Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please explain how to SOLVE PART C FOR THUMBS UP 6. Bank of America lends a coffee shop $200,000 on October 1, 2018. The coffee

please explain how to SOLVE PART C FOR THUMBS UP

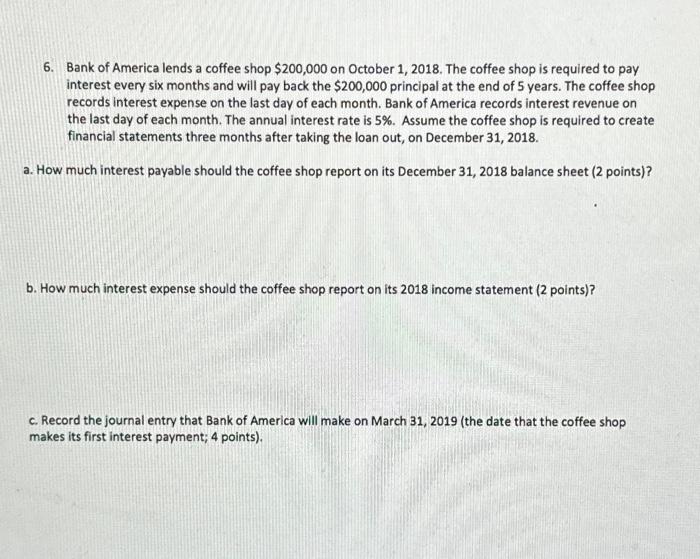

6. Bank of America lends a coffee shop $200,000 on October 1, 2018. The coffee shop is required to pay interest every six months and will pay back the $200,000 principal at the end of 5 years. The coffee shop records interest expense on the last day of each month. Bank of America records interest revenue on the last day of each month. The annual interest rate is 5%. Assume the coffee shop is required to create financial statements three months after taking the loan out, on December 31, 2018. a. How much interest payable should the coffee shop report on its December 31,2018 balance sheet ( 2 points)? b. How much interest expense should the coffee shop report on its 2018 income statement (2 points)? c. Record the journal entry that Bank of America will make on March 31, 2019 (the date that the coffee shop makes its first interest payment; 4 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started