Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do this question fast On February 1, 2014 X-cell Inc. borrowed $1,056,000 by signing a five-year installment note bearing interest at 9%. Complete the

please do this question fast

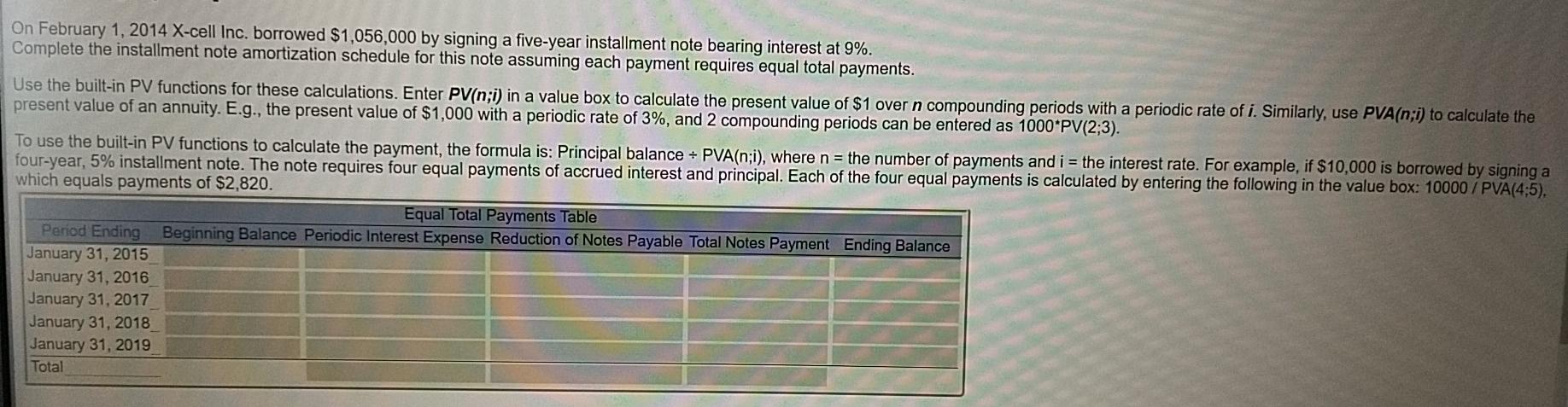

On February 1, 2014 X-cell Inc. borrowed $1,056,000 by signing a five-year installment note bearing interest at 9%. Complete the installment note amortization schedule for this note assuming each payment requires equal total payments. Use the built-in PV functions for these calculations. Enter PV(n;i) in a value box to calculate the present value of $1 over n compounding periods with a periodic rate of i. Similarly, use PVA(n;i) to calculate the present value of an annuity. E.g., the present value of $1,000 with a periodic rate of 3%, and 2 compounding periods can be entered as 1000+PV(2:3). To use the built-in PV functions to calculate the payment, the formula is: Principal balance + PVA(n;i), where n = the number of payments and i = the interest rate. For example, if $10,000 is borrowed by signing a four-year, 5% installment note. The note requires four equal payments of accrued interest and principal. Each of the four equal payments is calculated by entering the following in the value box: 10000 / PVA(4;5), which equals payments of $2,820. Equal Total Payments Table Period Ending Beginning Balance Periodic Interest Expense Reduction of Notes Payable Total Notes Payment Ending Balance January 31, 2015 January 31, 2016 January 31, 2017 January 31, 2018 January 31, 2019 TotalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started