Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please explain each answer short i need to understand 3.Identify key content in tax forms relevant to credit and cash flow analysis APFS3A. Cash flow

please explain each answer short i need to understand

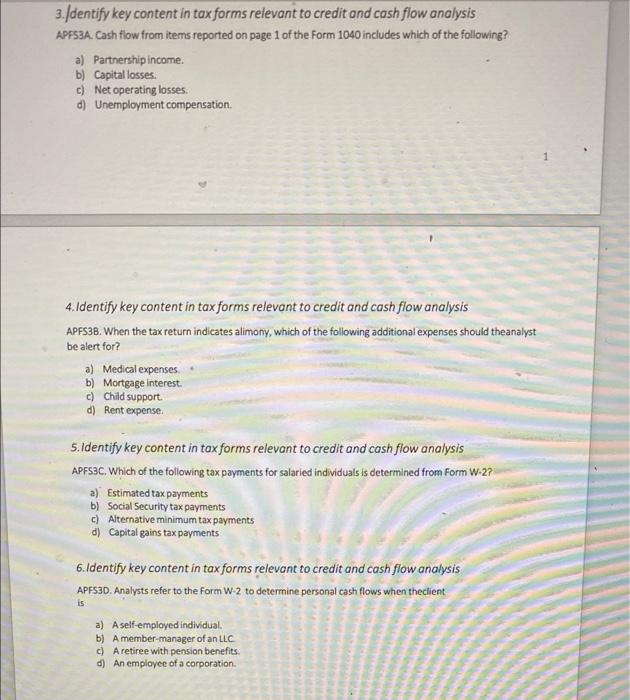

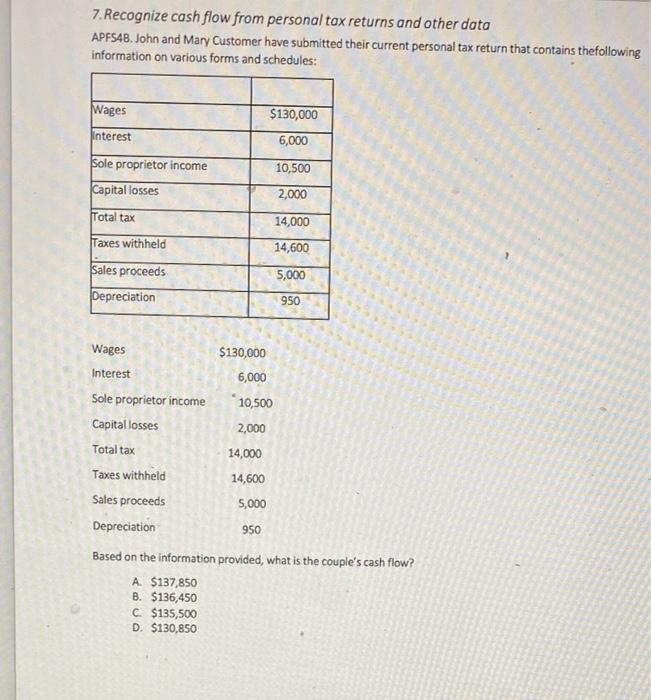

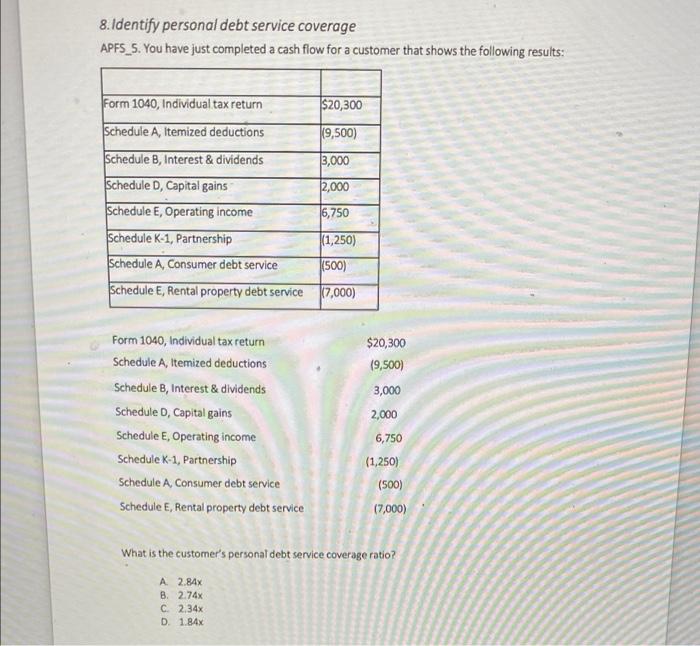

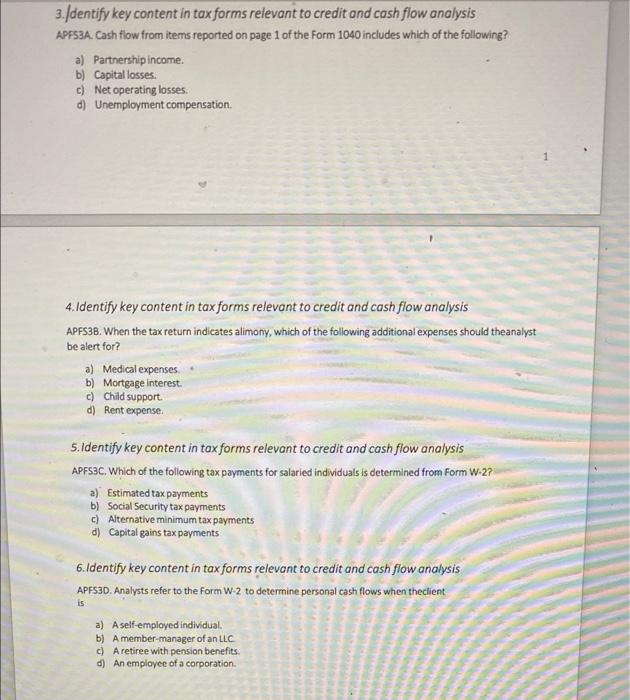

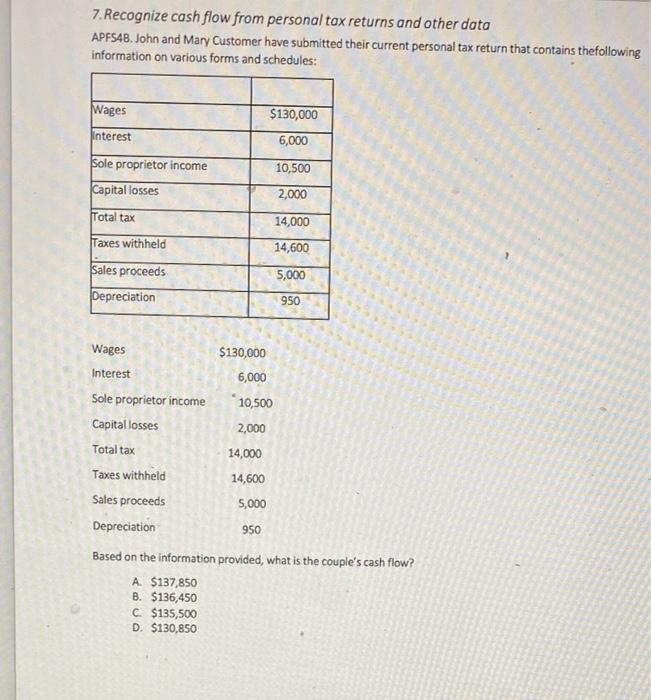

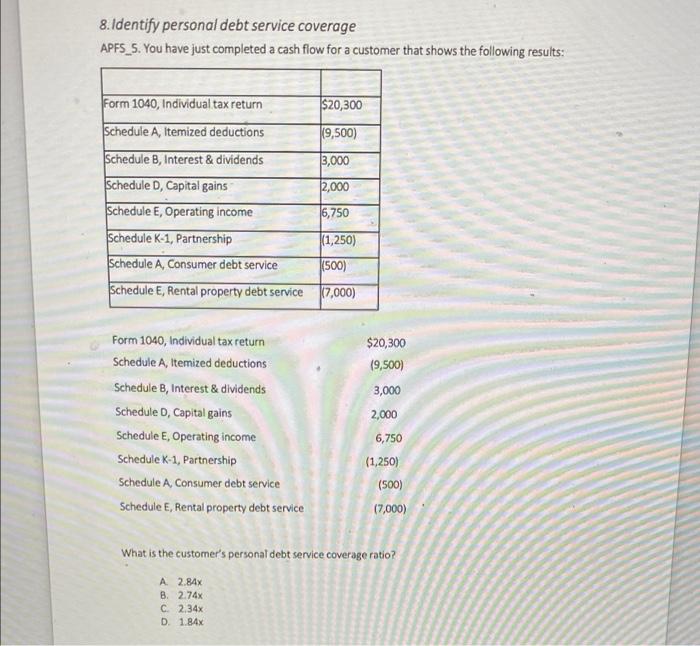

3.Identify key content in tax forms relevant to credit and cash flow analysis APFS3A. Cash flow from items reported on page 1 of the Form 1040 includes which of the following? a) Partnership income b) Capital losses. c) Net operating losses. d) Unemployment compensation 4. Identify key content in tax forms relevant to credit and cash flow analysis APFS38. When the tax return indicates alimony, which of the following additional expenses should the analyst be alert for? a) Medical expenses b) Mortgage Interest. c) Child support d) Rent expense 5.Identify key content in tax forms relevant to credit and cash flow analysis APFS3C. Which of the following tax payments for salaried individuals is determined from Form W-2? a) Estimated tax payments b) Social Security tax payments c) Alternative minimum tax payments d) Capital gains tax payments 6. Identify key content in tax forms relevant to credit and cash flow analysis APFS3D. Analysts refer to the Form W-2 to determine personal cash flows when theclient is a) A self-employed individual. b) A member-manager of an LLC c) A retiree with pension benefits d) An employee of a corporation 7. Recognize cash flow from personal tax returns and other data APFS48. John and Mary Customer have submitted their current personal tax return that contains thefollowing information on various forms and schedules: Wages $130,000 Interest 6,000 Sole proprietor income 10,500 Capital losses 2,000 Total tax 14,000 Taxes withheld 14,600 5,000 Sales proceeds Depreciation 950 Wages $130,000 Interest 6,000 Sole proprietor income 10,500 Capital losses 2,000 Total tax 14,000 Taxes withheld 14,600 Sales proceeds 5,000 Depreciation 950 Based on the information provided what is the couple's cash flow? A $137,850 B. $136,450 C$135,500 D. $130,850 8. Identify personal debt service coverage APFS_5. You have just completed a cash flow for a customer that shows the following results: $20,300 119,500) 3,000 Form 1040, Individual tax return Schedule A Itemized deductions Schedule B, Interest & dividends Schedule D, Capital gains Schedule E, Operating income Schedule K-1, Partnership 2,000 6,750 |(1,250) Schedule A, Consumer debt service |(500) Schedule E, Rental property debt service (7,000) Form 1040, Individual tax return Schedule A, Itemized deductions Schedule B, Interest & dividends Schedule D, Capital gains Schedule E, Operating income Schedule K-1, Partnership Schedule A, Consumer debt service Schedule E, Rental property debt service $20,300 (9,500) 3,000 2,000 6,750 (1,250) (500) (7,000) What is the customer's personal debt service coverage ratio? A 2.84x B. 2.74% C 2.34x D1.84x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started