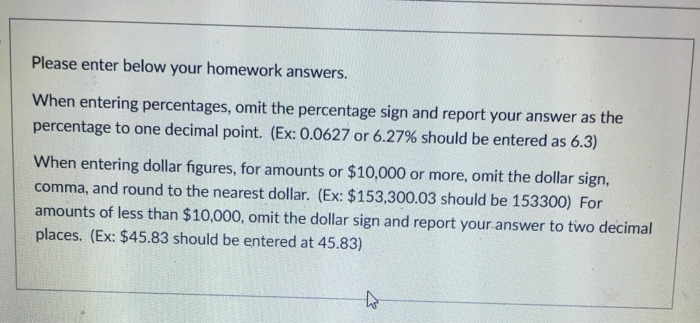

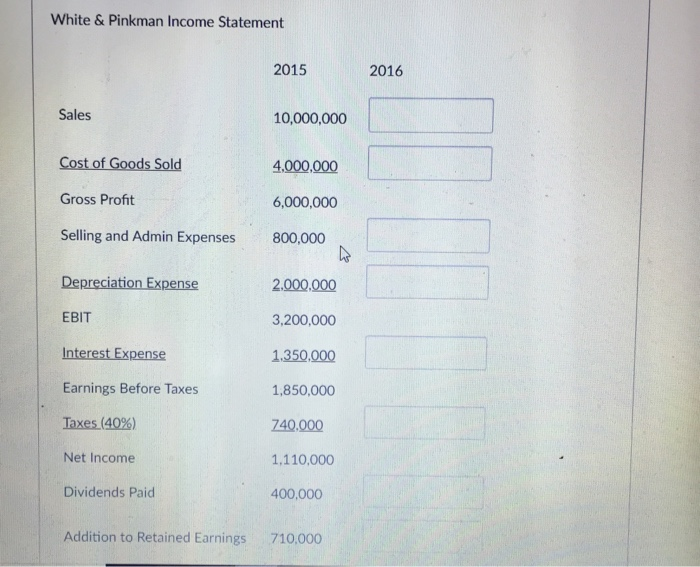

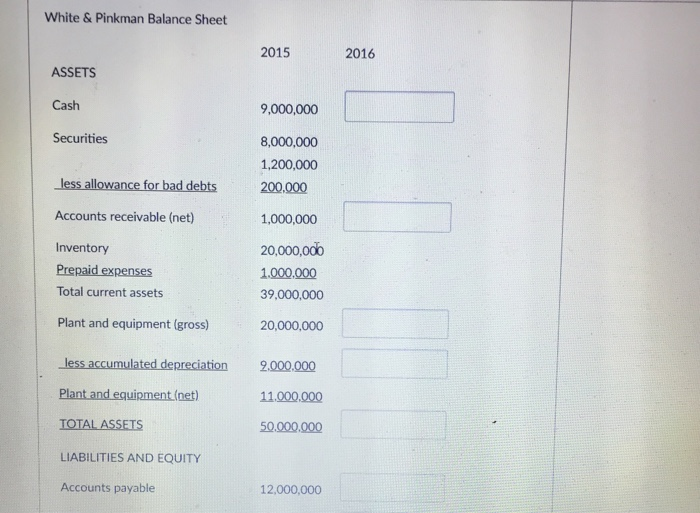

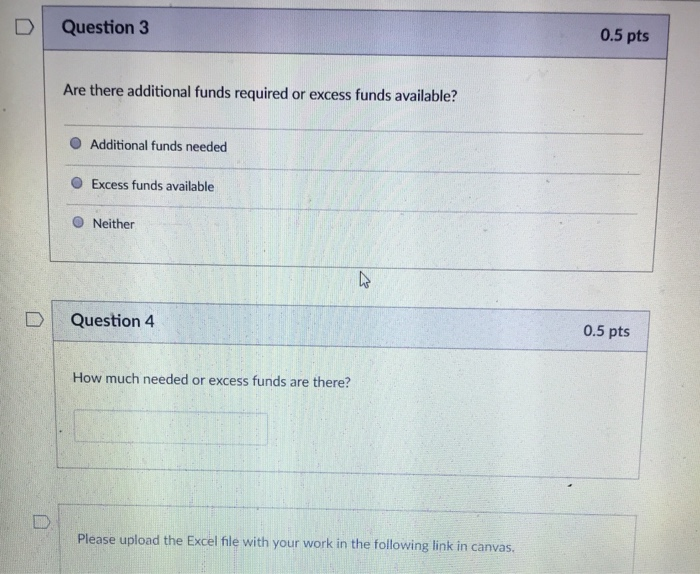

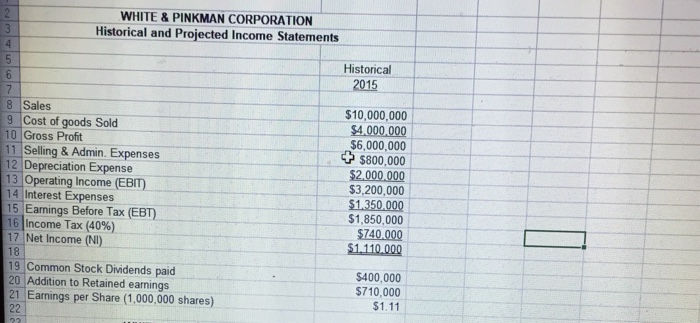

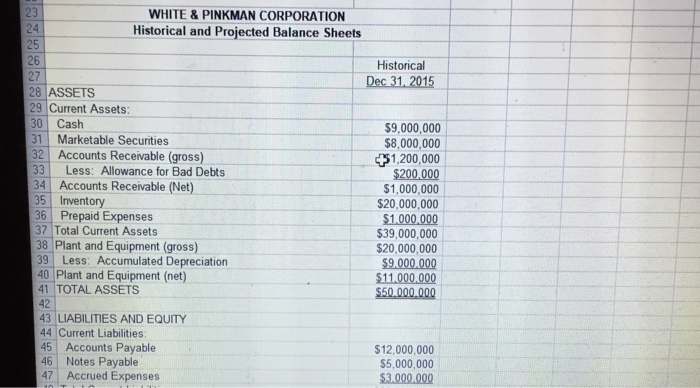

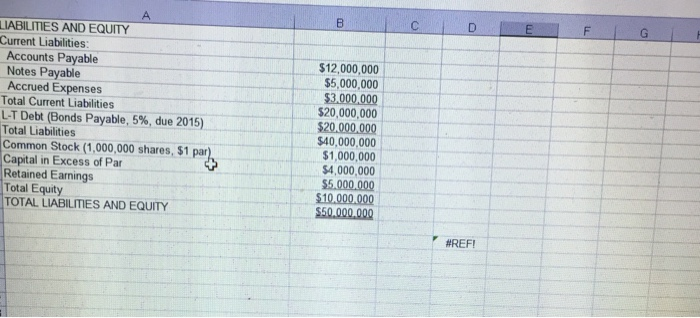

Please enter below your homework answers. When entering percentages, omit the percentage sign and report your answer as the percentage to one decimal point. (Ex: 0.0627 or 6.27% should be entered as 6.3) When entering dollar figures, for amounts or $10,000 or more, omit the dollar sign, comma, and round to the nearest dollar. (Ex: $153,300.03 should be 153300) For amounts of less than $10,000, omit the dollar sign and report your answer to two decimal places. (Ex: $45.83 should be entered at 45.83) White & Pinkman Balance Sheet 2015 2016 ASSETS Cash Securities 9,000,000 8,000,000 1,200,000 less allowance for bad debts Accounts receivable (net) 1,000,000 20,000,o0o 1.000.000 39,000,000 20,000,000 Inventory Prepaid expenses Total current assets Plant and equipment (gross) less accumulated depreciation Plant and equipment (net) TOTAL ASSETS 2.000000 11.000.000 50,000.000 LIABILITIES AND EQUITY Accounts payable 12,000,000 D Question 3 0.5 pts Are there additional funds required or excess funds available? O Additional funds needed O Excess funds available O Neither DI Question 4 0.5 pts How much needed or excess funds are there? Please upload the Excel file with your work in the following link in canvas 23 24 WHITE&PINKMAN CORPORATION Historical and Projected Balance Sheets 26 27 Historical 28 ASSETS 9 Current Assets: 0Cash 31 Marketable Securities 32 Accounts Receivable (gross) 33 Less: Allowance for Bad Debts 34 Accounts Receivable (Net) 35 Inventory 36 Prepaid Expenses 37 Total Current Assets $9,000,000 8,000,000 51,200,000 $200,000 $1,000,000 $20,000,000 $1,000 000 39,000,000 20,000,000 38 Plant and Equipment (gross) 39 Less: Accumulated Depreciation 40 Plant and Equipment (net) 41 TOTAL ASSETS 42 $11.000,000 43 LIABILITIES AND EQUITY 44 Current Liabilities 45 Accounts Payable $12,000,000 $5,000,000 46 Notes Payable 47 Accrued Expenses LIABILITIES AND EQUITY Current Liabilities Accounts Payable Notes Payable Accrued Expenses Total Current Liabilities LT Debt (Bonds Payable, 5%, due 2015) Total Liabilities Common Stock (1,000,000 shares, $1 par Capital in Excess of Par Retained Earnings Total Equity TOTAL LIABILITIES AND EQUITY $12,000,000 $5,000,000 $3,000,000 $20,000,000 $20.000,000 $40,000,000 $1,000,000 $4,000,000 5.000,000 r #REF! Please enter below your homework answers. When entering percentages, omit the percentage sign and report your answer as the percentage to one decimal point. (Ex: 0.0627 or 6.27% should be entered as 6.3) When entering dollar figures, for amounts or $10,000 or more, omit the dollar sign, comma, and round to the nearest dollar. (Ex: $153,300.03 should be 153300) For amounts of less than $10,000, omit the dollar sign and report your answer to two decimal places. (Ex: $45.83 should be entered at 45.83) White & Pinkman Balance Sheet 2015 2016 ASSETS Cash Securities 9,000,000 8,000,000 1,200,000 less allowance for bad debts Accounts receivable (net) 1,000,000 20,000,o0o 1.000.000 39,000,000 20,000,000 Inventory Prepaid expenses Total current assets Plant and equipment (gross) less accumulated depreciation Plant and equipment (net) TOTAL ASSETS 2.000000 11.000.000 50,000.000 LIABILITIES AND EQUITY Accounts payable 12,000,000 D Question 3 0.5 pts Are there additional funds required or excess funds available? O Additional funds needed O Excess funds available O Neither DI Question 4 0.5 pts How much needed or excess funds are there? Please upload the Excel file with your work in the following link in canvas 23 24 WHITE&PINKMAN CORPORATION Historical and Projected Balance Sheets 26 27 Historical 28 ASSETS 9 Current Assets: 0Cash 31 Marketable Securities 32 Accounts Receivable (gross) 33 Less: Allowance for Bad Debts 34 Accounts Receivable (Net) 35 Inventory 36 Prepaid Expenses 37 Total Current Assets $9,000,000 8,000,000 51,200,000 $200,000 $1,000,000 $20,000,000 $1,000 000 39,000,000 20,000,000 38 Plant and Equipment (gross) 39 Less: Accumulated Depreciation 40 Plant and Equipment (net) 41 TOTAL ASSETS 42 $11.000,000 43 LIABILITIES AND EQUITY 44 Current Liabilities 45 Accounts Payable $12,000,000 $5,000,000 46 Notes Payable 47 Accrued Expenses LIABILITIES AND EQUITY Current Liabilities Accounts Payable Notes Payable Accrued Expenses Total Current Liabilities LT Debt (Bonds Payable, 5%, due 2015) Total Liabilities Common Stock (1,000,000 shares, $1 par Capital in Excess of Par Retained Earnings Total Equity TOTAL LIABILITIES AND EQUITY $12,000,000 $5,000,000 $3,000,000 $20,000,000 $20.000,000 $40,000,000 $1,000,000 $4,000,000 5.000,000 r #REF