Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain how you get N to be 10 for the formula at the bottom. I understand the graph is showing that it is 5

Please explain how you get N to be 10 for the formula at the bottom. I understand the graph is showing that it is 5 years but It doesnt make sense to me. Thank you.

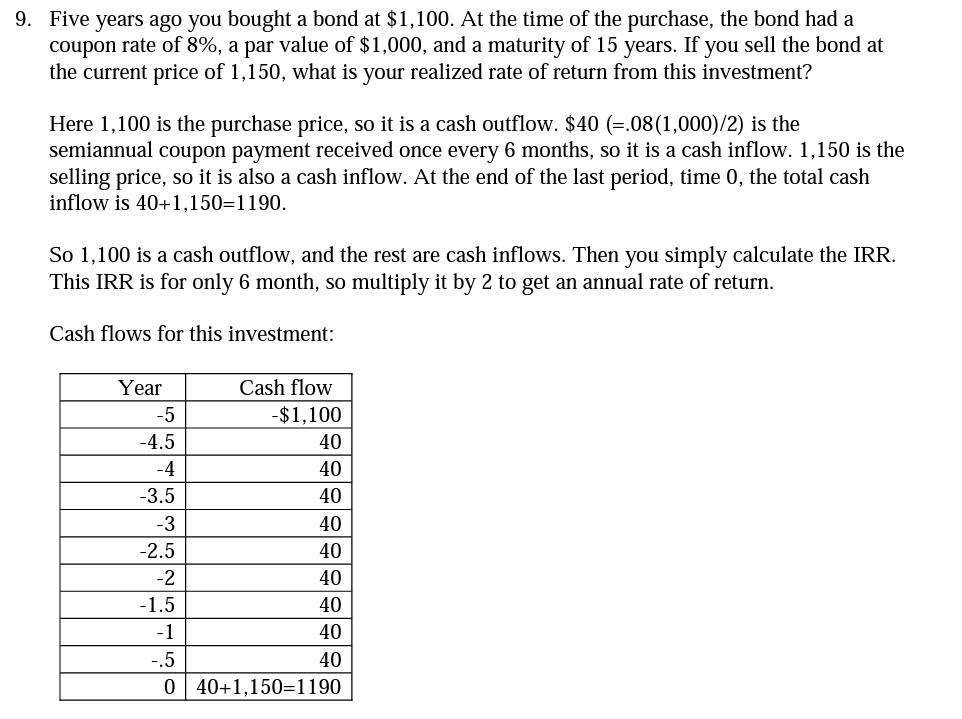

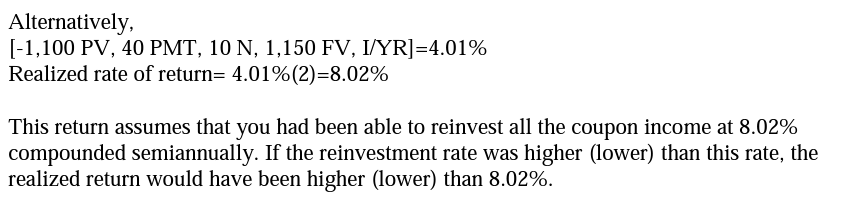

9. Five years ago you bought a bond at $1,100. At the time of the purchase, the bond had a coupon rate of 8%, a par value of $1,000, and a maturity of 15 years. If you sell the bond at the current price of 1,150 , what is your realized rate of return from this investment? Here 1,100 is the purchase price, so it is a cash outflow. $40(=.08(1,000)/2) is the semiannual coupon payment received once every 6 months, so it is a cash inflow. 1,150 is the selling price, so it is also a cash inflow. At the end of the last period, time 0 , the total cash inflow is 40+1,150=1190. So 1,100 is a cash outflow, and the rest are cash inflows. Then you simply calculate the IRR. This IRR is for only 6 month, so multiply it by 2 to get an annual rate of return. Cash flows for this investment: Alternatively, [1,100PV,40PMT,10N,1,150FV,I/YR]=4.01% Realized rate of return =4.01%(2)=8.02% This return assumes that you had been able to reinvest all the coupon income at 8.02% compounded semiannually. If the reinvestment rate was higher (lower) than this rate, the realized return would have been higher (lower) than 8.02%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started