Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do requirements 7-10. please use formatting for the bottom 2 pictures. this is the 3rd time i have posted this question. please only answer

please do requirements 7-10. please use formatting for the bottom 2 pictures. this is the 3rd time i have posted this question. please only answer if you know.

you can reference the other questions i posted but they are incorrect

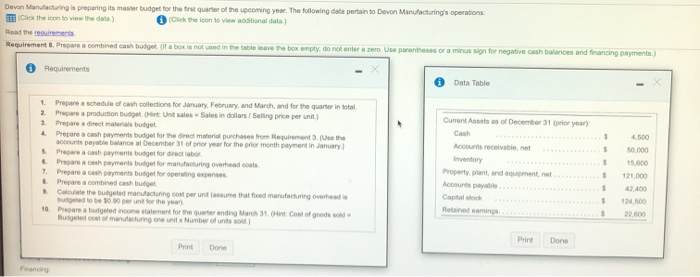

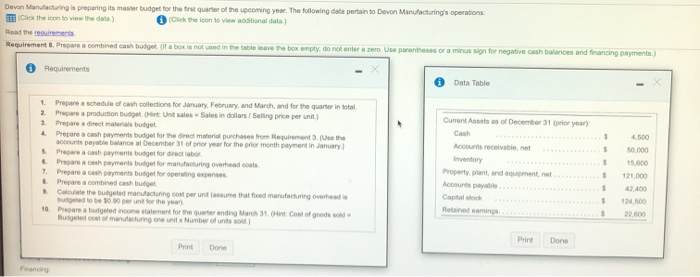

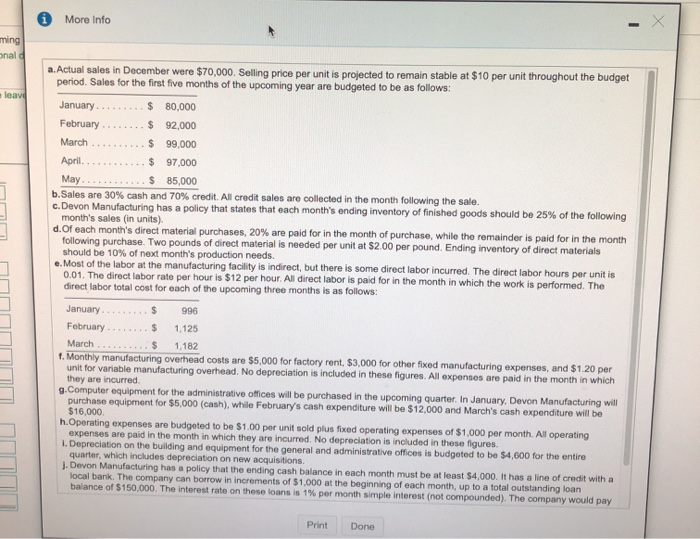

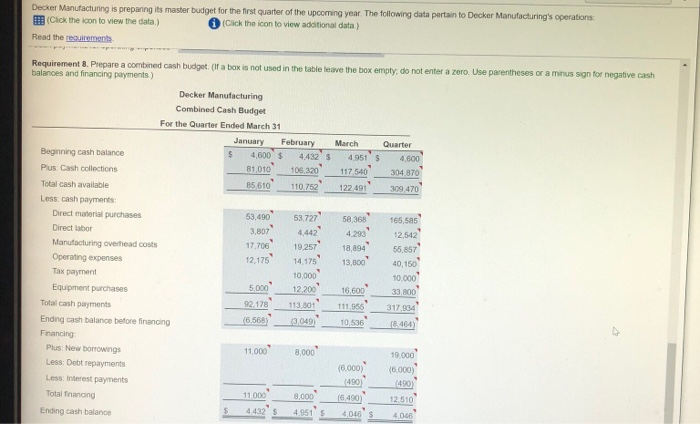

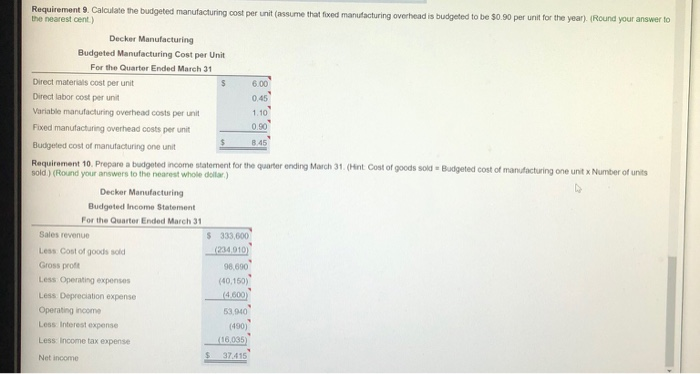

Devon Manufacturing is preparing ito master budget for the first quarter of the upcoming year. The following data pertain to Devon Manufacturing's operations Chok the icon to view the data) Click the icon to view additional data) Read the regrements Requirement. Prepare a combined cash budget (if a box is not used in the table lave boxemply do not enter a zero Use parentheses or a minus sign for negative cash balances and financing payments.) Requirements Data Table $ $ 1 Prepare a schedule of cash collections for January February, and March, and for the quarter in total 2. Prepare a production budgetunt unit sales - Sales in dollars/ Saling price per unit) 1 Prepare a direct materials budget 4 Prepare a cash payments budget for the direct material purchases from Regement 3. (Use the accounts payable balance at December 31 of prior year for the prior month payment in January Prepare a cash payments budget for direct labor & Prepare the payments budget for manufacturing overhead costs 7. Prepare a cash payments budget for operating expenses Prepare a combined cash budget Caleate the budgeted manufacturing cost per un sun that feed manufacturing overhede buted to be 0.00 per unit for the year 10. Presarea butted income statement for the quarter anding March 31.int. Cont of goods sold Buled out of manufacturing one Number of units old) Current Assets of December 31 Crior year) Cash Accounts receivable.net Inventory Property, plant, and Guiment, net Acounts payable Capital S 4.500 50.000 15.00 121,000 42.400 12.500 S Print Done Print Done More Info ming onal a. Actual sales in December were $70,000. Selling price per unit is projected to remain stable at $10 per unit throughout the budget period. Sales for the first five months of the upcoming year are budgeted to be as follows: leave January $ 80,000 February $ 92.000 March $ 99,000 April $ 97,000 May $ 85,000 b. Sales are 30% cash and 70% credit. All credit sales are collected in the month following the sale. c. Devon Manufacturing has a policy that states that each month's ending inventory of finished goods should be 25% of the following month's sales (in units). d. Of each month's direct material purchases, 20% are paid for in the month of purchase, while the remainder is paid for in the month following purchase. Two pounds of direct material is needed per unit at $2.00 per pound. Ending inventory of direct materials should be 10% of next month's production needs. e. Most of the labor at the manufacturing facility is indirect, but there is some direct labor incurred. The direct labor hours per unit is 0.01. The direct labor rate per hour is $12 per hour. All direct labor is paid for in the month in which the work is performed. The direct labor total cost for each of the upcoming three months is as follows: January 996 February 1.125 March $ 1,182 1. Monthly manufacturing overhead costs are $5,000 for factory rent, $3,000 for other fixed manufacturing expenses, and $1.20 per unit for variable manufacturing overhead. No depreciation is included in these figures. All expenses are paid in the month in which they are incurred g.Computer equipment for the administrative offices will be purchased in the upcoming quarter. In January, Devon Manufacturing will purchase equipment for $5,000 (cash), while February's cash expenditure will be $12,000 and March's cash expenditure will be h.Operating expenses are budgeted to be $1.00 per unit sold plus fixed operating expenses of $1,000 per month. All operating expenses are paid in the month in which they are incurred. No depreciation is included in these figures. 1. Depreciation on the building and equipment for the general and administrative offices is budgeted to be $4,600 for the entire quarter, which includes depreciation on new acquisitions. 1. Devon Manufacturing has a policy that the ending cash balance in each month must be at least $4,000. It has a line of credit with a local bank. The company can borrow in increments of $1,000 at the beginning of each month, up to a total outstanding loan balance of $150,000. The interest rate on these loans is 1% per month simple interest (not compounded). The company would pay Print Done Decker Manufacturing is preparing its master budget for the first quarter of the upcoming year. The following data pertain to Decker Manufacturing's operations (Click the icon to view the data.) (Click the icon to view additional data) Read the requirements Requirement 8. Prepare a combined cash budget. (If a box is not used in the table leave the box empty do not enter a zero. Use parentheses or a minus sign for negative cash balances and financing payments) Decker Manufacturing Combined Cash Budget For the Quarter Ended March 31 January February March Quarter Beginning cash balance $ 4,600$ 44325 4951 4,600 Plus Cash collections 81,010 105,320 117 540 304.870 Total cash available 85 610 110.752 122.491 309 470 Less cash payments Direct material purchases 53,490 53.727 58 368 165,585 Direct labor 3,807 4,442 4.290 12,542 Manufacturing overhead costs 17.706 19.257 18,894 55.857 Operating expenses 12,175 14 175 13,800 40,150 Tax payment 10,000 5.000 Equipment purchases 12 200 16,600 33.800 Total cash payments 92.178 113.301 111.956 317.934 Ending cash balance before financing (6.568 (3049) 10.536 (8.464) Financing Plus: New borrowings 11.000 8,000 19.000 Less: Debt repayments (6.000) (6.000) Less Interest payments (490) 490 Total financing 11 000 8,000 (6.490) 12510 $ Ending cash balance 44325 4.951 4046S 4,06 10.000 Requirement 9. Calculate the budgeted manufacturing cost per unit (assume that fixed manufacturing overhead is budgeted to be $0.90 per unit for the year). (Round your answer to the nearest cent) Decker Manufacturing Budgeted Manufacturing Cost per Unit For the Quarter Ended March 31 Direct materials cost per unit $ 6.00 Direct labor cost per unit 0.45 Variable manufacturing overhead costs per unit 1.10 0.90 Fixed manufacturing overhead costs per unit 8.45 Budgeted cost of manufacturing one unit Requirement 10. Prepare a budgeted income statement for the quarter ending March 31. (Hint Cost of goods sold Budgeted cost of manufacturing one unit x Number of units sold) (Round your answers to the nearest whole dollar) Decker Manufacturing Budgeted Income Statement For the Quarter Ended March 31 Sales revenue $333,600 Less Cost of goods sold (234010 Gross proft 98.600 Less Operating expenses (40,150) Less Depreciation expense Operating income 53.940 Less Interest expense Less Income tax eo pense (16.035 $ Net income 37.415 (490) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started