please explain how to prepare the journal entries for cash sale on July 31 2020. and please provide detail steps.

please explain how to prepare the journal entries for cash sale on July 31 2020. and please provide detail steps.

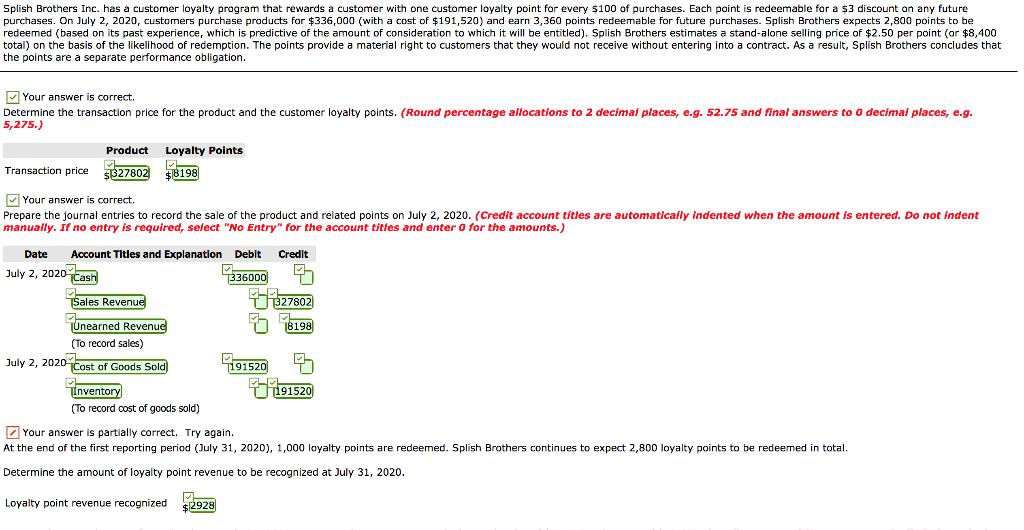

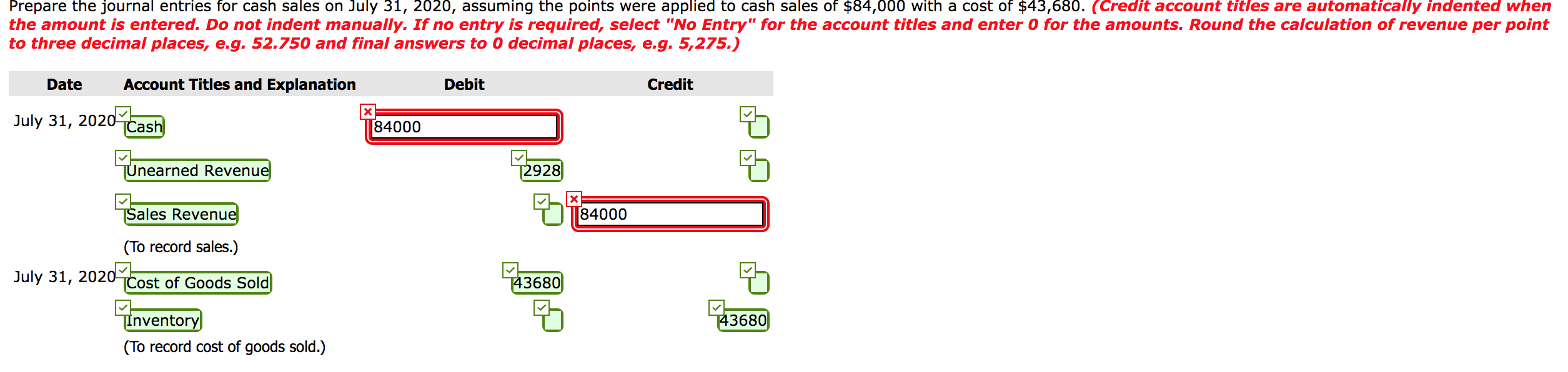

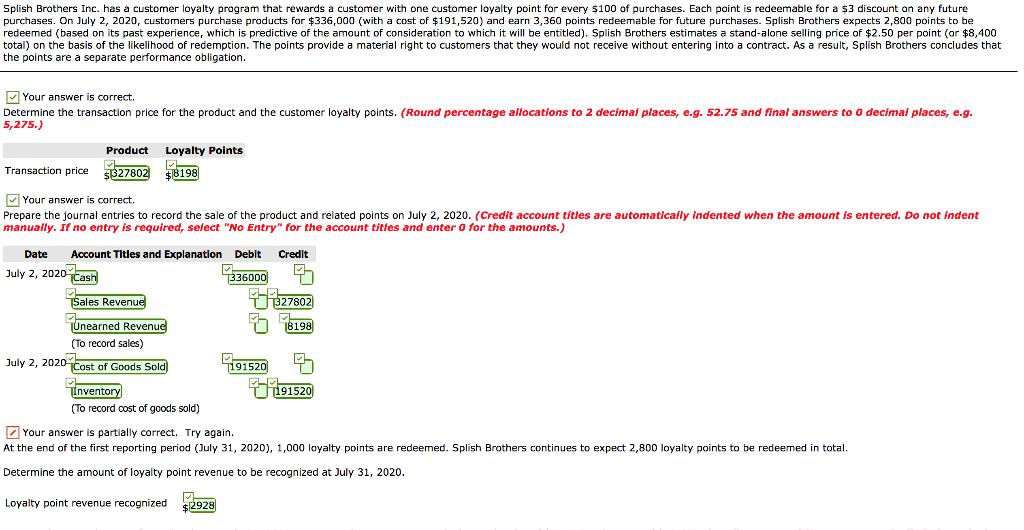

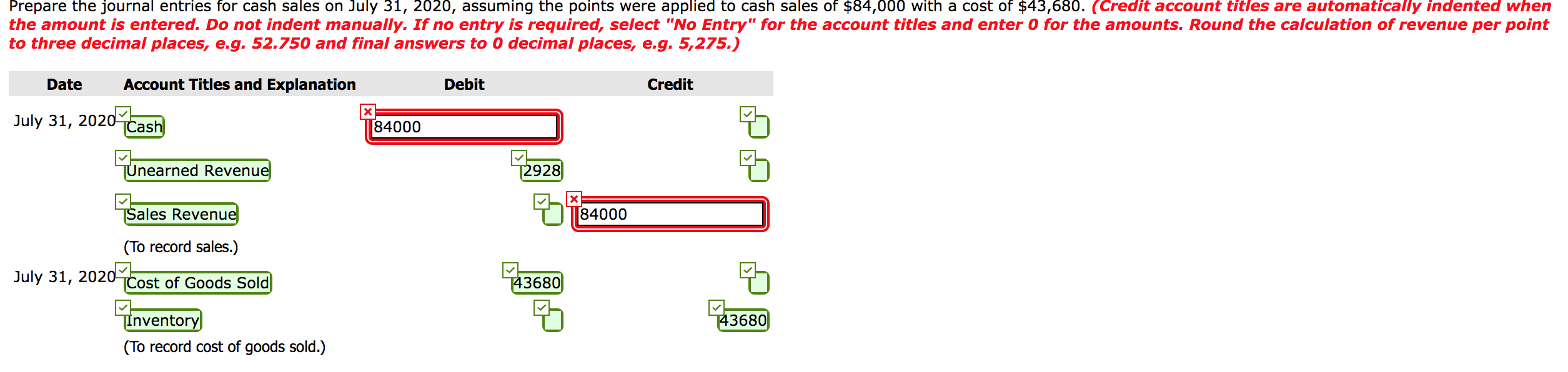

Splish Brothers Inc. has a customer loyalty program that rewards a customer with one customer loyalty point for every $100 of purchases. Each point is redeemable for a $3 discount on any future purchases. On July 2, 2020, customers purchase products for $336,000 (with a cost of $191,520) and earn 3,360 points redeemable for future purchases. Splish Brothers expects 2,800 points to be redeemed (based on its past experience, which is predictive of the amount of consideration to which it will be entitled). Splish Brothers estimates a stand-alone selling price of $2.50 per point (or $8,400 total) on the basis of the likelihood of redemption. The points provide a material right to customers that they would not receive without entering into a contract. As a result, Splish Brothers concludes that the points are a separate performance obligation. Your answer is correct. Determine the transaction price for the product and the customer loyalty points. (Round percentage allocations to 2 decimal places, e.g. 52.75 and final answers to 0 decimal places, e.g. 5,275.) Transaction price Product $327802 Loyalty Points $8198 Your answer is correct. Prepare the journal entries to record the sale of the product and related points on July 2, 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account tities and enter o for the amounts.) Date Account Titles and Explanation Debit Credit July 2, 2020 tash 336000 3 Sales Revenue 1327802 Unearned Revenue 8198 (To record sales) July 2, 2020 Cost of Goods Sold 9191520 Inventory 191520 (To record cost of goods sold) Your answer is partially correct. Try again. At the end of the first reporting period (July 31, 2020), 1,000 loyalty points are redeemed. Splish Brothers continues to expect 2,800 loyalty points to be redeemed in total. Determine the amount of loyalty point revenue to be recognized at July 31, 2020. Loyalty point revenue recognized $2928 Prepare the journal entries for cash sales on July 31, 2020, assuming the points were applied to cash sales of $84,000 with a cost of $43,680. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round the calculation of revenue per point to three decimal places, e.g. 52.750 and final answers to 0 decimal places, e.g. 5,275.) Debit Credit Date Account Titles and Explanation July 31, 2020 Cash T84000 Unearned Revenue 572928 97134000 Sales Revenue (To record sales.) July 31, 2020 Cost of Goods Sold 73680 Inventory 143680 (To record cost of goods sold.)

please explain how to prepare the journal entries for cash sale on July 31 2020. and please provide detail steps.

please explain how to prepare the journal entries for cash sale on July 31 2020. and please provide detail steps.