Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please explain how they got this answer step by step. I am verh confused. Can you determine the market value of the $6 million of

please explain how they got this answer step by step. I am verh confused.

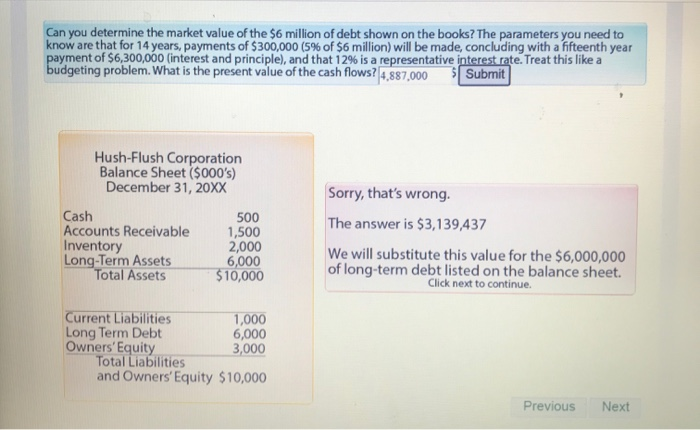

Can you determine the market value of the $6 million of debt shown on the books? The parameters you need to know are that for 14 years, payments of $300,000 (5% of $6 million) will be made, concluding with a fifteenth year payment of $6,300,000 interest and principle), and that 12% is a representative interest rate. Treat this like a budgeting problem. What is the present value of the cash flows? 4,887,000 Submit Hush-Flush Corporation Balance Sheet ($000's) December 31, 20XX Cash 500 Accounts Receivable 1,500 Inventory 2,000 Long-Term Assets 6,000 Total Assets $10,000 Sorry, that's wrong. The answer is $3,139,437 We will substitute this value for the $6,000,000 of long-term debt listed on the balance sheet. Click next to continue Current Liabilities 1,000 Long Term Debt 6,000 Owners'Equity 3,000 Total Liabilities and Owners' Equity $10,000 Previous Next Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started