Answered step by step

Verified Expert Solution

Question

1 Approved Answer

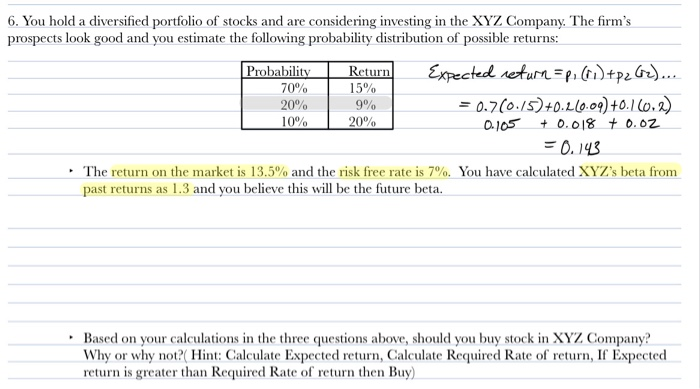

please explain and show work 6. You hold a diversified portfolio of stocks and are considering investing in the XYZ Company. The firm's prospects look

please explain and show work

6. You hold a diversified portfolio of stocks and are considering investing in the XYZ Company. The firm's prospects look good and you estimate the following probability distribution of possible returns: Expected nesturn pi)+pe Probability Return 70% 15% 0.7(0.15)+0.110.09)+0.1 Lo.2) O.105 9% 20% 10% 20% +0.018 t 0.0Z 0. 143 The return on the market is 13.5% and the risk free rate is 7%. You have calculated XYZ's beta from past returns as 1.3 and you believe this will be the future beta. Based on your calculations in the three questions above, should you buy stock in XYZ Company? Why or why not?(Hint: Calculate Expected return, Calculate Required Rate of return, If Expected return is greater than Required Rate of return then Buy) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started