Question

Please explain how to calculate this to get an answer like the key above (check the picture for the complete question) for number 59, 60,

Please explain how to calculate this to get an answer like the key above (check the picture for the complete question) for number 59, 60, 61, 62, 66, 74, 79, 80, and 121

Chapter : INVESTMENTS

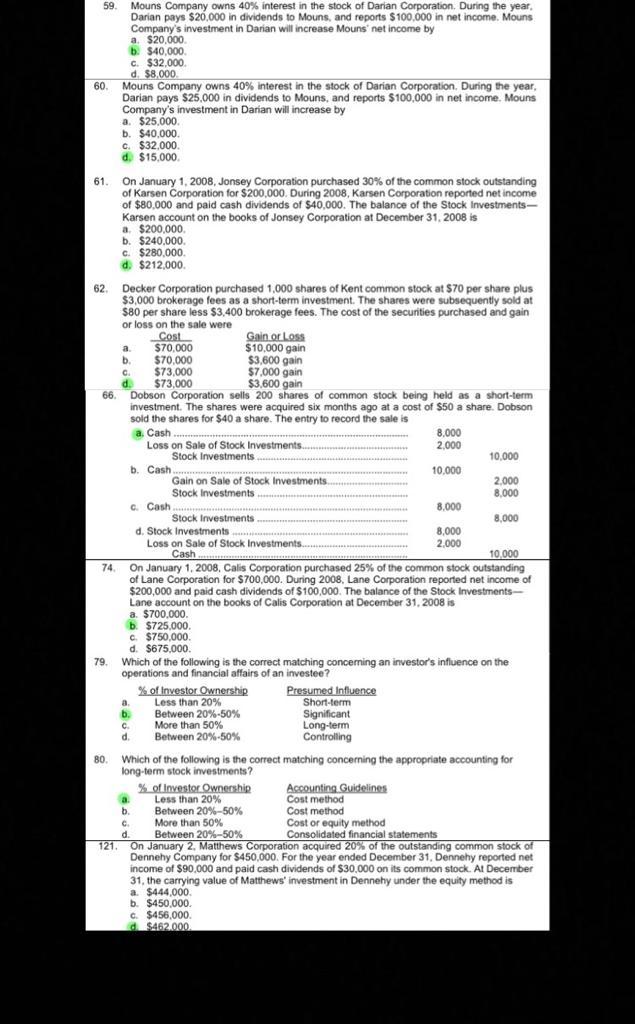

59. Mouns Company owns 40% interest in the stock of Darian Corporation. During the year, Darian pays $20,000 in dividends to Mouns, and reports $100,000 in net income. Mouns Companys investment in Darian will increase Mouns net income by

60. Mouns Company owns 40% interest in the stock of Darian Corporation. During the year, Darian pays $25,000 in dividends to Mouns, and reports $100,000 in net income. Mouns Companys investment in Darian will increase by

61. On January 1, 2008, Jonsey Corporation purchased 30% of the common stock outstanding of Karsen Corporation for $200,000. During 2008, Karsen Corporation reported net income of $80,000 and paid cash dividends of $40,000. The balance of the Stock Investments Karsen account on the books of Jonsey Corporation at December 31, 2008 is

62. Decker Corporation purchased 1,000 shares of Kent common stock at $70 per share plus $3,000 brokerage fees as a short-term investment. The shares were subsequently sold at $80 per share less $3,400 brokerage fees. The cost of the securities purchased and gain or loss on the sale were

66. Dobson Corporation sells 200 shares of common stock being held as a short-term investment. The shares were acquired six months ago at a cost of $50 a share. Dobson sold the shares for $40 a share. The entry to record the sale is

74. On January 1, 2008, Calis Corporation purchased 25% of the common stock outstanding of Lane Corporation for $700,000. During 2008, Lane Corporation reported net income of $200,000 and paid cash dividends of $100,000. The balance of the Stock Investments Lane account on the books of Calis Corporation at December 31, 2008 is

79. Which of the following is the correct matching concerning an investor's influence on the operations and financial affairs of an investee?

80. Which of the following is the correct matching concerning the appropriate accounting for long-term stock investments?

121. On January 2, Matthews Corporation acquired 20% of the outstanding common stock of Dennehy Company for $450,000. For the year ended December 31, Dennehy reported net income of $90,000 and paid cash dividends of $30,000 on its common stock. At December 31, the carrying value of Matthews' investment in Dennehy under the equity method is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started