please exaplain your answers and write by using journal entries

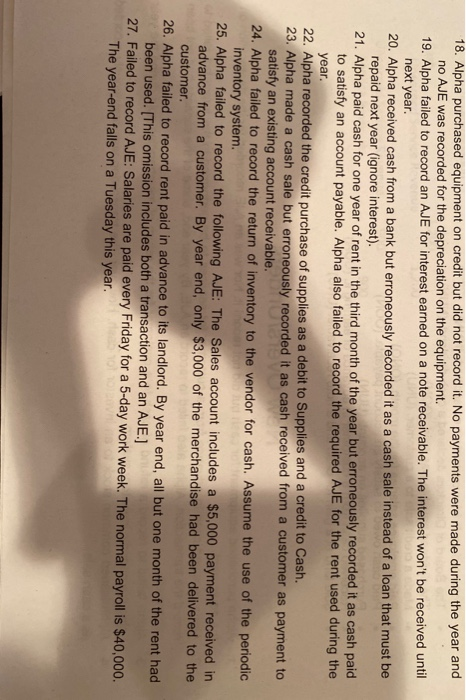

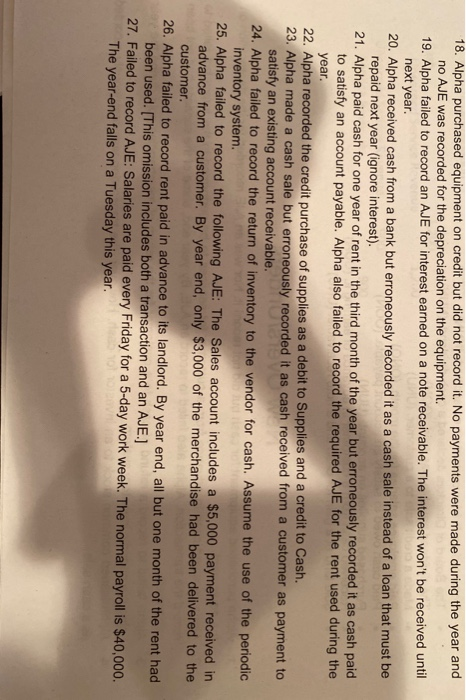

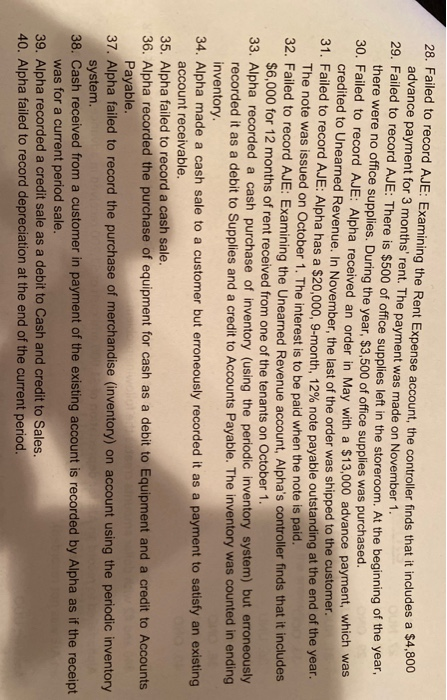

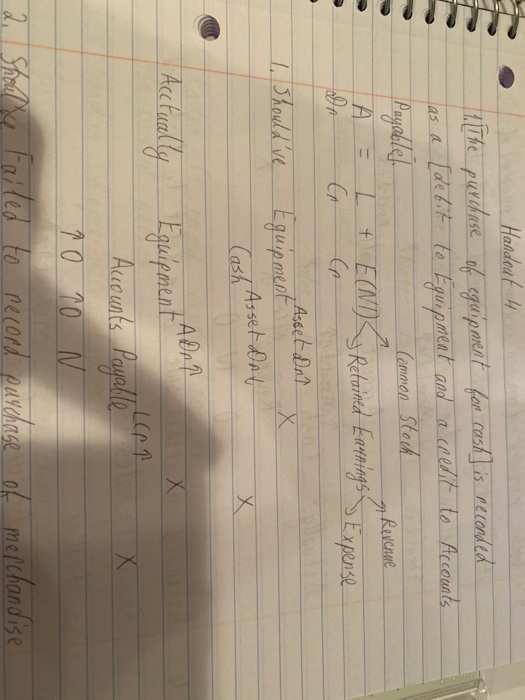

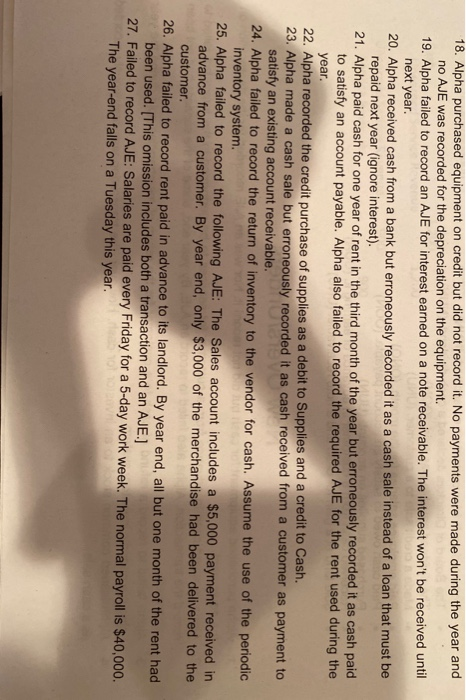

18. Alpha purchased equipment on credit but did not record it. No payments were made during the year and no AJE was recorded for the depreciation on the equipment. 19. Alpha failed to record an AJE for interest earned on a note receivable. The interest won't be received until next year. 20. Alpha received cash from a bank but erroneously recorded it as a cash sale instead of a loan that must be repaid next year (ignore interest). 21. Alpha paid cash for one year of rent in the third month of the year but erroneously recorded it as cash paid to satisfy an account payable. Alpha also failed to record the required AJE for the rent used during the year 22. Alpha recorded the credit purchase of supplies as a debit to Supplies and a credit to Cash. 23. Alpha made a cash sale but erroneously recorded it as cash received from a customer as payment to satisfy an existing account receivable. 24. Alpha failed to record the return of inventory to the vendor for cash. Assume the use of the periodic inventory system 25. Alpha failed to record the following AJE: The Sales account includes a $5,000 payment received in advance from a customer. By year end, only $3,000 of the merchandise had been delivered to the customer. 26. Alpha failed to record rent paid in advance to its landlord. By year end, all but one month of the rent had been used. [This omission includes both a transaction and an AJE. 27. Failed to record AJE: Salaries are paid every Friday for a 5-day work week. The normal payroll is $40,000. The year-end falls on a Tuesday this year. 28. Failed to record AJE: Examining the Rent Expense account, the controller finds that it includes a $4,800 advance payment for 3 months' rent. The payment was made on November 1 29. Failed to record AJE: There is $500 of office supplies left in the storeroom. At the beginning of the yeal there were no office supplies. During the year, $3,500 of office supplies was purchased. 30. Failed to record AJE: Alpha received an order in May with a $13,000 advance payment, which was credited to Unearned Revenue. In November, the last of the order was shipped to the customer. 31. Failed to record AJE: Alpha has a $20,000, 9-month, 12% note payable outstanding at the end of the year. The note was issued on October 1. The interest is to be paid when the note is paid. 32.Failed to record AJE: Examining the Unearned Revenue account, Alpha's controller finds that it includes $6,000 for 12 months of rent received from one of the tenants on October 1. 33. Alpha recorded a cash purchase of inventory (using the periodic inventory system) but erroneously recorded it as a debit to Supplies and a credit inventory. 34. Alpha made a cash sale to a customer but erroneously recorded it as a payment to satisfy an existing account receivable. Accounts Payable. The inventory was counted in ending 35. Alpha failed to record a cash sale. 36. Alpha recorded the purchase of equipment for cash as a debit to Equipment and a credit to Accounts Payable. 37. Alpha failed to record the purchase of merchandise (inventory) on account using the periodic inventory system. 38. Cash received from a customer in payment of the existing account is recorded by Alpha as if the receipt was for a current period sale. 39. Alpha recorded a credit sale as a debit to Cash and credit to Sales. 40. Alpha failed to record depreciation at the end of the current period. Haldoat H TAThe purchese of eguipaat for cash randed as a Lde b.t to quipment and a ceedt to Aecaunts Payaldle Common Stek Reverme E(NDReard EingsExpense Cr Asset Dn Eguipment Cash Asset at LShoul d ve A0r Acetual ly X Aucuats Payable X T0 10 N 2 Spod Eailed to rerord parchage af necord paschase melchand'se