Question

Please explain how to calculate this to get an answer like the key above (check the picture for the complete question) for number 39, 40,

Please explain how to calculate this to get an answer like the key above (check the picture for the complete question) for number 39, 40, 41, 42, 47, 48, 49, and 65

Chapter : INVESTMENTS

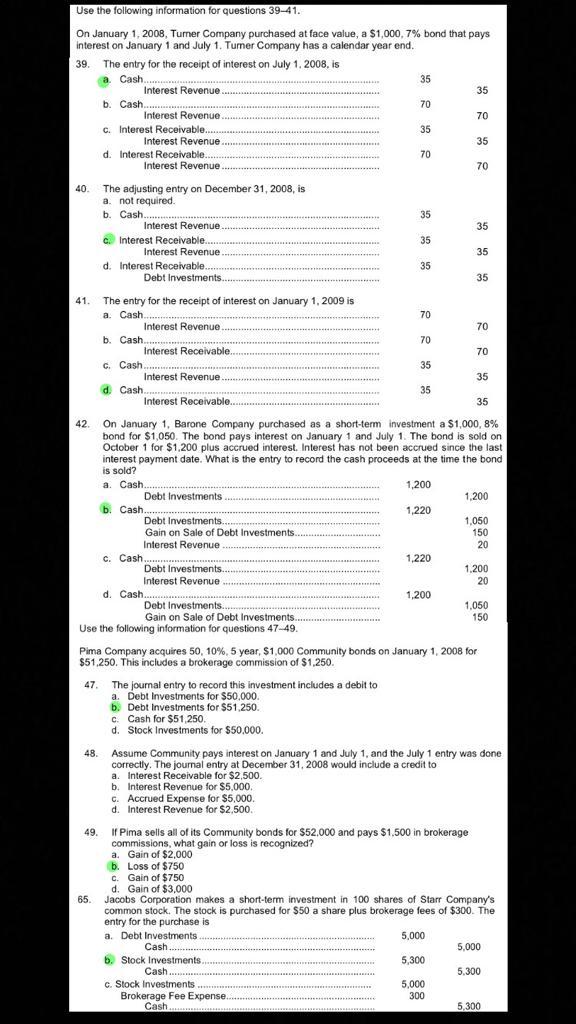

39. On January 1, 2008, Turner Company purchased at face value, a $1,000, 7% bond that pays interest on January 1 and July 1. Turner Company has a calendar year end. The entry for the receipt of interest on July 1, 2008, is

40. On January 1, 2008, Turner Company purchased at face value, a $1,000, 7% bond that pays interest on January 1 and July 1. Turner Company has a calendar year end. The adjusting entry on December 31, 2008, is

41. On January 1, 2008, Turner Company purchased at face value, a $1,000, 7% bond that pays interest on January 1 and July 1. Turner Company has a calendar year end. The entry for the receipt of interest on January 1, 2009 is

42. On January 1, 2008, Turner Company purchased at face value, a $1,000, 7% bond that pays interest on January 1 and July 1. Turner Company has a calendar year end. On January 1, Barone Company purchased as a short-term inverstment a $1.000, 8% bond for $1,050. The bond pays interest on January 1 and July 1. The bond is sold on October 1 for $1,200 plus accrued interest. Interest has not been accrued since the last interest payment date. What is the entry to record the cash proceeds at the time the bond is sold?

47. Pima Company acquires 50, 10%, 5 year, $1,000 Community bonds on January 1, 2008 for $51,250. This includes a brokerage commission of $1,250. The journal entry to record this investment includes a debit to

48. Pima Company acquires 50, 10%, 5 year, $1,000 Community bonds on January 1, 2008 for $51,250. This includes a brokerage commission of $1,250. Assume Community pays interest on January 1 and July 1, and the July 1 entry was done correctly. The journal entry at December 31, 2008 would include a credit to

49. Pima Company acquires 50, 10%, 5 year, $1,000 Community bonds on January 1, 2008 for $51,250. This includes a brokerage commission of $1,250. If Pima sells all of its Community bonds for $52,000 and pays $1,500 in brokerage commissions, what gain or loss is recognized?

65. Jacobs Corporation makes a short-term investment in 100 shares of Starr Company's common stock. The stock is purchased for $50 a share plus brokerage fees of $300. The entry for the purchase is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started