Please explain how the figures highlighted were calculated, it your answer is quite helpful, you get the like!! so try!

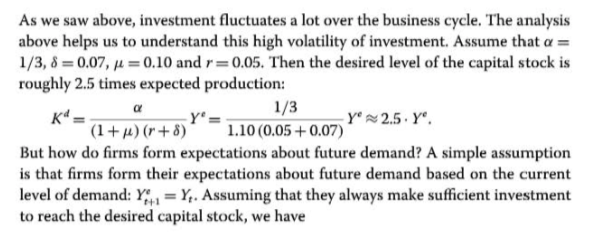

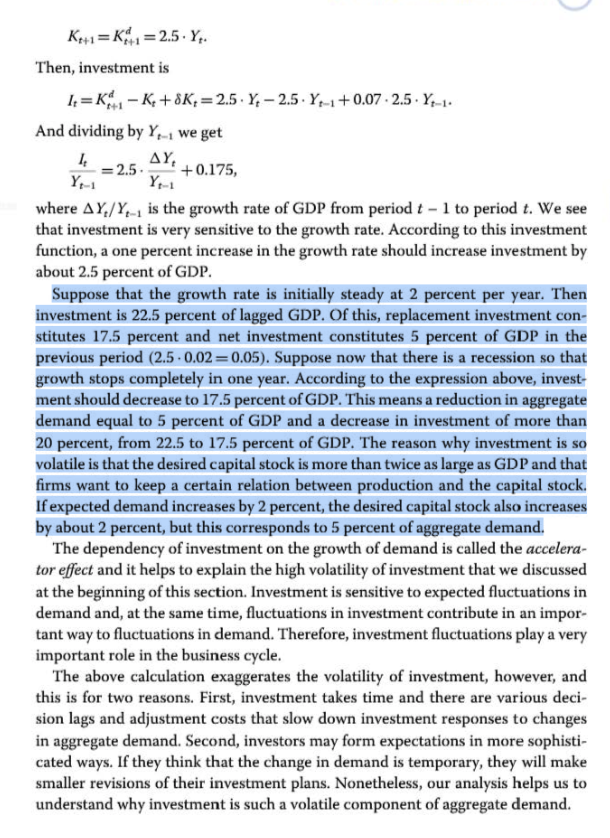

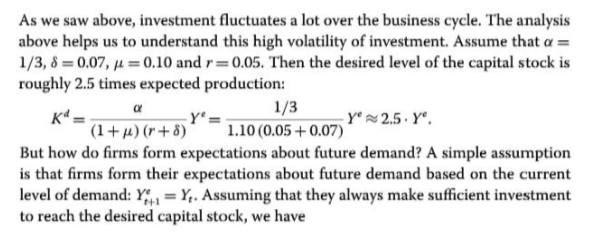

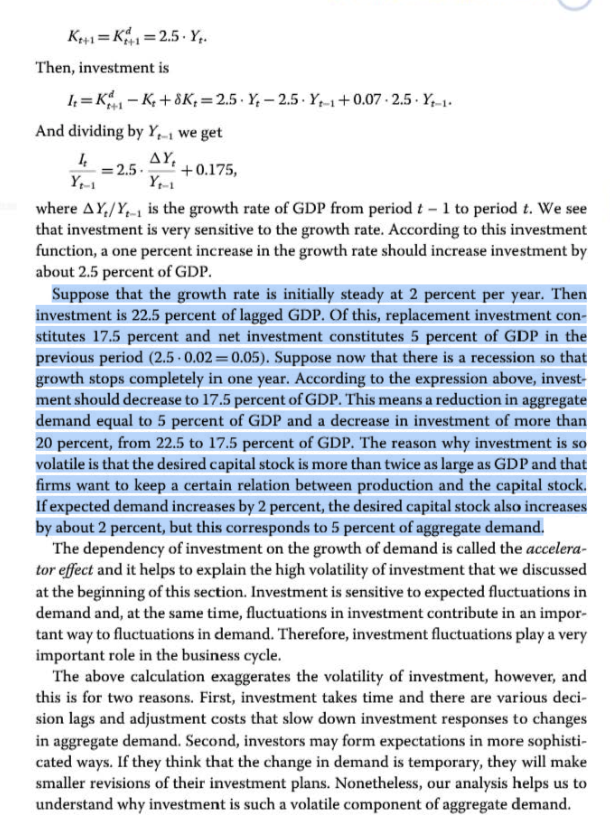

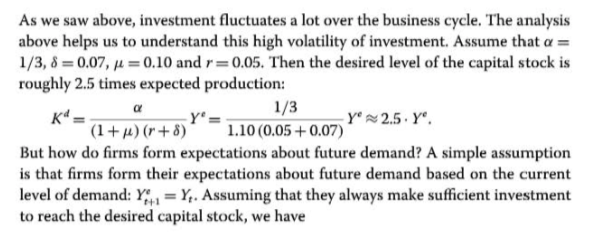

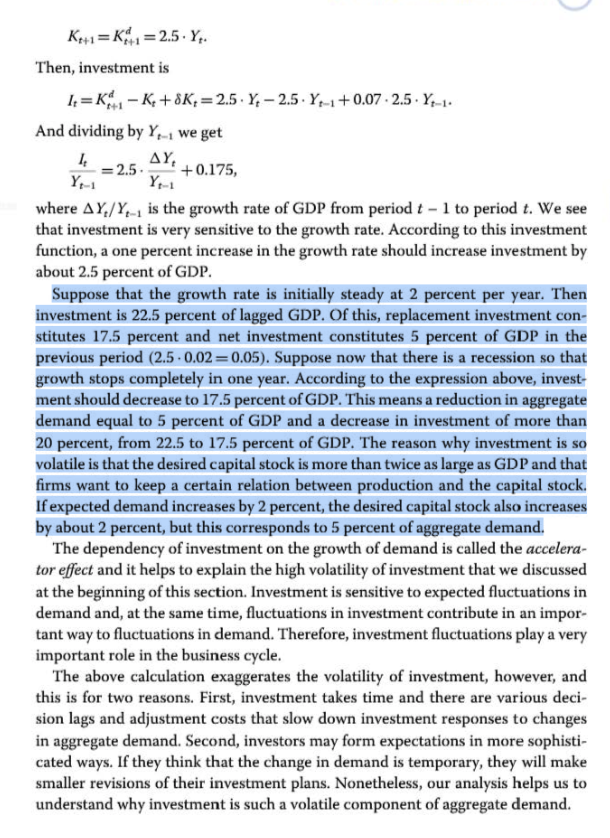

As we saw above, investment fluctuates a lot over the business cycle. The analysis above helps us to understand this high volatility of investment. Assume that a = 1/3, 8 = 0.07, / = 0.10 and / = 0.05. Then the desired level of the capital stock is roughly 2.5 times expected production: 1/3 Y'N 2.5 . Y. (1 + /) (r+8) 1.10 (0.05 + 0.07) But how do firms form expectations about future demand? A simple assumption is that firms form their expectations about future demand based on the current level of demand: Y% = Y. Assuming that they always make sufficient investment to reach the desired capital stock, we haveKIHI = KAI = 2.5 . Y. Then, investment is It = KA - K, + 8K, = 2.5 . Y, - 2.5 . Y, 1 + 0.07 . 2.5 . Y+-1. And dividing by Y, , we get 1 = 2.5. Art + 0.175, where AY,/Y,, is the growth rate of GDP from period t - 1 to period t. We see that investment is very sensitive to the growth rate. According to this investment function, a one percent increase in the growth rate should increase investment by about 2.5 percent of GDP. Suppose that the growth rate is initially steady at 2 percent per year. Then investment is 22.5 percent of lagged GDP. Of this, replacement investment con- stitutes 17.5 percent and net investment constitutes 5 percent of GDP in the previous period (2.5 . 0.02= 0.05). Suppose now that there is a recession so that growth stops completely in one year. According to the expression above, invest- ment should decrease to 17.5 percent of GDP. This means a reduction in aggregate demand equal to 5 percent of GDP and a decrease in investment of more than 20 percent, from 22.5 to 17.5 percent of GDP. The reason why investment is so volatile is that the desired capital stock is more than twice as large as GDP and that firms want to keep a certain relation between production and the capital stock. If expected demand increases by 2 percent, the desired capital stock also increases by about 2 percent, but this corresponds to 5 percent of aggregate demand. The dependency of investment on the growth of demand is called the accelera- tor effect and it helps to explain the high volatility of investment that we discussed at the beginning of this section. Investment is sensitive to expected fluctuations in demand and, at the same time, fluctuations in investment contribute in an impor- tant way to fluctuations in demand. Therefore, investment fluctuations play a very important role in the business cycle. The above calculation exaggerates the volatility of investment, however, and this is for two reasons. First, investment takes time and there are various deci- sion lags and adjustment costs that slow down investment responses to changes in aggregate demand. Second, investors may form expectations in more sophisti- cated ways. If they think that the change in demand is temporary, they will make smaller revisions of their investment plans. Nonetheless, our analysis helps us to understand why investment is such a volatile component of aggregate demand