please draw strategic mapping of this case

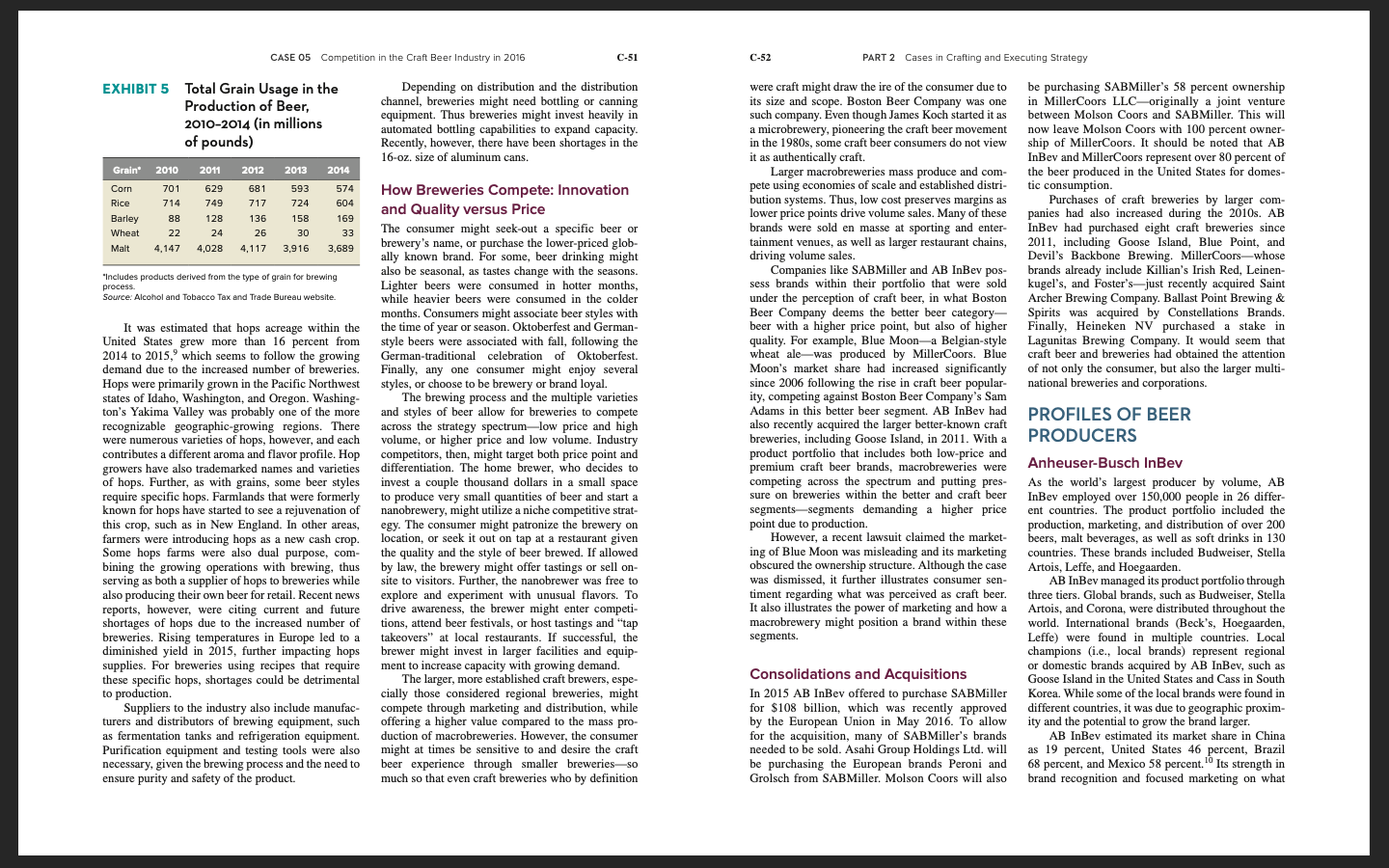

CASE 05 Competition in the Craft Beer Industry in 2016 C-51 C-52 PART 2 Cases in Crafting and Executing Strategy EXHIBIT 5 Total Grain Usage in the Depending on distribution and the distribution were craft might draw the ire of the consumer due to be purchasing SABMiller's 58 percent ownership Production of Beer, channel, breweries might need bottling or canning its size and scope. Boston Beer Company was one in MillerCoors LLC-originally a joint venture 2010-2014 (in millions equipment. Thus breweries might invest heavily in such company. Even though James Koch started it as between Molson Coors and SABMiller. This will of pounds) automated bottling capabilities to expand capacity. Recently, however, there have been shortages in the a microbrewery, pioneering the craft beer movement now leave Molson Coors with 100 percent owner- in the 1980s, some craft beer consumers do not view ship of MillerCoors. It should be noted that AB 16-oz. size of aluminum cans. it as authentically craft. InBev and MillerCoors represent over 80 percent of Grain* 2010 2011 2012 2013 2014 Larger macrobreweries mass produce and com- the beer produced in the United States for domes- Cor 701 629 681 593 574 How Breweries Compete: Innovation pete using economies of scale and established distri- tic consumption. Rice 714 749 717 724 604 Barley 88 179 136 158 169 and Quality versus Price bution systems. Thus, low cost preserves margins as lower price points drive volume sales. Many of these Purchases of craft breweries by larger com- panies had also increased during the 2010s. AB Wheat 24 26 30 33 The consumer might seek-out a specific beer or brands were sold en masse at sporting and enter- InBev had purchased eight craft breweries since Malt 4,147 4.028 4,117 3,916 3,689 brewery's name, or purchase the lower-priced glob- tainment venues, as well as larger restaurant chains, 2011, including Goose Island, Blue Point, and ally known brand. For some, beer drinking might driving volume sales. Devil's Backbone Brewing. MillerCoors-whose "Includes products derived from the type of grain for brewing also be seasonal, as tastes change with the seasons. Companies like SABMiller and AB InBev pos- sess brands within their portfolio that were sold brands already include Killian's Irish Red, Leinen process. kugel's, and Foster's-just recently acquired Saint Source: Alcohol and Tobacco Tax and Trade Bureau website. Lighter beers were consumed in hotter months, while heavier beers were consumed in the colder under the perception of craft beer, in what Boston Archer Brewing Company. Ballast Point Brewing & months. Consumers might associate beer styles with Beer Company deems the better beer category- It was estimated that hops acreage within the beer with a higher price point, but also of higher Spirits was acquired by Constellations Brands. the time of year or season. Oktoberfest and German- Finally, Heineken NV purchased a stake in United States grew more than 16 percent from style beers were associated with fall, following the quality. For example, Blue Moon-a Belgian-style German-traditional celebration of Oktoberfest. wheat ale-was produced by MillerCoors. Blue Lagunitas Brewing Company. It would seem that 2014 to 2015," which seems to follow the growing craft beer and breweries had obtained the attention demand due to the increased number of breweries. Finally, any one consumer might enjoy several Moon's market share had increased significantly of not only the consumer, but also the larger multi- Hops were primarily grown in the Pacific Northwest national breweries and corporations. states of Idaho, Washington, and Oregon. Washing- styles, or choose to be brewery or brand loyal. The brewing process and the multiple varieties since 2006 following the rise in craft beer popular- ity, competing against Boston Beer Company's Sam ton's Yakima Valley was probably one of the more and styles of beer allow for breweries to compete Adams in this better beer segment. AB InBev had recognizable geographic-growing regions. There across the strategy spectrum-low price and high also recently acquired the larger better-known craft PROFILES OF BEER were numerous varieties of hops, however, and each volume, or higher price and low volume. Industry breweries, including Goose Island, in 2011. With a PRODUCERS contributes a different aroma and flavor profile. Hop competitors, then, might target both price point and product portfolio that includes both low-price and growers have also trademarked names and varieties differentiation. The home brewer, who decides to premium craft beer brands, macrobreweries were Anheuser-Busch InBev of hops. Further, as with grains, some beer styles invest a couple thousand dollars in a small space competing across the spectrum and putting pres- As the world's largest producer by volume, AB require specific hops. Farmlands that were formerly to produce very small quantities of beer and start a sure on breweries within the better and craft beer InBev employed over 150,000 people in 26 differ- known for hops have started to see a rejuvenation of nanobrewery, might utilize a niche competitive strat- segments-segments demanding a higher price ent countries. The product portfolio included the this crop, such as in New England. In other areas, egy. The consumer might patronize the brewery on point due to production. However, a recent lawsuit claimed the market- production, marketing, and distribution of over 200 farmers were introducing hops as a new cash crop. location, or seek it out on tap at a restaurant given beers, malt beverages, as well as soft drinks in 130 Some hops farms were also dual purpose, com- the quality and the style of beer brewed. If allowed ing of Blue Moon was misleading and its marketing countries. These brands included Budweiser, Stella bining the growing operations with brewing, thus by law, the brewery might offer tastings or sell on- obscured the ownership structure. Although the case serving as both a supplier of hops to breweries while site to visitors. Further, the nanobrewer was free to was dismissed, it further illustrates consumer sen- Artois, Leffe, and Hoegaarden. timent regarding what was perceived as craft beer. AB InBev managed its product portfolio through also producing their own beer for retail. Recent news explore and experiment with unusual flavors. To three tiers. Global brands, such as Budweiser, Stella reports, however, were citing current and future shortages of hops due to the increased number of drive awareness, the brewer might enter competi- It also illustrates the power of marketing and how a Artois, and Corona, were distributed throughout the tions, attend beer festivals, or host tastings and "tap macrobrewery might position a brand within these world. International brands (Beck's, Hoegaarden, breweries. Rising temperatures in Europe led to a segments. Leffe) were found in multiple countries. Local diminished yield in 2015, further impacting hops takeovers" at local restaurants. If successful, the brewer might invest in larger facilities and equip- champions (i.e., local brands) represent regional supplies. For breweries using recipes that require ment to increase capacity with growing demand. or domestic brands acquired by AB InBev, such as these specific hops, shortages could be detrimental The larger, more established craft brewers, espe- Consolidations and Acquisitions to production. cially those considered regional breweries, might In 2015 AB InBev offered to purchase SABMiller Goose Island in the United States and Cass in South Korea. While some of the local brands were found in Suppliers to the industry also include manufac for $108 billion, which was recently approved different countries, it was due to geographic proxim- turers and distributors of brewing equipment, such compete through marketing and distribution, while offering a higher value compared to the mass pro- by the European Union in May 2016. To allow ity and the potential to grow the brand larger. as fermentation tanks and refrigeration equipment. duction of macrobreweries. However, the consumer for the acquisition, many of SABMiller's brands AB InBev estimated its market share in China Purification equipment and testing tools were also necessary, given the brewing process and the need to might at times be sensitive to and desire the craft much so that even craft breweries who by definition -so needed to be sold. Asahi Group Holdings Ltd. will as 19 percent, United States 46 percent, Brazil beer experience through smaller breweries- be purchasing the European brands Peroni and 68 percent, and Mexico 58 percent. Its strength in ensure purity and safety of the product. Grolsch from SABMiller. Molson Coors will also brand recognition and focused marketing on what