long-term debt - current portion Accounts payable Accrued compensation and employee benefits Liabilities held for sale Other current liabilities Total current liabilities Long-term debt Deferred income taxes Pensions Other noncurrent liabilities Total liabilities Commitments and contingencies (see Note 20) Shareholders' equity Preferred stock, $0.025 par value, authorized 16.0 million shares, issued - none Common stock, 90.625 par value, authorized 80.0 million shares, issued 54.3 million and 53.4 million shares Additional paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, at cost, 2.7 million and 2.5 million shares Total Modine shareholders' equity Noncontrolling interest Total equity Total liabilities and equity 1.4 21.9 233.9 66.5 103,3 42.2 469.2 311.2 5.9 58.6 75.7 920.6 49.2 372.0 452.0 8.1 130.9 79.5 1,042.5 33,9 255.0 259.2 (161.2 (38.2 348.7 7.4 356,1 1,276,7 33.3 245.1 469.9 (223.3 (37.1 4879 5.7 493.6 1,536.1 $ S The notes to consolidated financial statements are an integral part of these statements. (in millions) 2021 2020 2019 (209.5) $ (2.0) $ 166.8 77.1 8.6 (0.8) 6.6 1.0 5.6 (17.1) 36.6 (12.0) (37.7) (15.23 14.7 (24.6) 57.9 (21.7) 149.8 Cash flows from operating activities: Net (Loss) earnings Adjustments to reconcile net (loss) earnings to net cash provided by operating activities: Depreciation and amortization Impairment charges (Gain) loss on sale of assets Stock-based compensation expense Deferred income taxes Othernet Changes in operating assets and liabilities: Trade accounts receivable Inventories Accounts payable Accrued compensation and employee benefits Other assets Other liabilities Net cash provided by operating activities Cash flows from investing activities: Expenditures for property, plant and equipment Proceeds from dispositions of assets Proceeds from sale of investment in affiliate Proceeds from maturities of short-term investments Purchases of short-term investments Othernet Net cash used for investing activities Cash flows from financing activities: Borrowings of debt Repayments of debt Borrowings on bank overdraft facilities -net Dividend paid to noncontrolling interest Purchase of treasury stock under share repurchase program Financing fees paid Othernet Net cash (used for) provided by financing activities Effect of exchange rate changes on cash Net (decrease) increase in cash, cash equivalents, restricted cash and cash held for sale Cash, cash equivalents, restricted cash and cash held for sale - beginning of year Cash, cash equivalents, restricted cash and cash held for sale - end of year e... bagajel a. EEEE been rele LEEEEE 17 S (32.7) (71.3) 6.2 3.8 4.1 (3.3) (31.3 (60.5) (183,6) 672.0 (630,3 1.2 (1.3 (2.4 (2.8 (3.1) 33.3 (0.6 (2.8) (25.9 (145.1) 1.4 (25.2 71.3 46.1 (1.6) 29.1 42.2 71.3 (2.7 1.9 40.3 42.2 $ The notes to consolidated financial statements are an integral part of these statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started