Please expand the pictures for better view - Thank you! :-)

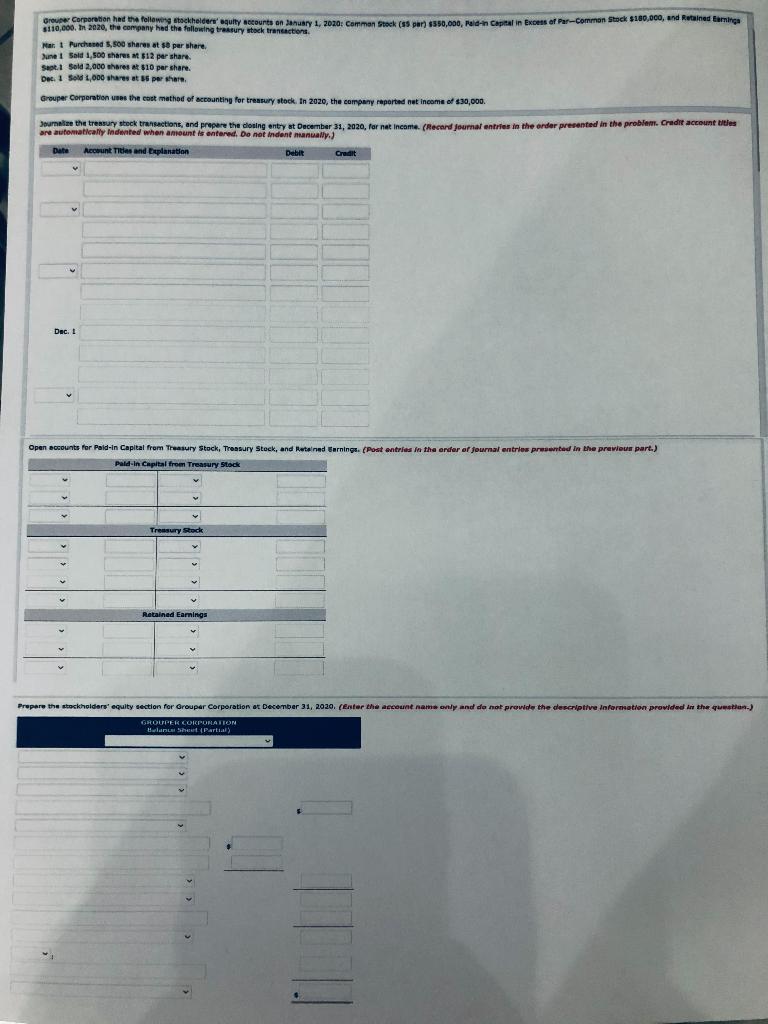

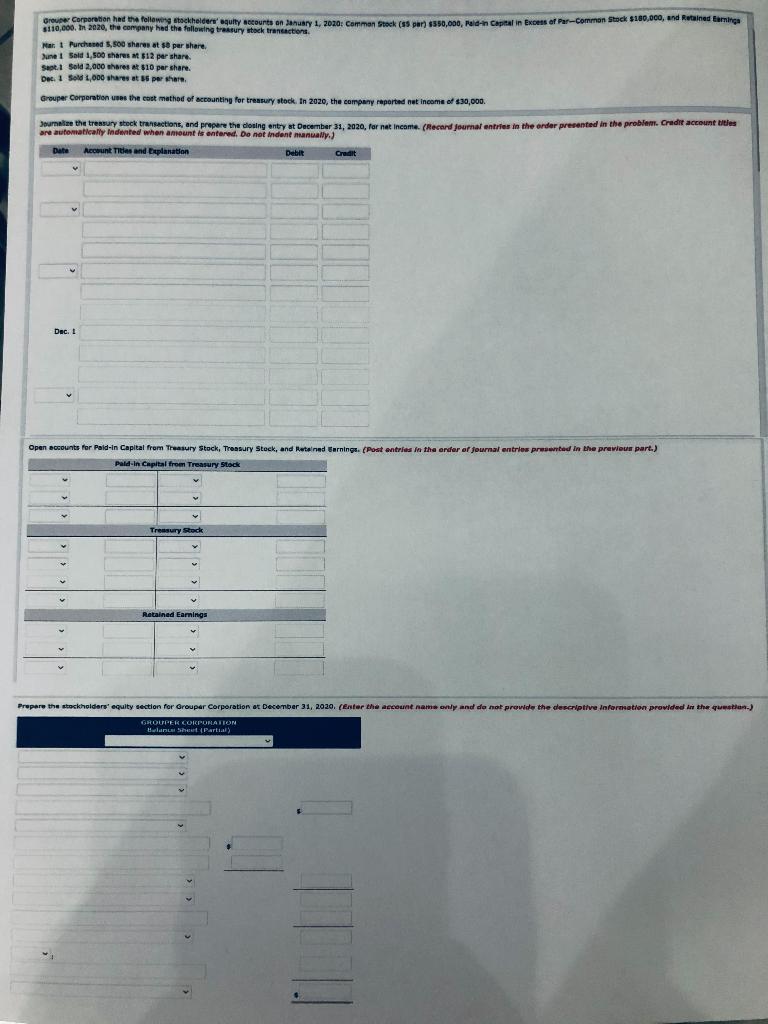

crues corporation have the following tsekelders gutty accounts on Manuary 1, 2020: Camman stock (85 par $550,000, ralen Capital in excess of Par-Common Stock $100.000, and retained Earnica 110,000In 2020, the company had the following treasury stock Mart Purchased 5,500 shares at per share June 1 Sold 1,500 shares Mt 512 per share. Seet. Sold 2,000 shares et $10 par share Del 1 Sold 1,000 shares at 35 per share Grouper Corporation was the cost method of accounting for treasury stock. In 2020, the company reported net income of $30,000 Jurate the treasury stock transactions, and prepare the doing antay st December 31, 2020, far nat Income. (Record Journal entries in the order presented in the problem. Credit account tilties are automatically Indented when anseunt is entered. Do not indene manually) Account Titles and Explanation Debit Credit Date Dec Open accounts for Polid-in Capital from Treasury Stock, Treasury Stock, and retained Earnings. (Post entries in the order of journal entries presented in the previous part.) Pald-In Capital from Treasury Stock v Treasury Stock Retained Earnings Prepare the stockholders' equity section Grouper Corporation et December 31, 2020. (Enter the account namely and do not provide the descriptive Information provided in the web.) GROUPER CORPORATION lunch Partial crues corporation have the following tsekelders gutty accounts on Manuary 1, 2020: Camman stock (85 par $550,000, ralen Capital in excess of Par-Common Stock $100.000, and retained Earnica 110,000In 2020, the company had the following treasury stock Mart Purchased 5,500 shares at per share June 1 Sold 1,500 shares Mt 512 per share. Seet. Sold 2,000 shares et $10 par share Del 1 Sold 1,000 shares at 35 per share Grouper Corporation was the cost method of accounting for treasury stock. In 2020, the company reported net income of $30,000 Jurate the treasury stock transactions, and prepare the doing antay st December 31, 2020, far nat Income. (Record Journal entries in the order presented in the problem. Credit account tilties are automatically Indented when anseunt is entered. Do not indene manually) Account Titles and Explanation Debit Credit Date Dec Open accounts for Polid-in Capital from Treasury Stock, Treasury Stock, and retained Earnings. (Post entries in the order of journal entries presented in the previous part.) Pald-In Capital from Treasury Stock v Treasury Stock Retained Earnings Prepare the stockholders' equity section Grouper Corporation et December 31, 2020. (Enter the account namely and do not provide the descriptive Information provided in the web.) GROUPER CORPORATION lunch Partial