Answered step by step

Verified Expert Solution

Question

1 Approved Answer

*please explain answer briefly* For simplicity, assume that customers always pay in advance. A company booked $50 in sales revenue in a given year but

*please explain answer briefly*

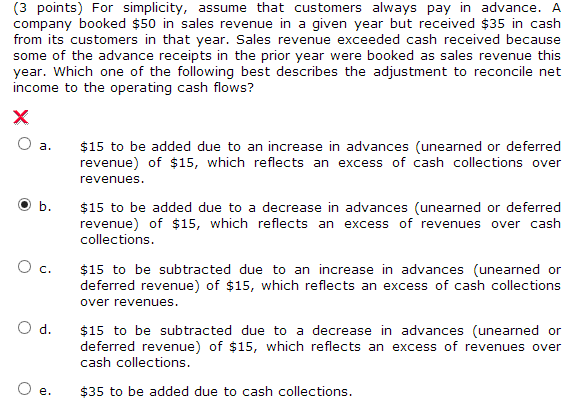

For simplicity, assume that customers always pay in advance. A company booked $50 in sales revenue in a given year but received $35 in cash from its customers in that year. Sales revenue exceeded cash received because some of the advance receipts in the prior year were booked as sales revenue this year. Which one of the following best describes the adjustment to reconcile net income to the operating cash flows? $15 to be added due to an increase in advances (unearned or deferred revenue) of $15, which reflects an excess of cash collections over revenues. $15 to be added due to a decrease in advances (unearned or deferred revenue) of $15, which reflects an excess of revenues over cash collections. $15 to be subtracted due to an increase in advances (unearned or deferred revenue) of $15, which reflects an excess of cash collections over revenues. $15 to be subtracted due to a decrease in advances (unearned or deferred revenue) of $15, which reflects an excess of revenues over cash collections. $35 to be added due to cash collectionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started