Question

Please double check my work based on the instructions provided below. I am not sure if I did this correctly. The local bakery has decided

Please double check my work based on the instructions provided below. I am not sure if I did this correctly.

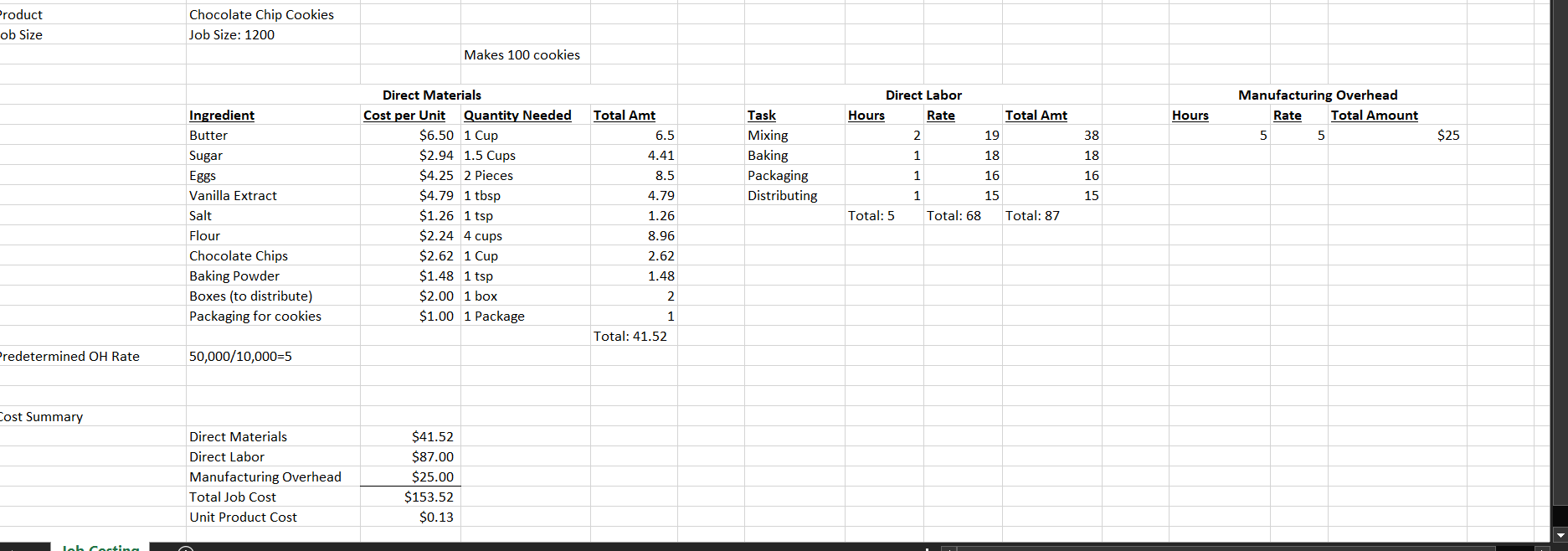

The local bakery has decided they want to produce a new product to sell to customers. The bakery utilizes job order costing, and a job cost sheet will be used to summarize all costs. The bakery uses direct labor hours as the allocation base to apply manufacturing overhead to a job. The bakery estimates $50,000 in total manufacturing overhead costs and estimates 10,000 total direct labor hours in the year.

Requirements:

1. Develop and complete a job cost sheet.

2. Choose any bakery product to produce, find a recipe, and determine job (batch) size.

3. Break down and list all ingredients, research cost of ingredients, and calculate total direct material cost.

4. Determine production tasks (i.e., mixer, baker, quality control, etc.), assign each production task an hourly wage, and calculate total direct labor cost.

5. From the information provided in the project summary, calculate the bakery wide predetermined overhead rate for manufacturing overhead using direct labor hours as the allocation base.

6. Apply manufacturing overhead to the job.

7. Calculate total job cost.

8. Calculate unit product cost.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started