please don't use excel but hand written answers

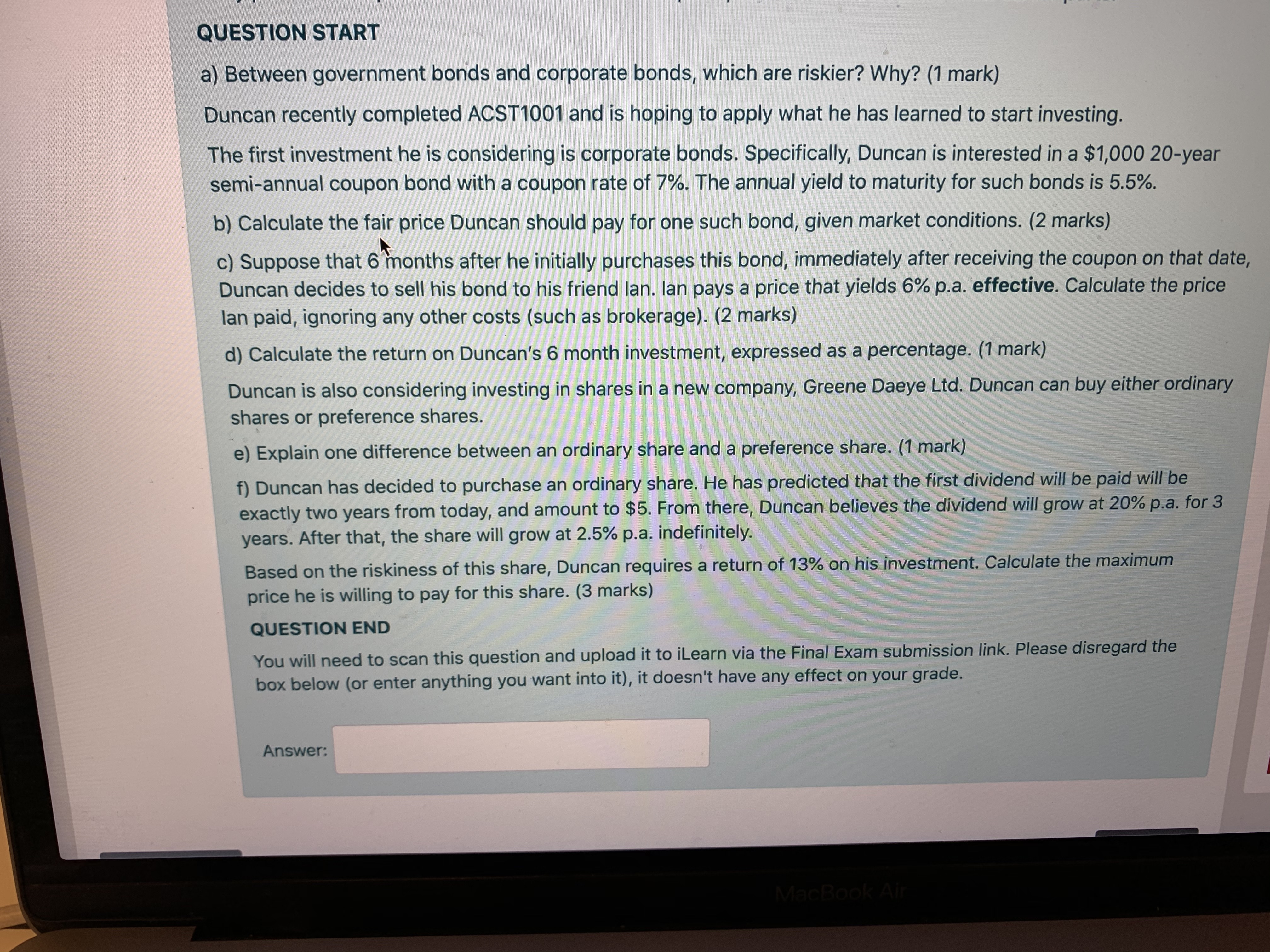

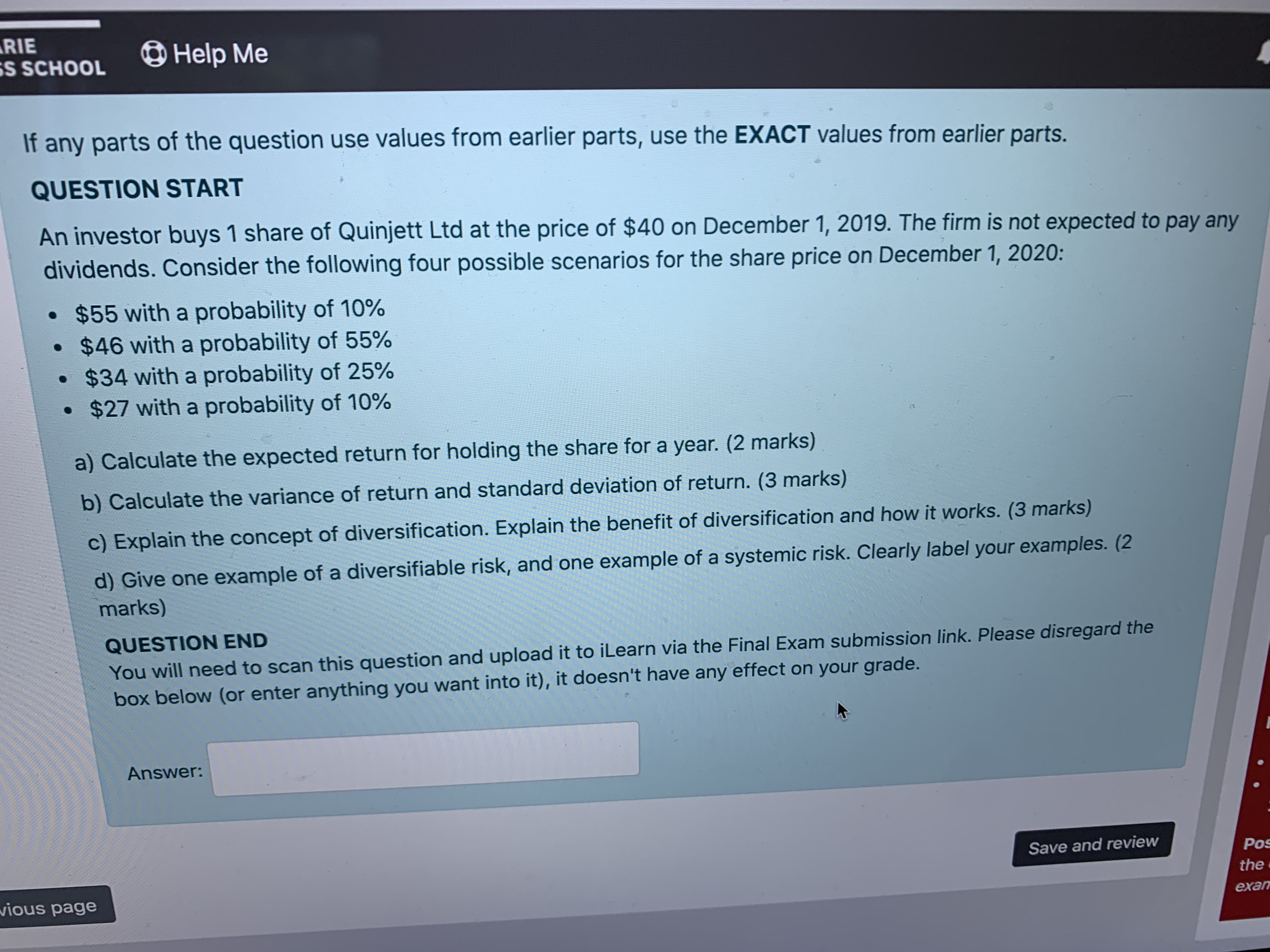

QUESTION START a) Between government bonds and corporate bonds, which are riskier? Why? (1 mark) Duncan recently completed ACST1001 and is hoping to apply what he has learned to start investing. The first investment he is considering is corporate bonds. Specifically, Duncan is interested in a $1,000 20-year semi-annual coupon bond with a coupon rate of 7%. The annual yield to maturity for such bonds is 5.5%. b) Calculate the fair price Duncan should pay for one such bond, given market conditions. (2 marks) c) Suppose that 6 months after he initially purchases this bond, immediately after receiving the coupon on that date, Duncan decides to sell his bond to his friend lan. lan pays a price that yields 6% p.a. effective. Calculate the price lan paid, ignoring any other costs (such as brokerage). (2 marks) d) Calculate the return on Duncan's 6 month investment, expressed as a percentage. (1 mark) Duncan is also considering investing in shares in a new company, Greene Daeye Lid. Duncan can buy either ordinary shares or preference shares. e) Explain one difference between an ordinary share and a preference share. (1 mark) f) Duncan has decided to purchase an ordinary share. He has predicted that the first dividend will be paid will be exactly two years from today, and amount to $5. From there, Duncan believes the dividend will grow at 20% p.a. for 3 years. After that, the share will grow at 2.5% p.a. indefinitely. Based on the riskiness of this share, Duncan requires a return of 13% on his investment. Calculate the maximum price he is willing to pay for this share. (3 marks) QUESTION END You will need to scan this question and upload it to iLearn via the Final Exam submission link. Please disregard the box below (or enter anything you want into it), it doesn't have any effect on your grade. Answer: MacBook AirRIE S SCHOOL Help Me If any parts of the question use values from earlier parts, use the EXACT values from earlier parts. QUESTION START An investor buys 1 share of Quinjett Ltd at the price of $40 on December 1, 2019. The firm is not expected to pay any dividends. Consider the following four possible scenarios for the share price on December 1, 2020: . $55 with a probability of 10% $46 with a probability of 55% . $34 with a probability of 25% . $27 with a probability of 10% a) Calculate the expected return for holding the share for a year. (2 marks) b) Calculate the variance of return and standard deviation of return. (3 marks) c) Explain the concept of diversification. Explain the benefit of diversification and how it works. (3 marks) d) Give one example of a diversifiable risk, and one example of a systemic risk. Clearly label your examples. (2 marks) QUESTION END You will need to scan this question and upload it to iLearn via the Final Exam submission link. Please disregard the box below (or enter anything you want into it), it doesn't have any effect on your grade. Answer: Save and review Po vious page the exan