Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please explain and show work Louie's Leisure Products is considering a project which will require the purchase of exist1.3 million in new equipment. Shipping and

please explain and show work

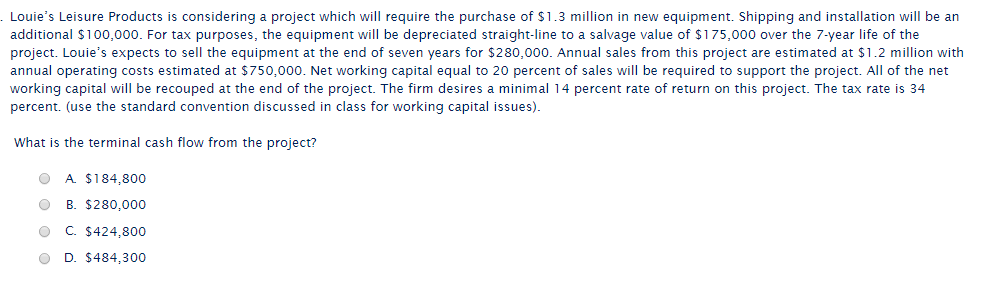

Louie's Leisure Products is considering a project which will require the purchase of exist1.3 million in new equipment. Shipping and installation will be an additional exist100,000. For tax purposes, the equipment will be depreciated straight-line to a salvage value of exist1 75,000 over the 7-year life of the project. Louie's expects to sell the equipment at the end of seven years for exist280,000. Annual sales from this project are estimated at exist1.2 million with annual operating costs estimated at exist750,000. Net working capital equal to 20 percent of sales will be required to support the project. All of the net working capital will be recouped at the end of the project. The firm desires a minimal 14 percent rate of return on this project. The tax rate is 34 percent, (use the standard convention discussed in class for working capital issues). What is the terminal cash flow from the project? A. exist184, 800 B. exist280,000 C. exist424, 800 D. exist484, 300Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started