Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please dont get any answer from CHEGG or any other website, and please answer the question completely. Thank you The transactions for the month of

Please dont get any answer from CHEGG or any other website, and please answer the question completely. Thank you

Please dont get any answer from CHEGG or any other website, and please answer the question completely. Thank you

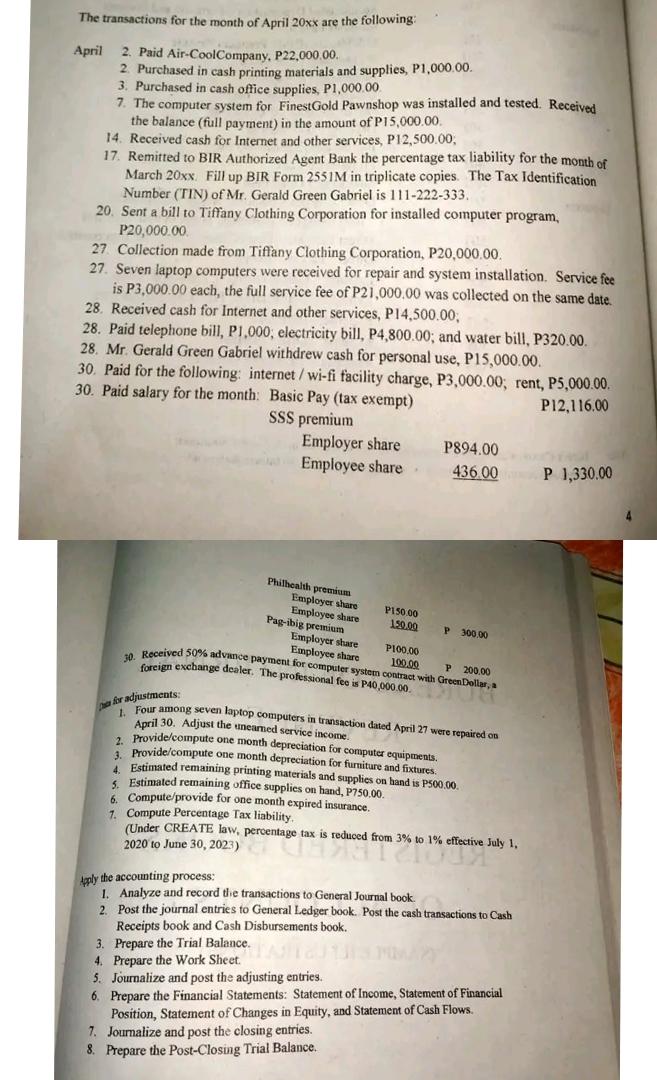

The transactions for the month of April 20xx are the following: April 2. Paid Air-CoolCompany, P22,000.00. 2. Purchased in cash printing materials and supplies, P1,000.00. 3. Purchased in cash office supplies, P1,000.00 7. The computer system for FinestGold Pawnshop was installed and tested. Received the balance (full payment) in the amount of P15,000.00. 14. Received cash for Internet and other services, P12,500.00, 17. Remitted to BIR Authorized Agent Bank the percentage tax liability for the month of March 20xx. Fill up BIR Form 2551M in triplicate copies. The Tax Identification Number (TIN) of Mr. Gerald Green Gabriel is 111-222-333. 20. Sent a bill to Tiffany Clothing Corporation for installed computer program, P20,000.00. 27 Collection made from Tiffany Clothing Corporation, P20,000.00. 27. Seven laptop computers were received for repair and system installation. Service fee is P3,000.00 each, the full service fee of P21,000.00 was collected on the same date. 28. Received cash for Internet and other services, P14,500.00, 28. Paid telephone bill, P1,000, electricity bill, P4,800.00; and water bill, P320.00. 28. Mr. Gerald Green Gabriel withdrew cash for personal use, P15,000.00. 30. Paid for the following: internet/wi-fi facility charge, P3,000.00; rent, P5,000.00. 30. Paid salary for the month: Basic Pay (tax exempt) P12,116.00 SSS premium Employer share Employee share Philhealth premium Employer share Employee share Pag-ibig premium P100.00 Employer share Employee share 100.00 P 200.00 30. Received 50% advance payment for computer system contract with GreenDollar, a foreign exchange dealer. The professional fee is P40,000.00. JA P150.00 150.00 6. Compute/provide for one month expired insurance. 1. Compute Percentage Tax liability. P894.00 436.00 for adjustments: 1. Four among seven laptop computers in transaction dated April 27 were repaired on April 30. Adjust the unearned service income. 2. Provide/compute one month depreciation for computer equipments. 1. Provide/compute one month depreciation for furniture and fixtures. 4. Estimated remaining printing materials and supplies on hand is P500.00. 5. Estimated remaining office supplies on hand, P750.00. P 300,00 13 (Under CREATE law, percentage tax is reduced from 3% to 1% effective July 1, 2020 to June 30, 2023) is reduced from 3% 1019 Apply the accounting process: 1. Analyze and record the transactions to General Journal book. 2. Post the journal entries to General Ledger book. Post the cash transactions to Cash Receipts book and Cash Disbursements book. 3. Prepare the Trial Balance. MAY 4. Prepare the Work Sheet. 5. Journalize and post the adjusting entries. 6. Prepare the Financial Statements: Statement of Income, Statement of Financial Position, Statement of Changes in Equity, and Statement of Cash Flows. 7. Journalize and post the closing entries. 8. Prepare the Post-Closing Trial Balance. P 1,330.00

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

GENERAL JOURNAL 33 34 15 6 DATE 2012 APRIL 2 Accounts rayable 2 Cash 3 PARTICULARS Paid Air C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started