please explain every step in detail for me to understand it

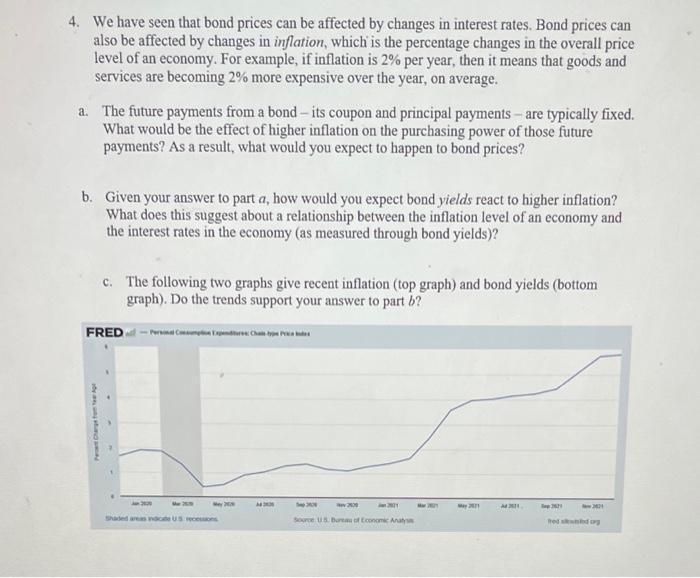

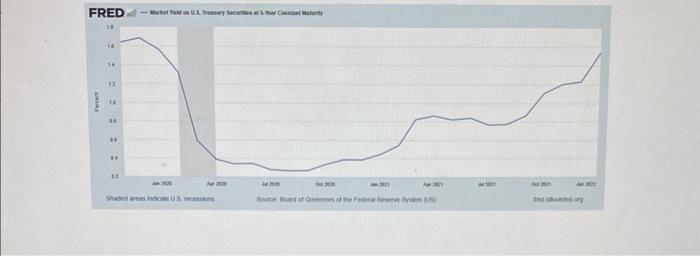

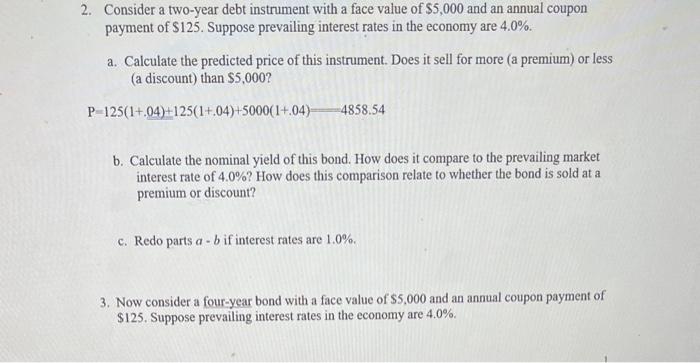

2. Consider a two-year debt instrument with a face value of $5,000 and an annual coupon payment of $125. Suppose prevailing interest rates in the economy are 4.0%. a. Calculate the predicted price of this instrument. Does it sell for more (a premium) or less (a discount) than $5,000 ? P=125(1+.04)+125(1+.04)+5000(1+.04)=4858.54 b. Calculate the nominal yield of this bond. How does it compare to the prevailing market interest rate of 4.0% ? How does this comparison relate to whether the bond is sold at a premium or discount? c. Redo parts ab if interest rates are 1.0%. 3. Now consider a four-year bond with a face value of $5,000 and an annual coupon payment of $125. Suppose prevailing interest rates in the economy are 4.0%. 4. We have seen that bond prices can be affected by changes in interest rates. Bond prices can also be affected by changes in inflation, which is the percentage changes in the overall price level of an economy. For example, if inflation is 2% per year, then it means that goods and services are becoming 2% more expensive over the year, on average. a. The future payments from a bond - its coupon and principal payments - are typically fixed. What would be the effect of higher inflation on the purchasing power of those future payments? As a result, what would you expect to happen to bond prices? b. Given your answer to part a, how would you expect bond yields react to higher inflation? What does this suggest about a relationship between the inflation level of an economy and the interest rates in the economy (as measured through bond yields)? c. The following two graphs give recent inflation (top graph) and bond yields (bottom graph). Do the trends support your answer to part b ? 2. Consider a two-year debt instrument with a face value of $5,000 and an annual coupon payment of $125. Suppose prevailing interest rates in the economy are 4.0%. a. Calculate the predicted price of this instrument. Does it sell for more (a premium) or less (a discount) than $5,000 ? P=125(1+.04)+125(1+.04)+5000(1+.04)=4858.54 b. Calculate the nominal yield of this bond. How does it compare to the prevailing market interest rate of 4.0% ? How does this comparison relate to whether the bond is sold at a premium or discount? c. Redo parts ab if interest rates are 1.0%. 3. Now consider a four-year bond with a face value of $5,000 and an annual coupon payment of $125. Suppose prevailing interest rates in the economy are 4.0%. 4. We have seen that bond prices can be affected by changes in interest rates. Bond prices can also be affected by changes in inflation, which is the percentage changes in the overall price level of an economy. For example, if inflation is 2% per year, then it means that goods and services are becoming 2% more expensive over the year, on average. a. The future payments from a bond - its coupon and principal payments - are typically fixed. What would be the effect of higher inflation on the purchasing power of those future payments? As a result, what would you expect to happen to bond prices? b. Given your answer to part a, how would you expect bond yields react to higher inflation? What does this suggest about a relationship between the inflation level of an economy and the interest rates in the economy (as measured through bond yields)? c. The following two graphs give recent inflation (top graph) and bond yields (bottom graph). Do the trends support your answer to part b