Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please double-check my work, and if wrong, please show me where you got the numbers and calculations to get the correct answer. thank you in

please double-check my work, and if wrong, please show me where you got the numbers and calculations to get the correct answer. thank you in advance.

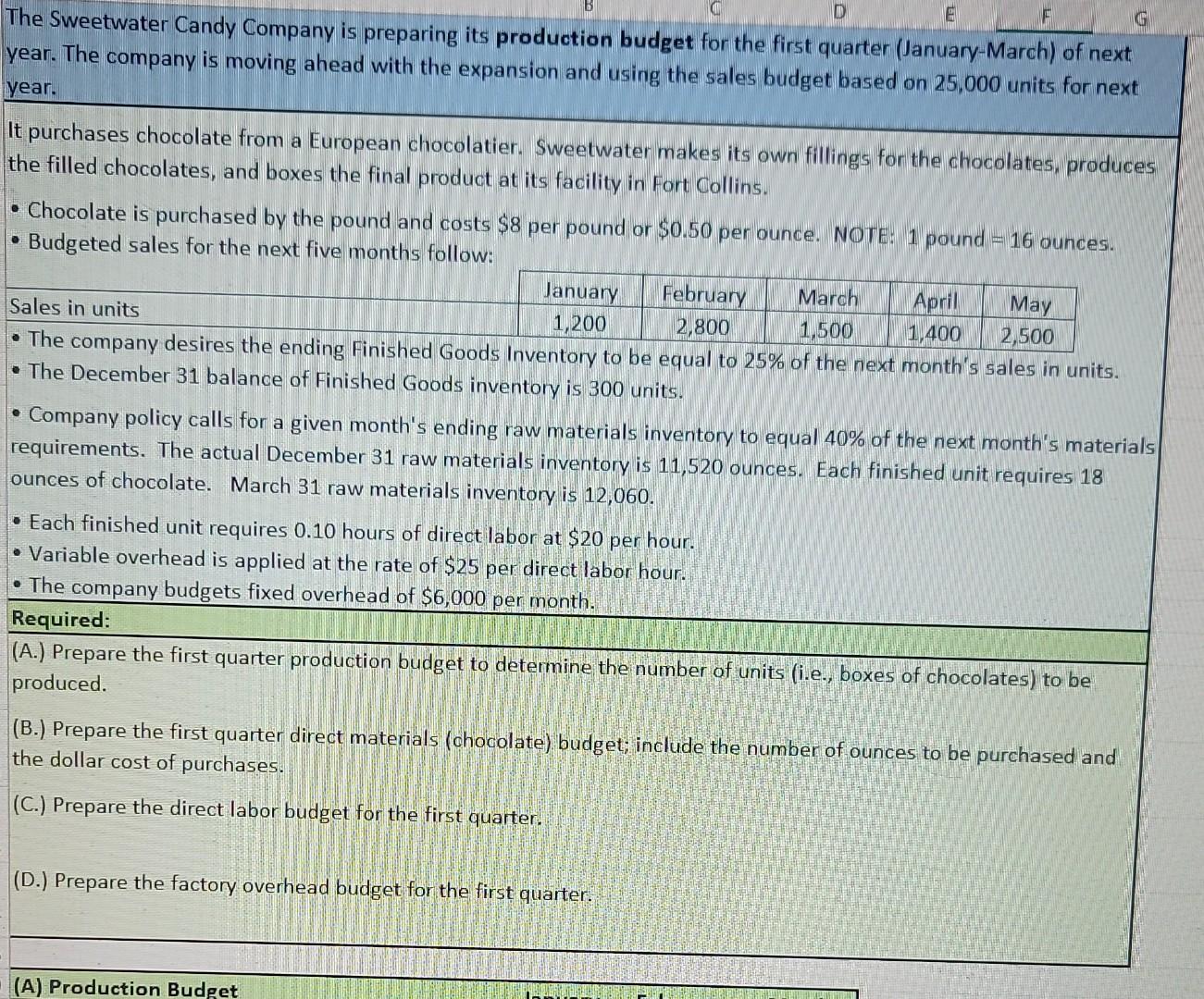

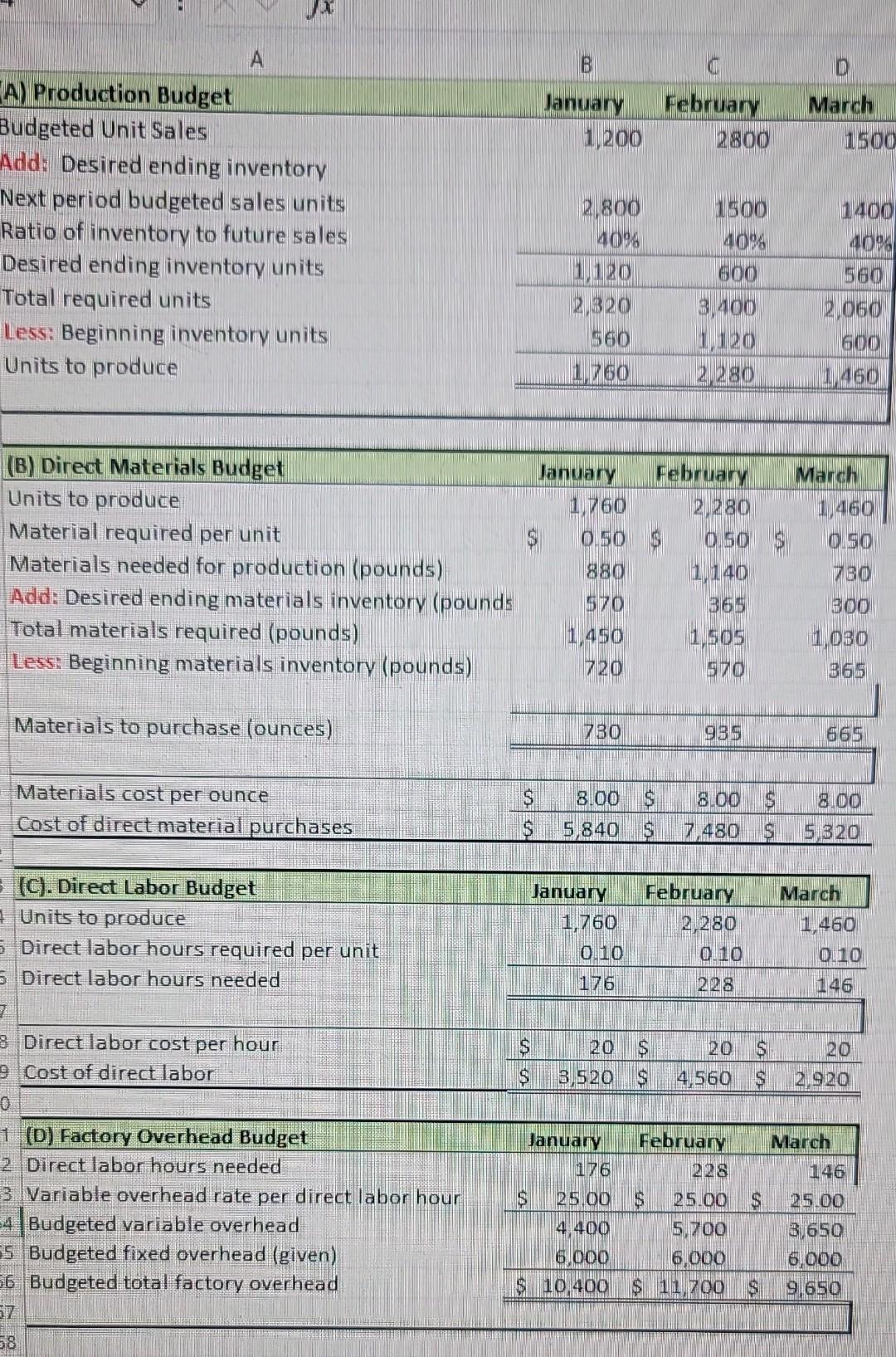

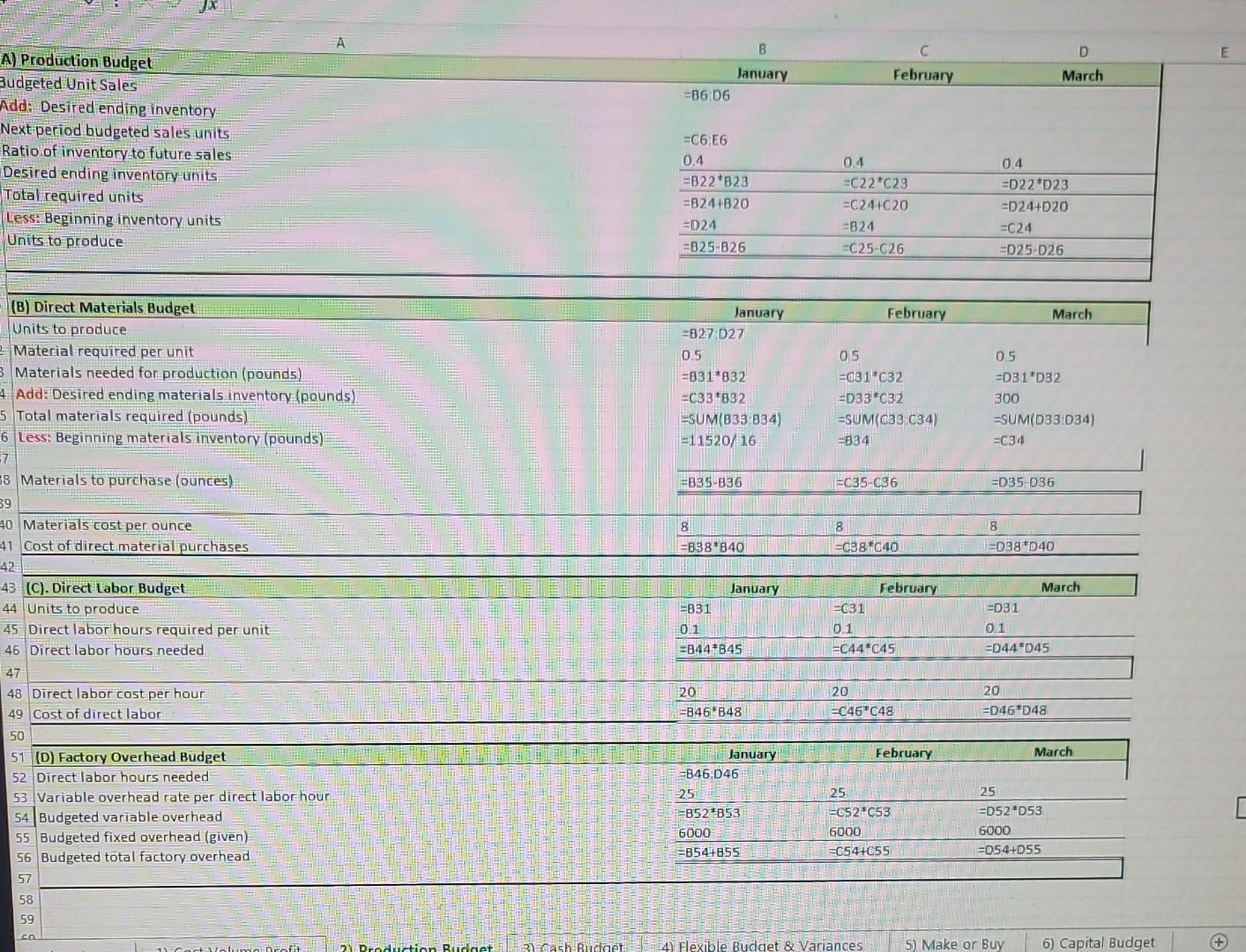

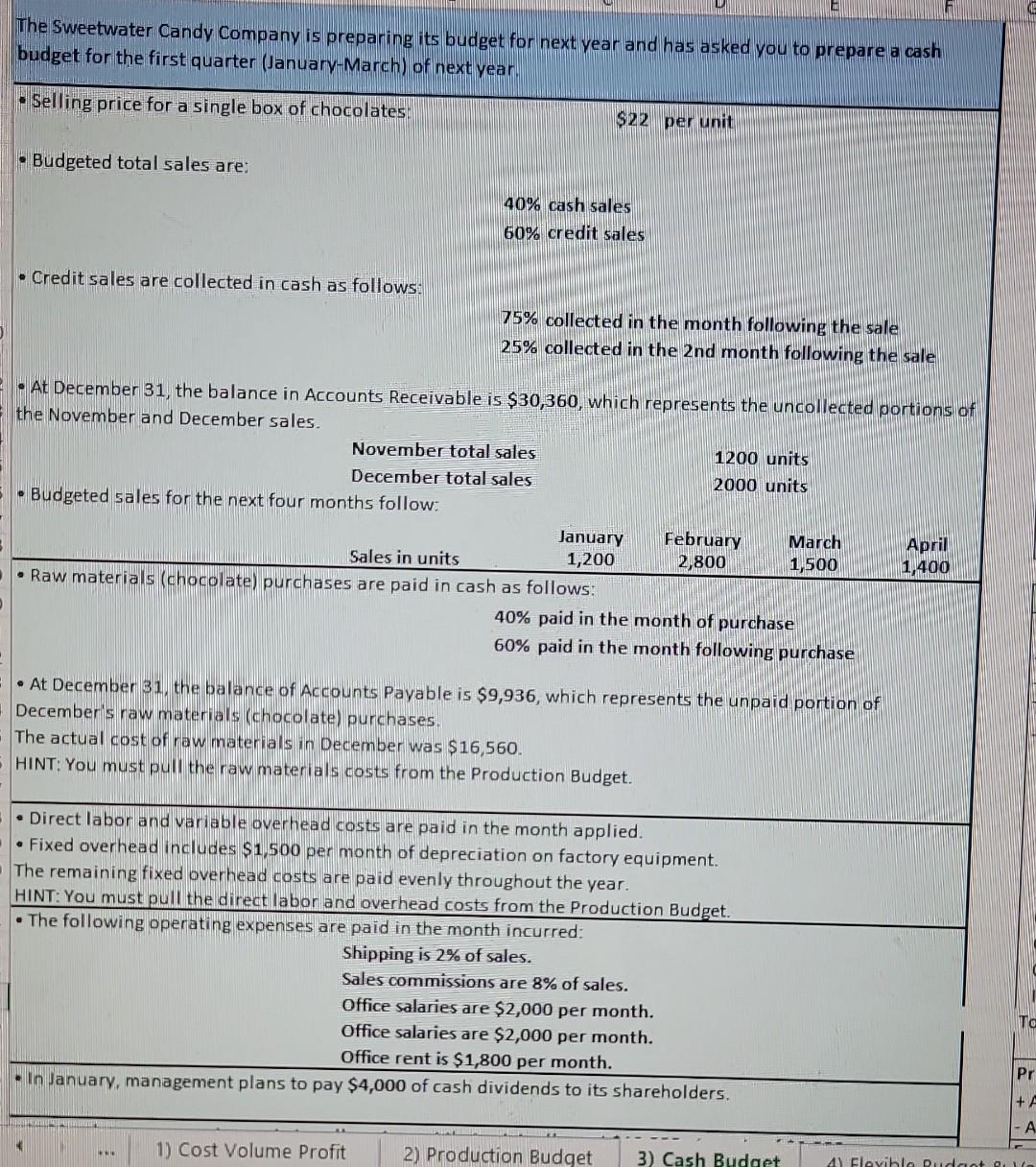

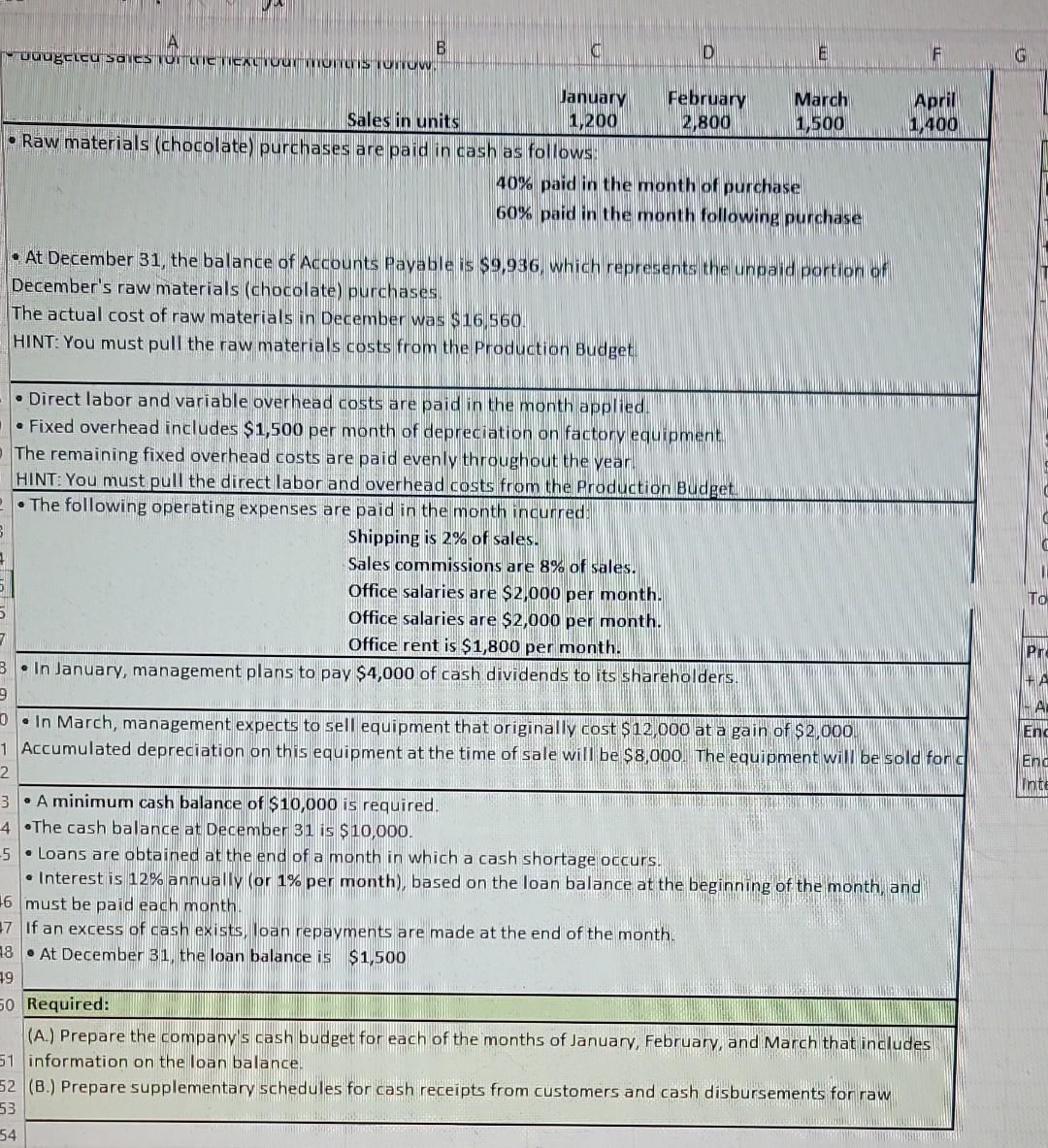

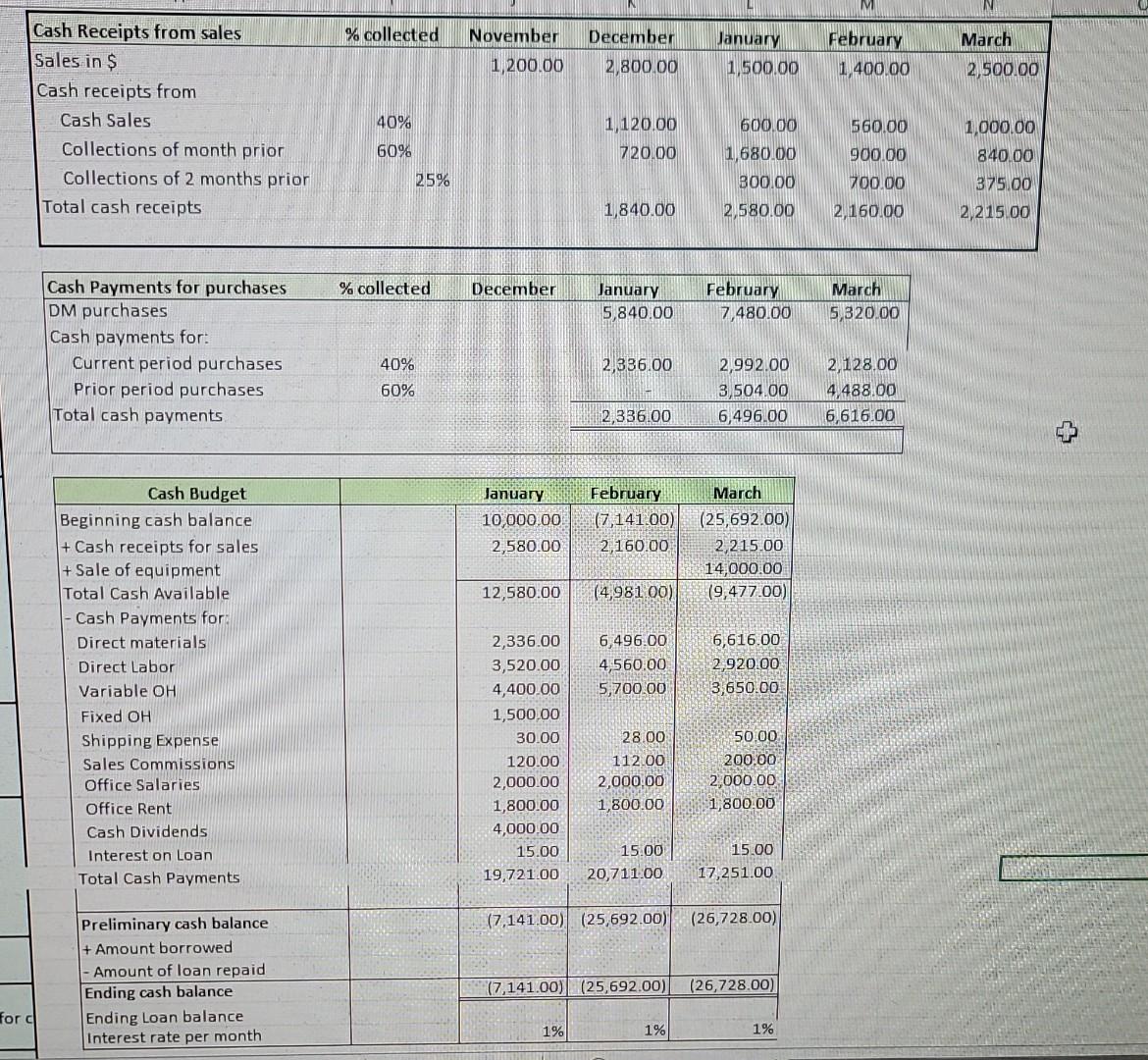

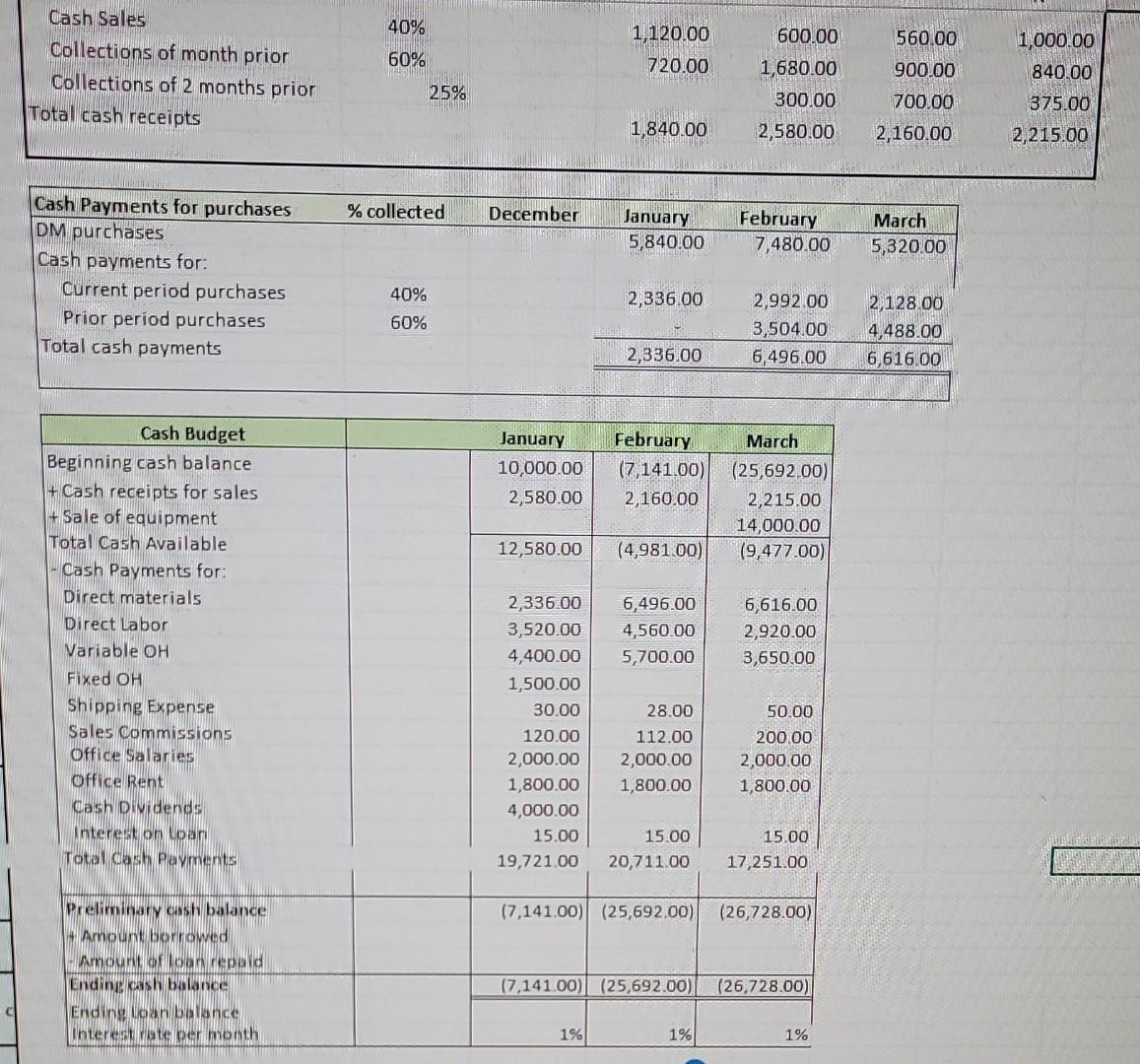

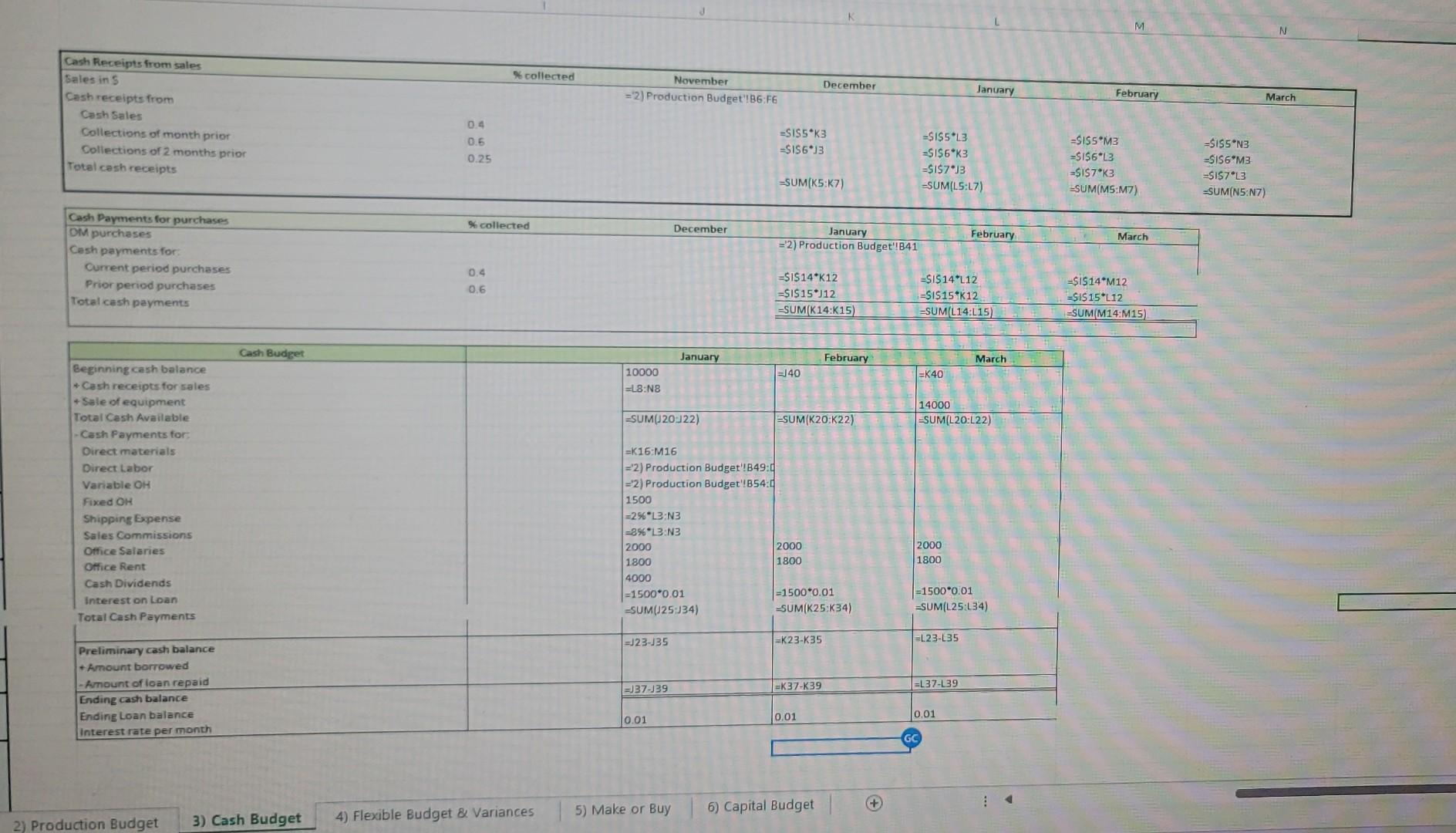

The Sweetwater Candy Company is preparing its production budget for the first quarter (January-March) of next year. The company is moving ahead with the expansion and using the sales budget based on 25,000 units for next year. It purchases chocolate from a European chocolatier. Sweetwater makes its own fillings for the chocolates, produces the filled chocolates, and boxes the final product at its facility in Fort Collins. - Chocolate is purchased by the pound and costs $8 per pound or $0.50 per ounce. NOTE: 1 pound =16 ounces. - Budgeted sales for the next five months follow: of Finished Goods Inventory to be equal to 25% of the next month's sales in units. calls for a given month's ending raw materials inventory to equal 40% of the next month's materials requirements. The actual December 31 raw materials inventory is 11,520 ounces. Each finished unit requires 18 ounces of chocolate. March 31 raw materials inventory is 12,060. - Each finished unit requires 0.10 hours of direct labor at $20 per hour. - Variable overhead is applied at the rate of \$25 per direct labor hour. - The company budgets fixed overhead of $6,000 per month. Required: (A.) Prepare the first quarter production budget to determine the number of units (i.e., boxes of chocolates) to be produced. (B.) Prepare the first quarter direct materials (chocolate) budget; include the number of ounces to be purchased and the dollar cost of purchases. (C.) Prepare the direct labor budget for the first quarter. (D.) Prepare the factory overhead budget for the first quarter. \begin{tabular}{|lrrrr|} \hline 1 & (D) Factory Overhead Budget & January & February & March \\ 2 & Direct labor hours needed & 176 & 228 & 146 \\ 3 & Variable overhead rate per direct labor hour & $25.00 & $25.00 & $25.00 \\ 4 & Budgeted variable overhead & 4,400 & 5,700 & 3,650 \\ 5 & Budgeted fixed overhead (given) & 6,000 & 6,000 & 6,000 \\ \hline 6 & Budgeted total factory overhead & $10,400 & $11,700 & $9,650 \\ \hline 7 & & & & \\ \hline \end{tabular} A) Production Budget A Budgeted Unit Sales Add: Desired ending inventory Next period budgeted sales units Ratio of inventory to future sales Desired ending inventory units: Total required units Less: Beginning inventory units Units to produce \begin{tabular}{|ccc|} \hline January & February & March \\ \hline=827027 & & \end{tabular} \begin{tabular}{lll} =C6:E6 & & \\ 0.4 & 0.4 & 0.4 \\ \hline=B22B23 & =C22C23 & =D22D23 \\ \hline=B24+B20 & =C24+C20 & =D24+D20 \\ =D24 & =B24 & =C24 \\ \hline=B25B26 & =C25C26 & =D25D26 \end{tabular} 40 Materials costper ounce Cost of direct material purchases 0.5=831832=C33832=SUM(833:834)=11520/160.5=C31C32=D33C32=SUM(C33C34)=8340.5=031D32300=5UM(D33:D34)=C34 (C). Direct Labor Budget Units to produce =835-836 =C3SC36 = D35 D36 Direct labor hours required per unit Direct labor hours needed \begin{tabular}{lll} 8 & 8 \\ \hline=838840 & =C38C40 & 8 \\ \hline \end{tabular} Direct labor cost per hour Cost of direct labor 846B4820 January (D) Factory Overhead Budget H lanuary February March 52 Direct labor hours needed 53 Variable overhead rate per direct labor hour Budgeted variable overhead Budgeted fixed overhead (given) Budgeted total factory overhead \begin{tabular}{lll} 6000 & 6000 & 6000 \\ \hline854+855 & =C54+C55 & =0.54+D55 \\ \hline \end{tabular} 59 The Sweetwater Candy Company is preparing its budget for next year and has asked you to prepare a cash oudget for the first quarter (January-March) of next year. - At December 31 , the balance of Accounts Payable is $9,936, which represents the unpaid portion of December's raw materials (chocolate) purchases. The actual cost of raw materials in December was $16,560. HINT: You must pull the raw materials costs from the Production Budget. - Direct labor and variable overhead costs are paid in the month applied. - Fixed overhead includes $1,500 per month of depreciation on factory equipment The remaining fixed overhead costs are paid evenly throughout the vear. HINT: You must pull the direct labor and overhead costs from the Production Budget. - The following operating expenses are paid in the month incurred Shipping is 2% of sales. Sales commissions are 8% of sales. Office salaries are $2,000 per month. Office salaries are $2,000 per month. Office rent is $1,800 per month. - In January, management plans to pay \$4,000 of cash dividends to its shareholders. - In March, management expects to sell equipment that originally cost $12,000 at a gain of $2,000. Accumulated depreciation on this equipment at the time of sale will be $8,000. The equipment will be sold for c - A minimum cash balance of $10,000 is required. -The cash balance at December 31 is $10,000. - Loans are obtained at the end of a month in which a cash shortage occurs. - Interest is 12% annually (or 1% per month), based on the loan balance at the beginning of the month, and must be paid each month. If an excess of cash exists, loan repayments are made at the end of the month. - At December 31 , the loan balance is $1,500 Required: (A.) Prepare the company's cash budget for each of the months of January, February, and March that includes information on the loan balance. (B.) Prepare supplementary schedules for cash receipts from customers and cash disbursements for raw \begin{tabular}{lrrrrrr} Cash Sales & 40% & 1,120.00 & 600.00 & 560.00 & 1,000.00 \\ Collections of month prior & 60% & 720.00 & 1,680.00 & 900.00 & 840.00 \\ Collections of 2 months prior & 25% & & 300.00 & 700.00 & 375.00 \\ Total cash receipts & & 1,840.00 & 2,580.00 & 2,160.00 & 2,215.00 \\ & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started