Please dont answer it if you dont know all of it

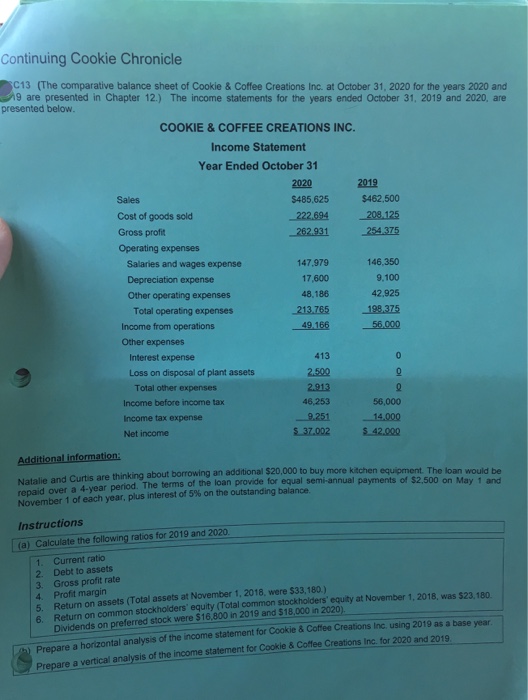

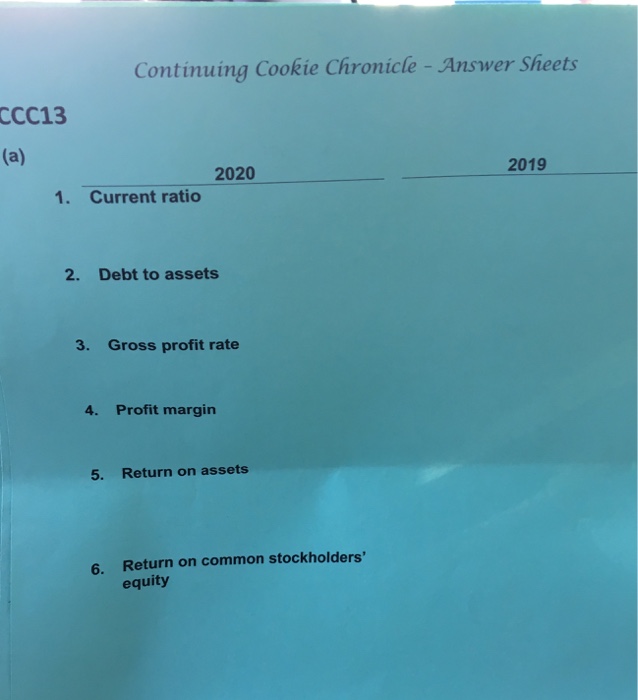

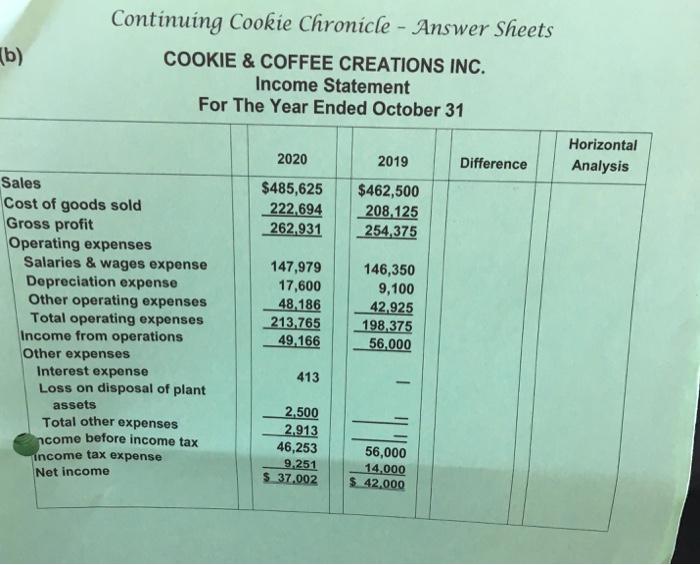

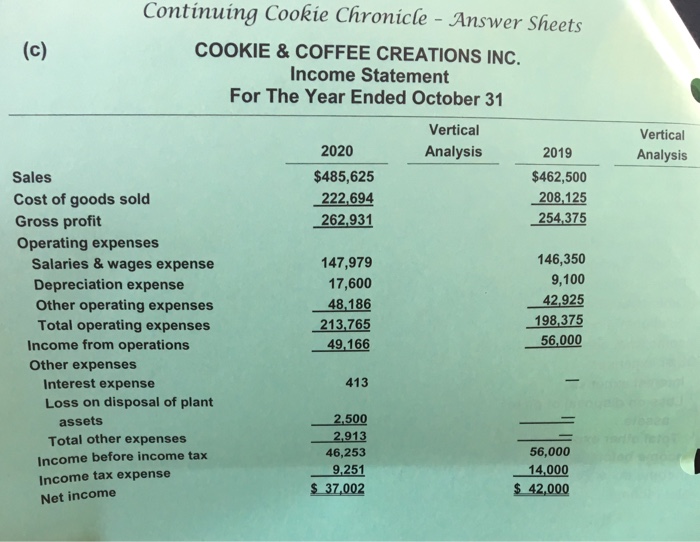

Continuing Cookie Chronicle C13 (The comparative balance sheet of Cookie & Coffee Creations Inc. at October 31, 2020 for the years 2020 and 9 are presented in Chapter 12.) The income statements for the years ended October 31, 2019 and 2020, ane presented below. COOKIE &COFFEE CREATIONS INC. Income Statement Year Ended October 31 2020 $485.625 222,694208.125 262.931 2019 $462,500 Sales Cost of goods sold Gross profit Operating expenses Salaries and wages expense Depreciation expense Other operating expenses 147,979 17,600 48,186 213.765 49 166 146,350 9,100 42,925 198.375 Total operating expenses Income from operations Other expenses Interest expense 413 Loss on disposal of plant assets 2.502 Total other expenses Income before income tax Income tax expense Net income 46,253 56,000 Natalie and Curtis are thinking about borrowing an additional $20,000 to buy more kitchen repaid over a 4-year period. The terms of the loan provide for equal semi-annual payments oan would be November 1 of each year, plus interest of 5% on the outstanding balance. of $2,500 on May 1 and Instructions Calculate the following ratios for 2019 and 2020 1. Current ratio 2 Debt to assets (a) 3. Gross profit rate 4. Profit margin 6Return on common stockholders' equity (Total common stockholders' equity at November 1,2018, was $23,180 Prepare a horizontal analysis of the Prepare a vertical analysis of the income statement for Cookle& Coffee Creations Inc. for 2020 Return on assets (Total assets at November 1, 2018, were $33,180) Dividends on preferred stock were $16,800 in 2019 and $18,000 in 2020) income statement for Cookie & Coffee Creations Inc using 2019 as a base year Continuing Cookie Chronicle C13 (The comparative balance sheet of Cookie & Coffee Creations Inc. at October 31, 2020 for the years 2020 and 9 are presented in Chapter 12.) The income statements for the years ended October 31, 2019 and 2020, ane presented below. COOKIE &COFFEE CREATIONS INC. Income Statement Year Ended October 31 2020 $485.625 222,694208.125 262.931 2019 $462,500 Sales Cost of goods sold Gross profit Operating expenses Salaries and wages expense Depreciation expense Other operating expenses 147,979 17,600 48,186 213.765 49 166 146,350 9,100 42,925 198.375 Total operating expenses Income from operations Other expenses Interest expense 413 Loss on disposal of plant assets 2.502 Total other expenses Income before income tax Income tax expense Net income 46,253 56,000 Natalie and Curtis are thinking about borrowing an additional $20,000 to buy more kitchen repaid over a 4-year period. The terms of the loan provide for equal semi-annual payments oan would be November 1 of each year, plus interest of 5% on the outstanding balance. of $2,500 on May 1 and Instructions Calculate the following ratios for 2019 and 2020 1. Current ratio 2 Debt to assets (a) 3. Gross profit rate 4. Profit margin 6Return on common stockholders' equity (Total common stockholders' equity at November 1,2018, was $23,180 Prepare a horizontal analysis of the Prepare a vertical analysis of the income statement for Cookle& Coffee Creations Inc. for 2020 Return on assets (Total assets at November 1, 2018, were $33,180) Dividends on preferred stock were $16,800 in 2019 and $18,000 in 2020) income statement for Cookie & Coffee Creations Inc using 2019 as a base year