please double check and correct

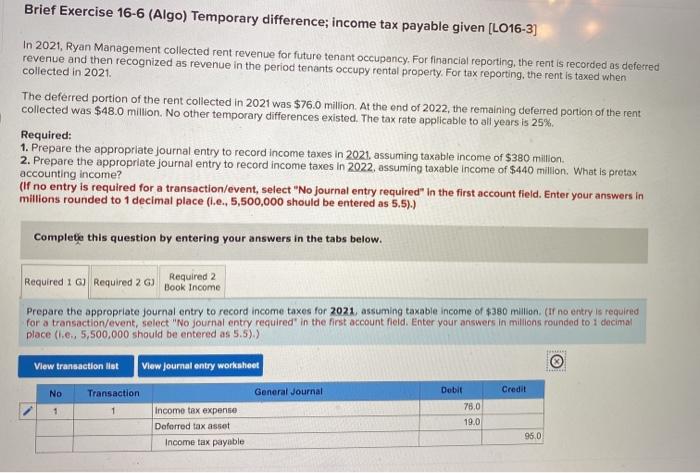

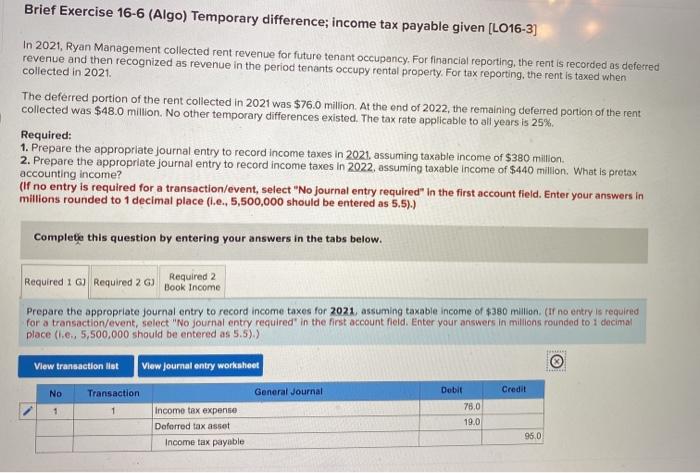

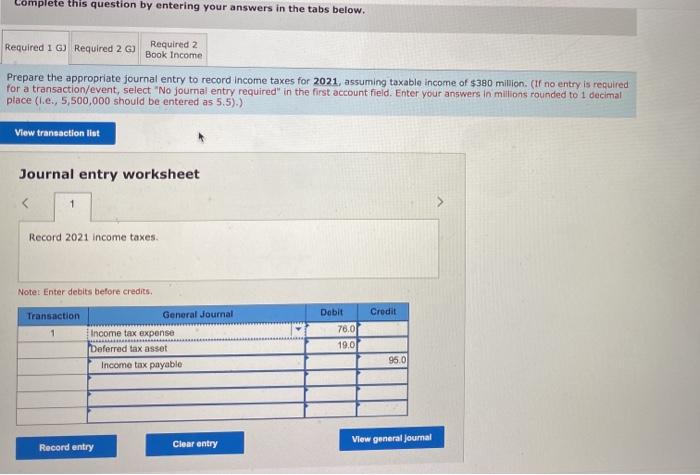

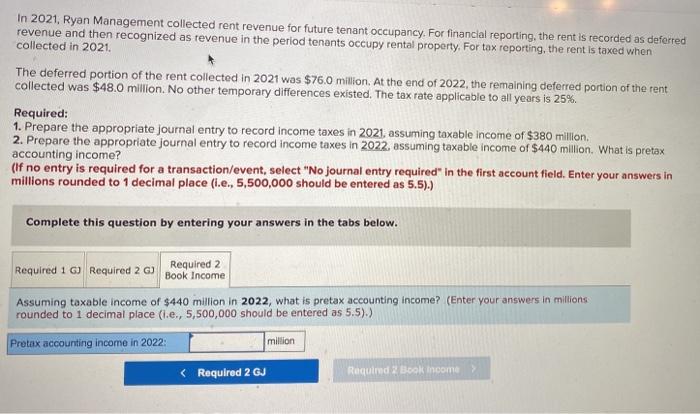

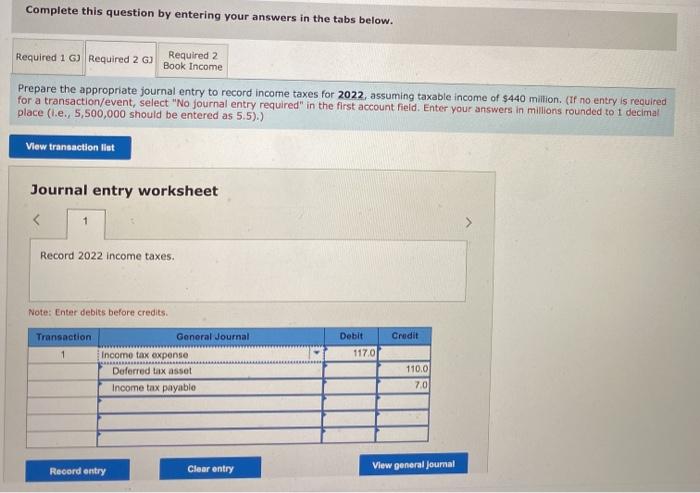

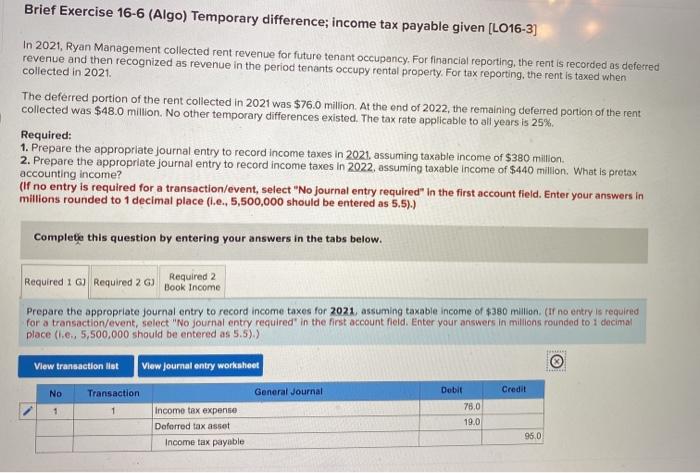

Brief Exercise 16-6 (Algo) Temporary difference; income tax payable given (L016-3] In 2021, Ryan Management collected rent revenue for future tenant occupancy, For financial reporting, the rent is recorded as deferred revenue and then recognized as revenue in the period tenants occupy rental property. For tax reporting, the rent is taxed when collected in 2021 The deferred portion of the rent collected in 2021 was $76.0 million. At the end of 2022, the remaining deferred portion of the rent collected was $48.0 million. No other temporary differences existed. The tax rate applicable to all years is 25% Required: 1. Prepare the appropriate journal entry to record income taxes in 2021. assuming taxable income of $380 million 2. Prepare the appropriate journal entry to record income taxes in 2022, assuming taxable income of $440 million. What is protax accounting income? (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (l.e., 5,500,000 should be entered as 5.5).) Complete this question by entering your answers in the tabs below. Required 2 Required 1 Required 2G) Book Income Prepare the appropriate Journal entry to record income taxes for 2021, assuming taxable income of $380 milion. (Ir no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (1.6, 5,500,000 should be entered as 5.5)) View transaction et View Journal entry worksheet 1. NO Transaction General Journal Credit 1 1 Dobit 78,0 19.0 Income tax expense Doforred tax asset Income tax payable 95.0 Complete this question by entering your answers in the tabs below. Required 16 Required 2G Required 2 Book Income Prepare the appropriate journal entry to record income taxes for 2021, assuming taxable income of $380 million. (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Enter your answers in millions rounded to 1 decimal place (1.e., 5,500,000 should be entered as 5.5).) View transaction list Journal entry worksheet