please do the requirment for part A

1 2 3

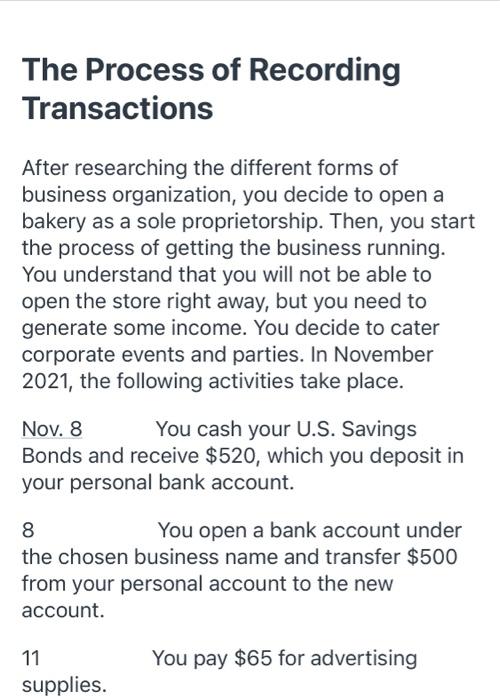

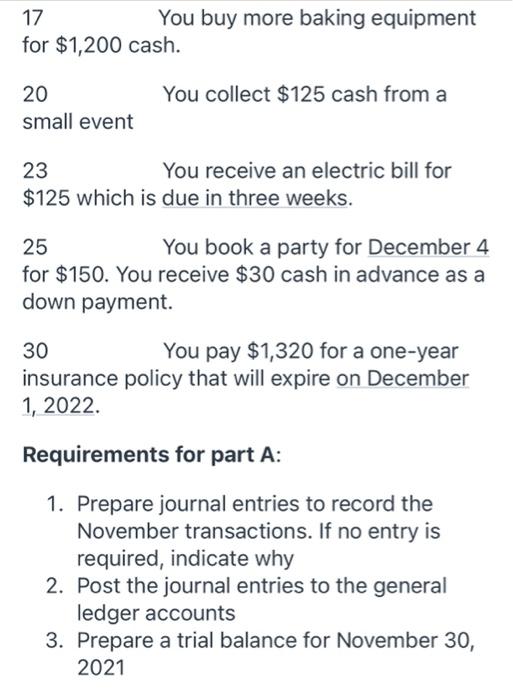

The Process of Recording Transactions After researching the different forms of business organization, you decide to open a bakery as a sole proprietorship. Then, you start the process of getting the business running. You understand that you will not be able to open the store right away, but you need to generate some income. You decide to cater corporate events and parties. In November 2021, the following activities take place. Nov. 8 You cash your U.S. Savings Bonds and receive $520, which you deposit in your personal bank account. 8 You open a bank account under the chosen business name and transfer $500 from your personal account to the new account. 11 supplies. You pay $65 for advertising 11 supplies. 13 You buy supplies, such as flour, sugar, butter, and fruit for $425 cash. (Hint: Use Supplies account.). You pay $65 for advertising 14 You start to gather some equipment. You have an excellent top-of-the- line mixer that originally cost you $750. You decide to start using it in your new business. You estimate that the equipment is currently worth $300. You invest the equipment in the business. 16 You realize that your initial cash investment is not enough. Your parents lend you $2,500 cash, for which you sign a note payable in the name of the business. You deposit the money in the business bank account. (Hint: The note does not have to be repaid for 24 months. As a result, the note payable should be reported in the accounts as the last liability and on the balance sheet as the last liability.) 17 for $1,200 cash. You buy more baking equipment 20 small event You collect $125 cash from a 23 $125 which is due in three weeks. You receive an electric bill for 25 You book a party for December 4 for $150. You receive $30 cash in advance as a down payment. 30 You pay $1,320 for a one-year insurance policy that will expire on December 1, 2022. Requirements for part A: 1. Prepare journal entries to record the November transactions. If no entry is required, indicate why 2. Post the journal entries to the general ledger accounts 3. Prepare a trial balance for November 30, 2021 The Process of Recording Transactions After researching the different forms of business organization, you decide to open a bakery as a sole proprietorship. Then, you start the process of getting the business running. You understand that you will not be able to open the store right away, but you need to generate some income. You decide to cater corporate events and parties. In November 2021, the following activities take place. Nov. 8 You cash your U.S. Savings Bonds and receive $520, which you deposit in your personal bank account. 8 You open a bank account under the chosen business name and transfer $500 from your personal account to the new account. 11 supplies. You pay $65 for advertising 11 supplies. 13 You buy supplies, such as flour, sugar, butter, and fruit for $425 cash. (Hint: Use Supplies account.). You pay $65 for advertising 14 You start to gather some equipment. You have an excellent top-of-the- line mixer that originally cost you $750. You decide to start using it in your new business. You estimate that the equipment is currently worth $300. You invest the equipment in the business. 16 You realize that your initial cash investment is not enough. Your parents lend you $2,500 cash, for which you sign a note payable in the name of the business. You deposit the money in the business bank account. (Hint: The note does not have to be repaid for 24 months. As a result, the note payable should be reported in the accounts as the last liability and on the balance sheet as the last liability.) 17 for $1,200 cash. You buy more baking equipment 20 small event You collect $125 cash from a 23 $125 which is due in three weeks. You receive an electric bill for 25 You book a party for December 4 for $150. You receive $30 cash in advance as a down payment. 30 You pay $1,320 for a one-year insurance policy that will expire on December 1, 2022. Requirements for part A: 1. Prepare journal entries to record the November transactions. If no entry is required, indicate why 2. Post the journal entries to the general ledger accounts 3. Prepare a trial balance for November 30, 2021