Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please explain Having one employee prepare company checks and sign those cheeks relates to which internal control activity? a violation of proper segregation of duties

please explain

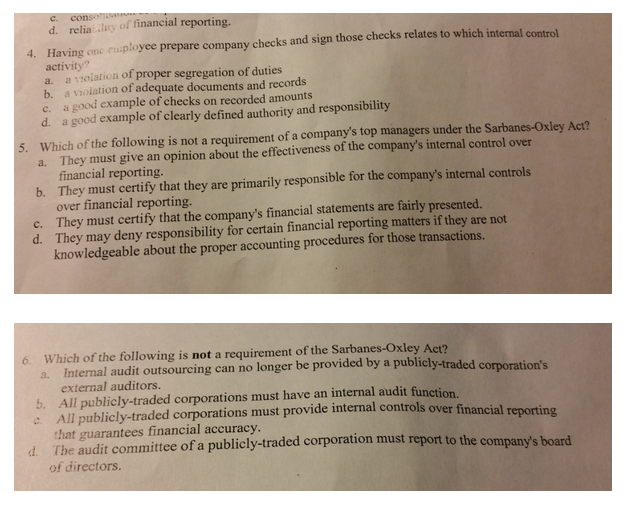

Having one employee prepare company checks and sign those cheeks relates to which internal control activity? a violation of proper segregation of duties a violation of adequate documents and records a good example of checks on recorded amounts a example of clearly defined authority and responsibility Which of the following is not a requirement of a company's top managers under the Sarbanes-Oxley Act? They must give an opinion about the effctiveness of the company's internal control over financial reporting They must certify they are primarily responsible for the company's internal controls over financial reporting. They must certify that, the company's financial statements are fairly presented. They may deny responsibility for certain financial reporting matters if they are not knowledgeable about the proper accounting procedures for those transactions. which of the following is not a requirement of the Sarbanes-Oxley Act? Internal audit outsourcing can no longer be provided by a publicly-traded corporation's external auditors. All publicly-traded corporations must have an internal audit function. All publicly-traded corporations must provide internal controls over financial reporting that guarantees financial accuracy. The audit committee of a publicly-traded corporation must report to the company's board of directors. Having one employee prepare company checks and sign those cheeks relates to which internal control activity? a violation of proper segregation of duties a violation of adequate documents and records a good example of checks on recorded amounts a example of clearly defined authority and responsibility Which of the following is not a requirement of a company's top managers under the Sarbanes-Oxley Act? They must give an opinion about the effctiveness of the company's internal control over financial reporting They must certify they are primarily responsible for the company's internal controls over financial reporting. They must certify that, the company's financial statements are fairly presented. They may deny responsibility for certain financial reporting matters if they are not knowledgeable about the proper accounting procedures for those transactions. which of the following is not a requirement of the Sarbanes-Oxley Act? Internal audit outsourcing can no longer be provided by a publicly-traded corporation's external auditors. All publicly-traded corporations must have an internal audit function. All publicly-traded corporations must provide internal controls over financial reporting that guarantees financial accuracy. The audit committee of a publicly-traded corporation must report to the company's board of directorsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started