Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please don't reply with all text, I can't read it, if possible can you upload pictures to show the process. I can't read all the

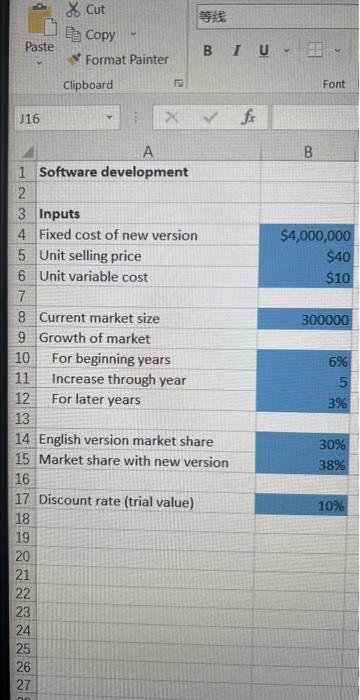

Please don't reply with all text, I can't read it, if possible can you upload pictures to show the process. I can't read all the text because I'm new to this topic. The picture below the topic is the table made by the message.

Please answer five question.

please show me the function!!!

A software company sells a program at $40 each and incurs a variable cost of $10 to produce it. Currently, the size of the market for the product is 300,000 units per year, and the English version of the software has a 30% share of the market. The company estimates that the market size will grow by 6% a year for the next 5 years, and at 3% per year after that. The company is considering translating its program into Chinese. It will cost the company $4 million to create a Chinese version of the program. The translation will increase the market share of the program to 38%. Assuming a 10-year planning horizon, find out how the discount rate affects the profitability of creating the Chinese version of the software. You are required to do the following.

Question:

1. Define range names for all the inputs, apply them in formulas, and paste the range names on the worksheet.

2. Assume that all variable costs and revenues are incurred at the ends of the respective years. Construct a model to calculate the change in the net present value after introducing the Chinese version. Hint: To calculate the NPV for the cases without and with the Chinese version, you can first do the following: For each year in the planning horizon, calculate the market size as well as the sales volume and profit for each case.

3. Use a one-way data table to analyze how the discount rate impacts the change in the net present value. Use the discount rate from 10% to 26% in increments of 2%.

4. Based on your result in question (3), create a scatter chart with smooth lines and markers to demonstrate the relationship between the change in the net present value and the discount rate (from 10% to 26%). Include in the chart a chart title and axes titles.

5. Highlight the range of NPVs so that the company will not consider the Chinese version

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started