please explain how to calculate

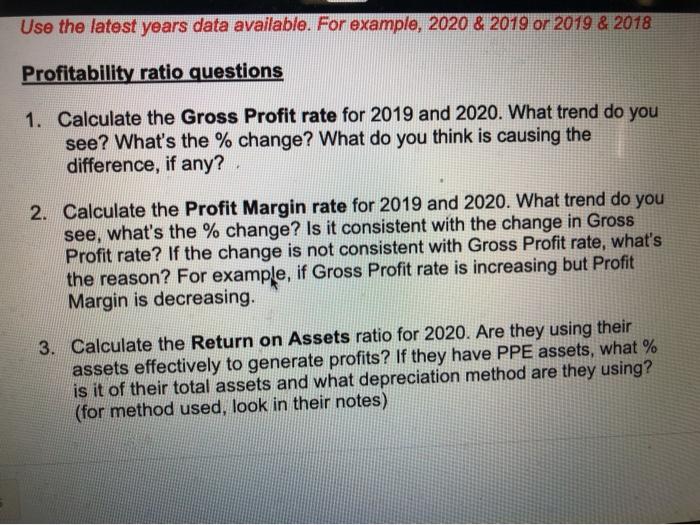

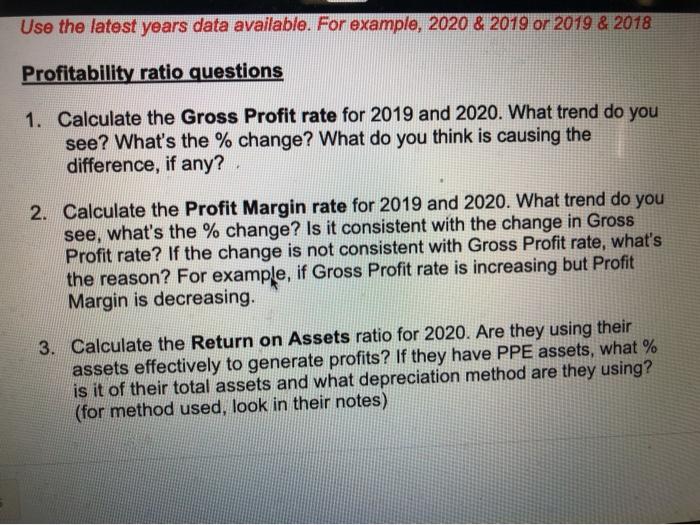

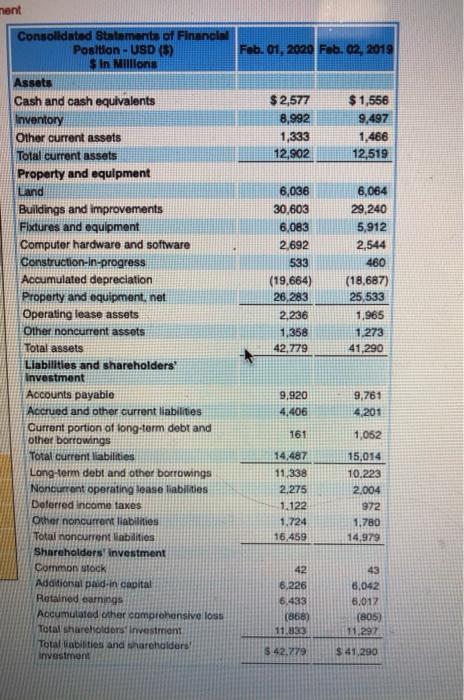

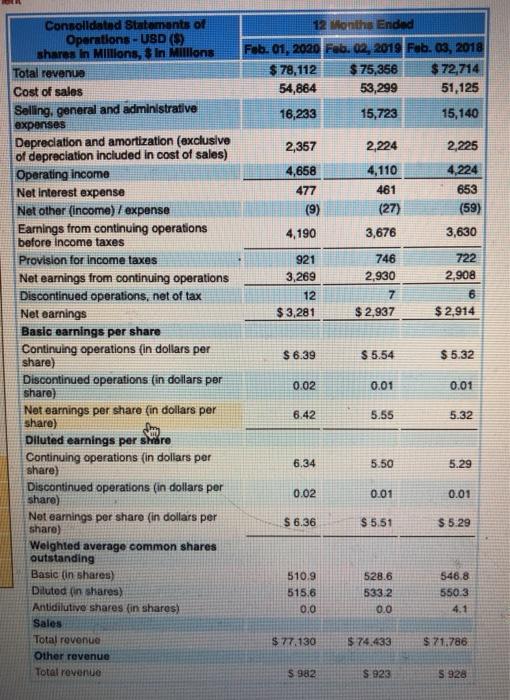

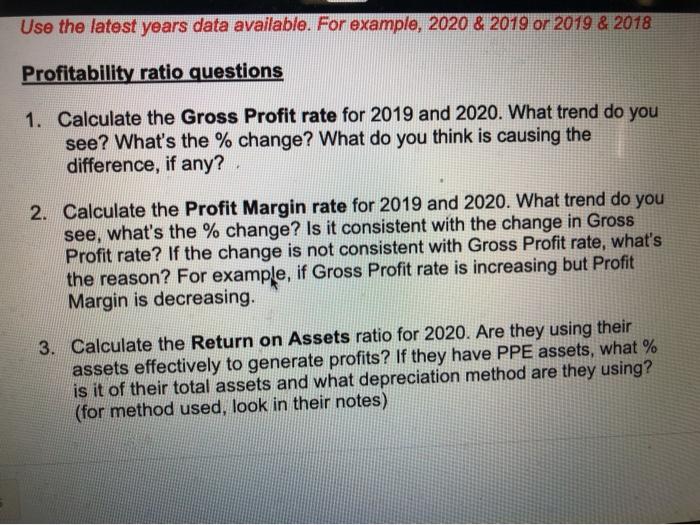

Use the latest years data available. For example, 2020 & 2019 or 2019 & 2018 Profitability ratio questions 1. Calculate the Gross Profit rate for 2019 and 2020. What trend do you see? What's the % change? What do you think is causing the difference, if any? 2. Calculate the Profit Margin rate for 2019 and 2020. What trend do you see, what's the % change? Is it consistent with the change in Gross Profit rate? If the change is not consistent with Gross Profit rate, what's the reason? For example, if Gross Profit rate is increasing but Profit Margin is decreasing. 3. Calculate the Return on Assets ratio for 2020. Are they using their assets effectively to generate profits? If they have PPE assets, what % is it of their total assets and what depreciation method are they using? (for method used, look in their notes) ment Feb. 01, 2020 Feb. 02, 2019 $ 2,577 8,992 1,333 12,902 $1,556 9,497 1,466 12,519 Consolidated Statements of Financial Position - USD ($) Sin Millions Assets Cash and cash equivalents Inventory Other current assets Total current assets Property and equipment Land Buildings and improvements Fixtures and equipment Computer hardware and software Construction-in-progress Accumulated depreciation Property and equipment, net Operating lease assets Other noncurrent assets Total assets Liabilities and shareholders investment Accounts payable Accrued and other current liabilities Current portion of long-term debt and other borrowings Total current liabilities Long-term debt and other borrowings Noncurrent operating lease liabilities Deferred income taxes Other noncurrent liabilities Total noncurrent liabdities Shareholders' investment Common stock Additional pa din capital Retained earnings Accumulated other comprehensive loss Total shareholders investment Total abilities and shareholders investment 6,036 30,603 6,083 2,692 533 (19,664) 26,283 2,236 1.358 42,779 6,064 29,240 5,912 2,544 460 (18,687) 25,533 1,965 1.273 41,290 9.920 4,406 9,761 4201 161 1,052 14,487 11,338 2,275 1.122 1.724 16,459 15,014 10.223 2.004 972 1,780 14,979 42 6.226 6,433 (868) 11.833 43 6.042 6.012 (805) 11,297 $42.779 $.41.290 12 months Ended Feb. 01, 2020 Feb. 02, 2019 Feb. 03, 2018 $ 78,112 $ 75,356 $72,714 54,864 53,299 51,125 16,233 15,723 15,140 2,224 2,225 2,357 4,658 477 (9) 4,190 4,110 461 (27) 3,676 4.224 653 (59) 3,630 921 3,269 12 $3,281 746 2.930 7 $ 2,937 722 2,908 6 $ 2,914 Consolidated Statements of Operations - USD ($) shares in Millions, $ in Millions Total revenue Cost of sales Selling, general and administrative expenses Depreciation and amortization (exclusive of depreciation included in cost of sales) Operating income Net interest expense Net other (income) / expense Earnings from continuing operations before income taxes Provision for income taxes Net earnings from continuing operations Discontinued operations, net of tax Net earnings Basic earnings per share Continuing operations (in dollars per share) Discontinued operations (in dollars per share) Net earnings per share (in dollars per share) Diluted earnings per shtre Continuing operations (in dollars per share) Discontinued operations (in dollars per share) Net earnings per share (in dollars per sharo) Weighted average common shares outstanding Basic in shares) Diluted in shares) Antidilutive shares in shares) Sales Total revenue Other revenue Total revenue $6.39 $ 5.54 $ 5.32 0.02 0.01 0.01 6.42 5.55 5.32 6.34 5.50 5.29 0.02 0.01 0.01 S 6.36 $ 5.51 $ 5.29 510.9 5156 0.0 528.6 533.2 0.0 546,8 550.3 $77.130 $74.433 $ 71.786 S 982 S 923 5 928