Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please do your work in excel. Upvotes will be given. 2. Park 10.30 The Balas Manufacturing Company is considering buying an overhead pulley system. The

Please do your work in excel. Upvotes will be given.

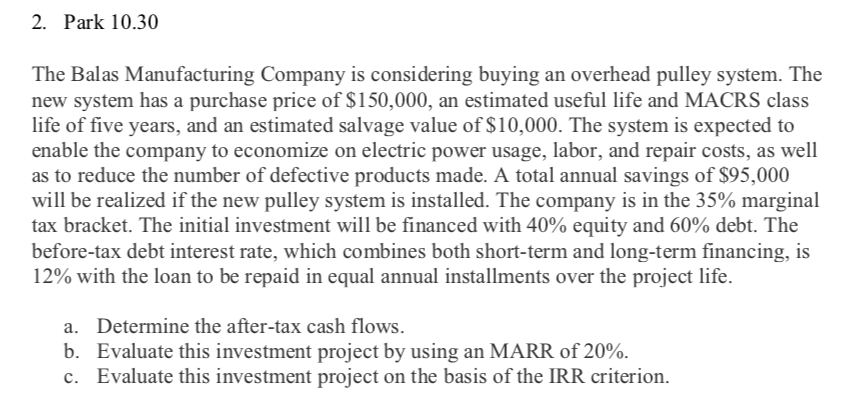

2. Park 10.30 The Balas Manufacturing Company is considering buying an overhead pulley system. The new system has a purchase price of $150,000, an estimated useful life and MACRS class life of five years, and an estimated salvage value of $10,000. The system is expected to enable the company to economize on electric power usage, labor, and repair costs, as well as to reduce the number of defective products made. A total annual savings of $95,000 will be realized if the new pulley system is installed. The company is in the 35% marginal tax bracket. The initial investment will be financed with 40% equity and 60% debt. The before-tax debt interest rate, which combines both short-term and long-term financing, is 12% with the loan to be repaid in equal annual installments over the project life. a. Determine the after-tax cash flows. b. Evaluate this investment project by using an MARR of 20%. c. Evaluate this investment project on the basis of the IRR criterion. 2. Park 10.30 The Balas Manufacturing Company is considering buying an overhead pulley system. The new system has a purchase price of $150,000, an estimated useful life and MACRS class life of five years, and an estimated salvage value of $10,000. The system is expected to enable the company to economize on electric power usage, labor, and repair costs, as well as to reduce the number of defective products made. A total annual savings of $95,000 will be realized if the new pulley system is installed. The company is in the 35% marginal tax bracket. The initial investment will be financed with 40% equity and 60% debt. The before-tax debt interest rate, which combines both short-term and long-term financing, is 12% with the loan to be repaid in equal annual installments over the project life. a. Determine the after-tax cash flows. b. Evaluate this investment project by using an MARR of 20%. c. Evaluate this investment project on the basis of the IRR criterionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started