Please explain how to calculate this to get an answer like the key above (check the picture for the complete question) for number 50, 51, 52, 53, 54, 55, 56, 57, and 58

Chapter : INVESTMENTS

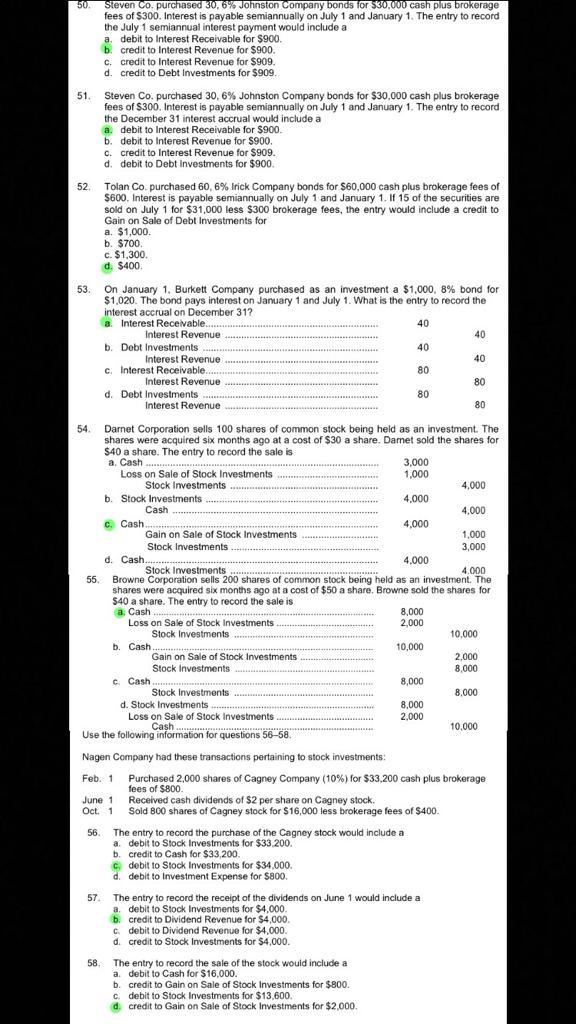

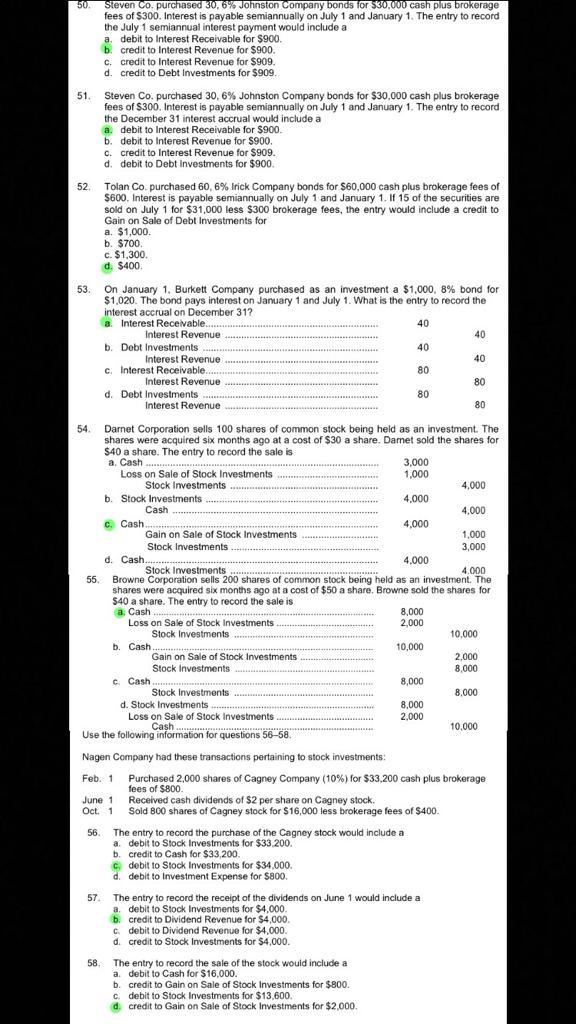

50. Steven Co. purchased 30, 6% Johnston Company bonds for $30,000 cash plus brokerage fees of $300. Interest is payable semiannually on July 1 and January 1. The entry to record the July 1 semiannual interest payment would include a

51. Steven Co. purchased 30, 6% Johnston Company bonds for $30,000 cash plus brokerage fees of $300. Interest is payable semiannually on July 1 and January 1. The entry to record the December 31 interest accrual would include a

52. Tolan Co. purchased 60, 6% Irick Company bonds for $60,000 cash plus brokerage fees of $600. Interest is payable semiannually on July 1 and January 1. If 15 of the securities are sold on July 1 for $31,000 less $300 brokerage fees, the entry would include a credit to Gain on Sale of Debt Investments for

53. On January 1, Burkett Company purchased as an investment a $1,000, 8% bond for $1,020. The bond pays interest on January 1 and July 1. What is the entry to record the interest accrual on December 31?

54. Darnet Corporation sells 100 shares of common stock being held as an investment. The shares were acquired six months ago at a cost of $30 a share. Darnet sold the shares for $40 a share. The entry to record the sale is

55. Browne Corporation sells 200 shares of common stock being held as an investment. The shares were acquired six months ago at a cost of $50 a share. $40 a share. The entry to record the sale is

56. The entry to record the purchase of the Cagney stock would include a

57. The entry to record the receipt of the dividends on June 1 would include a

58. The entry to record the sale of the stock would include a

50. Steven Co. purchased 30.6% Johnston Company bonds for $30.000 cash plus brokerage fees of $300. Interest is payable semiannually on July 1 and January 1. The entry to record the July 1 semiannual interest payment would include a a. debit to Interest Receivable for $900. b. credit to Interest Revenue for $900. C. credit to Interest Revenue for $909. d. credit to Debt Investments for $909 51 Steven Co. purchased 30,6% Johnston Company bonds for $30,000 cash plus brokerage fees of $300. Interest is payable semiannually on July 1 and January 1. The entry to record the December 31 interest accrual would include a a. debit to Interest Receivable for $900. b. debit to Interest Revenue for $900. c. credit to Interest Revenue for $909. d. debit to Debt Investments for $900. 52 Tolan Co purchased 60, 6% Irick Company bonds for $60,000 cash plus brokerage fees of $600. Interest is payable semiannually on July 1 and January 1. If 15 of the securities are sold on July 1 for $31.000 less $300 brokerage fees, the entry would include a credit to Gain on Sale of Debt Investments for a $1,000 b. $700. c. $1,300 d. $400 53. On January 1, Burkett Company purchased as an investment a $1,000, 8% bond for $1,020. The bond pays interest on January 1 and July 1. What is the entry to record the interest accrual on December 31? a. Interest Receivable 40 Interest Revenue 40 b. Debt Investments 40 Interest Revenue 40 c. Interest Receivable 80 Interest Revenue 80 d. Debt Investments 80 Interest Revenue 80 54 Darnet Corporation sells 100 shares of common stock being held as an investment. The shares were acquired six months ago at a cost of $30 a share. Damet sold the shares for $40 a share. The entry to record the sale is a Cash 3,000 Loss on Sale of Stock Investments 1,000 Stock Investments 4,000 b. Stock Investments 4,000 Cash 4.000 C. Cash 4,000 Gain on Sale of Stock Investments 1,000 Stock Investments 3,000 . d. Cash 4.000 Stock Investments 4.000 55. Browne Corporation sells 200 shares of common stock being held as an investment. The shares were acquired six months ago at a cost of $50 a share. Browne sold the shares for $40 a share. The entry to record the sale is a Cash 8,000 Loss on Sale of Stock Investments 2,000 Stock Investments 10,000 b. Cash 10,000 Gain on Sale of Stock Investments 2,000 Stock Investments 8,000 C. Cash 8,000 Stock Investments 8.000 d. Stock Investments d. 8,000 Loss on Sale of Stock Investments 2,000 Cash 10.000 Use the following information for questions 56-58. Nagen Company had these transactions pertaining to stock investments Feb. 1 Purchased 2,000 shares of Cagney Company (10%) for $33,200 cash plus brokerage fees of $800 June 1 Received cash dividends of $2 per share on Cagney stock. $ Oct. 1 Sold B00 shares of Cagney stock for $16,000 less brokerage fees of $400 56. The entry to record the purchase of the Cagney stock would include a a. debit to Stock Investments for $33.200. forca b. credit to Cash for $33,200. cdebit to Stock Investments for $34.000 d. debit to Investment Expense for $800. 57 The entry to record the receipt of the dividends on June 1 would include a a. debit to Stock Investments for $4,000 b. credit to Dividend Revenue for $4,000. c debit to Dividend Revenue for $4,000. d. credit to Stock Investments for $4,000. 58 The entry to record the sale of the stock would include a a. debit to Cash for $16,000 b. credit to Gain on Sale of Stock Investments for $800. c. debit to Stock Investments for $13,600. d credit to Gain on Sale of Stock Investments for $2.000