please do table and change the depriaction rate and method from 5 years straight line MACRS. i have attached the MACR info as well and show rates and assumptions in the area next to chart. the sprredaheer should show the calcultation of the depreciation tax shield.

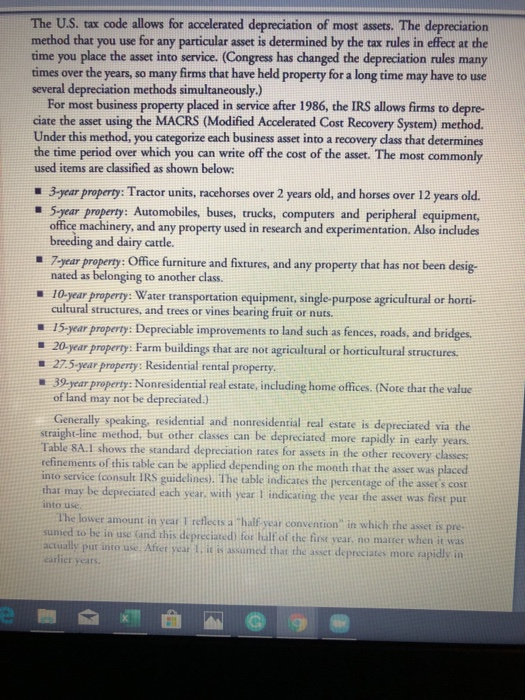

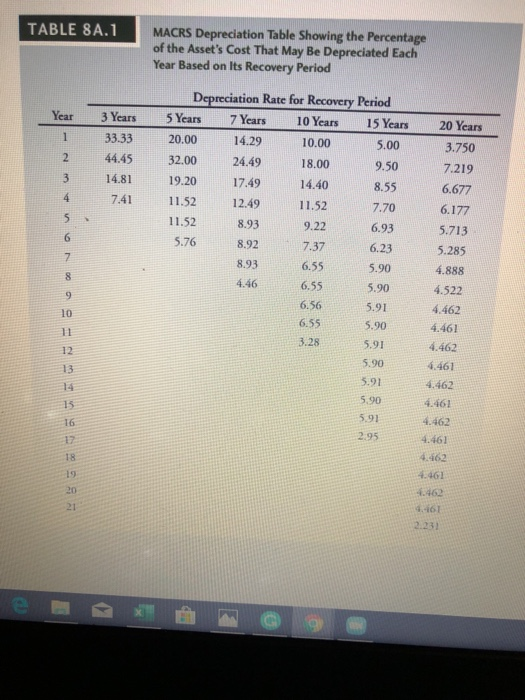

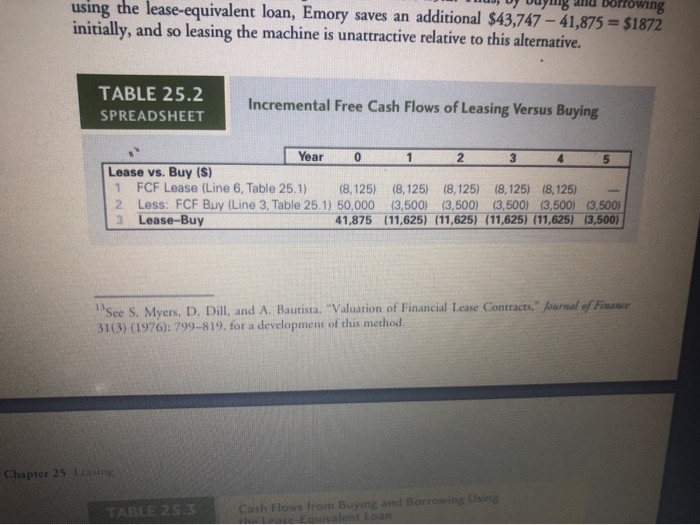

TABLE 25.2 SPREADSHEET Incremental Free Cash Flows of Leasing Versus Buying Year 0 23 Lease versus Buy ($) 1 FCF Lease 2 Less: FCF Buy L3 Lease-Buy NPV at 8.00% NPV at 0.00% The U.S. tax code allows for accelerated depreciation of most assets. The depreciation method that you use for any particular asset is determined by the tax rules in effect at the time you place the asset into service. (Congress has changed the depreciation rules many times over the years, so many firms that have held property for a long time may have to use several depreciation methods simultaneously.) For most business property placed in service after 1986, the IRS allows firms to depre- ciate the asset using the MACRS (Modified Accelerated Cost Recovery System) method. Under this method, you categorize each business asset into a recovery class that determines the time period over which you can write off the cost of the asset. The most commonly used items are classified as shown below: 3-year property: Tractor units, racehorses over 2 years old, and horses over 12 years old. 5-year property: Automobiles, buses, trucks, computers and peripheral equipment, office machinery, and any property used in research and experimentation. Also includes breeding and dairy cattle. 7-year property: Office furniture and fixtures, and any property that has not been desig- nated as belonging to another class. 1 10-year property: Water transportation equipment, single-purpose agricultural or horti- cultural structures, and trees or vines bearing fruit or nuts. 15-year property: Depreciable improvements to land such as fences, roads, and bridges, 20-year property: Farm buildings that are not agricultural or horticultural structures. 27.5.your property: Residential rental property. 39-year property: Nonresidential real estate, including home offices. (Note that the value of land may not be depreciated.) Generally speaking, residential and nonresidential real estate is depreciated via the straight-line method, but other classes can be depreciated more rapidly in early years. Table 8A.I shows the standard depreciation rates for assets in the other recovery classes refinements of this table can be applied depending on the month that the asset was placed into service (consult IRS guidelines). The table indicates the percentage of the asser's cost that may be depreciated each year, with year indicating the year the asset was first pur into The lower amount in year I reflects a "half year convention in which the asset is pre- sumed to be in use and this depreciated for half of the first year, no matter when it was actually put into use. After year it assumed that the asset depreciates more rapidly in earlier years. TABLE 8A.1 MACRS Depreciation Table Showing the Percentage of the Asset's Cost That May Be Depreciated Each Year Based on Its Recovery Period Year 3 Years 33.33 44.45 14.81 9.50 7.41 Depreciation Rate for Recovery Period 5 Years 7 Years 10 Years 15 Years 20.00 14.29 10.00 5.00 32.00 24.49 18.00 19.20 17.49 14.40 8.55 11.52 12.49 11.52 7.70 11.52 8.93 9.22 6.93 5.76 6.23 6.55 5.90 6.55 5.90 6.56 5.91 6.55 5.90 3.28 5.91 20 Years 3.750 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 462 4.-161 2.231 - Dy Dung di Dorrowing using the lease-equivalent loan, Emory saves an additional $43,747 - 41,875 = $1872 initially, and so leasing the machine is unattractive relative to this alternative. TABLE 25.2 SPREADSHEET Incremental Free Cash Flows of Leasing Versus Buying! 1 2 3 4 5 Year 0 Lease vs. Buy ($) 1. FCF Lease (Line 6, Table 25.1) (8,125) 2 Less: FCF Buy (Line 3, Table 25.1) 50,000 3 Lease-Buy 41,875 (8,125) (8,125) (8,125) (8,125) (3,500) (3,500) (3,500) (3,500) (3,500) (11,625) (11,625) (11,625) (11,625) (3,500) See S. Myers, D. Dill, and A. Bautista, "Valuation of Financial Lease Contracts," Journal of Finance 31(3) (1976): 799-819, for a development of this method. Chapter 25 lang TABLE 25.3 Cash Flows from Buying and Borrowing Using TABLE 25.2 SPREADSHEET Incremental Free Cash Flows of Leasing Versus Buying Year 0 23 Lease versus Buy ($) 1 FCF Lease 2 Less: FCF Buy L3 Lease-Buy NPV at 8.00% NPV at 0.00% The U.S. tax code allows for accelerated depreciation of most assets. The depreciation method that you use for any particular asset is determined by the tax rules in effect at the time you place the asset into service. (Congress has changed the depreciation rules many times over the years, so many firms that have held property for a long time may have to use several depreciation methods simultaneously.) For most business property placed in service after 1986, the IRS allows firms to depre- ciate the asset using the MACRS (Modified Accelerated Cost Recovery System) method. Under this method, you categorize each business asset into a recovery class that determines the time period over which you can write off the cost of the asset. The most commonly used items are classified as shown below: 3-year property: Tractor units, racehorses over 2 years old, and horses over 12 years old. 5-year property: Automobiles, buses, trucks, computers and peripheral equipment, office machinery, and any property used in research and experimentation. Also includes breeding and dairy cattle. 7-year property: Office furniture and fixtures, and any property that has not been desig- nated as belonging to another class. 1 10-year property: Water transportation equipment, single-purpose agricultural or horti- cultural structures, and trees or vines bearing fruit or nuts. 15-year property: Depreciable improvements to land such as fences, roads, and bridges, 20-year property: Farm buildings that are not agricultural or horticultural structures. 27.5.your property: Residential rental property. 39-year property: Nonresidential real estate, including home offices. (Note that the value of land may not be depreciated.) Generally speaking, residential and nonresidential real estate is depreciated via the straight-line method, but other classes can be depreciated more rapidly in early years. Table 8A.I shows the standard depreciation rates for assets in the other recovery classes refinements of this table can be applied depending on the month that the asset was placed into service (consult IRS guidelines). The table indicates the percentage of the asser's cost that may be depreciated each year, with year indicating the year the asset was first pur into The lower amount in year I reflects a "half year convention in which the asset is pre- sumed to be in use and this depreciated for half of the first year, no matter when it was actually put into use. After year it assumed that the asset depreciates more rapidly in earlier years. TABLE 8A.1 MACRS Depreciation Table Showing the Percentage of the Asset's Cost That May Be Depreciated Each Year Based on Its Recovery Period Year 3 Years 33.33 44.45 14.81 9.50 7.41 Depreciation Rate for Recovery Period 5 Years 7 Years 10 Years 15 Years 20.00 14.29 10.00 5.00 32.00 24.49 18.00 19.20 17.49 14.40 8.55 11.52 12.49 11.52 7.70 11.52 8.93 9.22 6.93 5.76 6.23 6.55 5.90 6.55 5.90 6.56 5.91 6.55 5.90 3.28 5.91 20 Years 3.750 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 462 4.-161 2.231 - Dy Dung di Dorrowing using the lease-equivalent loan, Emory saves an additional $43,747 - 41,875 = $1872 initially, and so leasing the machine is unattractive relative to this alternative. TABLE 25.2 SPREADSHEET Incremental Free Cash Flows of Leasing Versus Buying! 1 2 3 4 5 Year 0 Lease vs. Buy ($) 1. FCF Lease (Line 6, Table 25.1) (8,125) 2 Less: FCF Buy (Line 3, Table 25.1) 50,000 3 Lease-Buy 41,875 (8,125) (8,125) (8,125) (8,125) (3,500) (3,500) (3,500) (3,500) (3,500) (11,625) (11,625) (11,625) (11,625) (3,500) See S. Myers, D. Dill, and A. Bautista, "Valuation of Financial Lease Contracts," Journal of Finance 31(3) (1976): 799-819, for a development of this method. Chapter 25 lang TABLE 25.3 Cash Flows from Buying and Borrowing Using