Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please draw the decision trees for questions 2-5 1. A building supply store is considering expanding its capacity to meet a growing demand for its

please draw the decision trees for questions 2-5

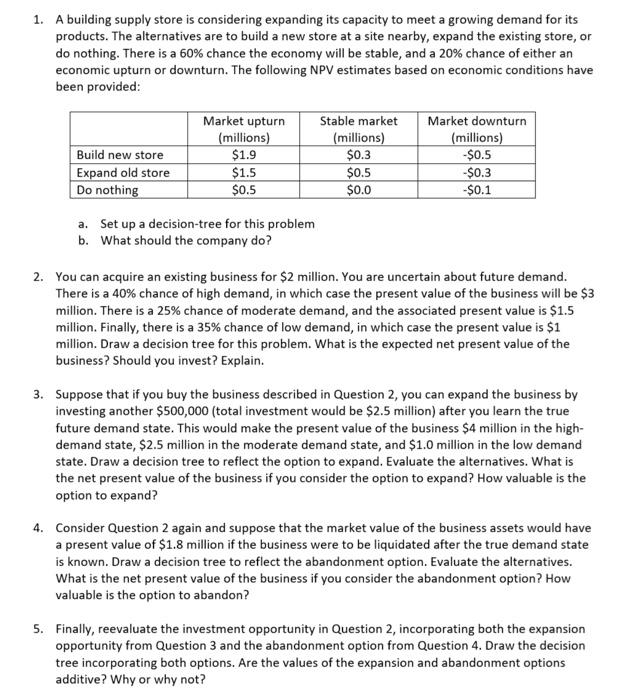

1. A building supply store is considering expanding its capacity to meet a growing demand for its products. The alternatives are to build a new store at a site nearby, expand the existing store, or do nothing. There is a 60% chance the economy will be stable, and a 20% chance of either an economic upturn or downturn. The following NPV estimates based on economic conditions have been provided: Build new store Expand old store Do nothing Market upturn (millions) $1.9 $1.5 $0.5 Stable market (millions) $0.3 $0.5 $0.0 Market downturn (millions) -$0.5 -$0.3 -$0.1 a. Set up a decision-tree for this problem b. What should the company do? 2. You can acquire an existing business for $2 million. You are uncertain about future demand. There is a 40% chance of high demand, in which case the present value of the business will be $3 million. There is a 25% chance of moderate demand, and the associated present value is $1.5 million. Finally, there is a 35% chance of low demand, in which case the present value is $1 million. Draw a decision tree for this problem. What is the expected net present value of the business? Should you invest? Explain. 3. Suppose that if you buy the business described in Question 2, you can expand the business by investing another $500,000 (total investment would be $2.5 million) after you learn the true future demand state. This would make the present value of the business $4 million in the high- demand state, $2.5 million in the moderate demand state, and $1.0 million in the low demand state. Draw a decision tree to reflect the option to expand. Evaluate the alternatives. What is the net present value of the business if you consider the option to expand? How valuable is the option to expand? 4. Consider Question 2 again and suppose that the market value of the business assets would have a present value of $1.8 million if the business were to be liquidated after the true demand state is known. Draw a decision tree to reflect the abandonment option. Evaluate the alternatives. What is the net present value of the business if you consider the abandonment option? How valuable is the option to abandon? 5. Finally, reevaluate the investment opportunity in Question 2, incorporating both the expansion opportunity from Question 3 and the abandonment option from Question 4. Draw the decision tree incorporating both options. Are the values of the expansion and abandonment options additive? Why or why not Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started