Please explain how you got your answer thanks.

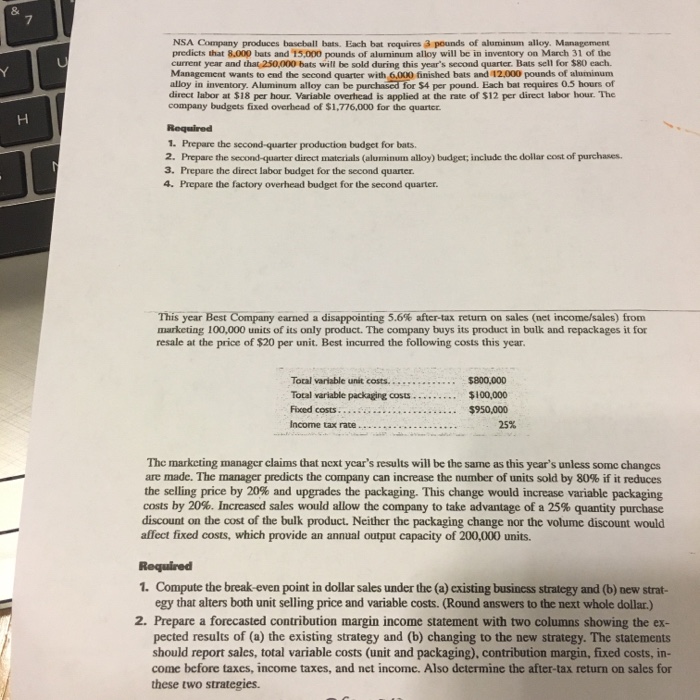

7 NSA Company produces baseball bats. Each bat requires 3 pounds of aluminum alloy. Management predicts that 8,000 bats and 15,000 pounds of aluminum alloy will be in inventory on March 31 of the current year and that 250,000 bats will be sold during this years second quarter. Bats sell for $80 each Management wants to end the second quarter with 6,000 finished bats and 12,000 pounds of aluminum alloy in inventory. Aluminum alloy can be purchased for $4 per pound. Each bat requires 0.5 hours of direct labor at $18 per hour. Variable overhead is applied at the rate of $12 per direct labor bour. The company budgets fixed overhead of $1,776,000 for the quarter Required 1. Prepare the second-quarter production budget for bats. 2. Prepare the second-quarter direct materials (aluminum alloy) budget, include the dollar cost of purchases 3. Prepare the direct labor budget for the second quarter. 4. Prepare the factory overhead budget for the second quarter Thisyear Best Company earned a disappointing 5.6% after-tax return on sales (net income/sales) from marketing 100,000 units of its only product. The company buys its product in bulk and repackages it for resale at the price of $20 per unit. Best incurred the following costs this year. $100,000 $950,000 Total variable packaging costs. - Income tax rate.... 25% The markcting manager claims that next ycar's results will be the same as this year's unless some changes are made. The manager predicts the company can increase the nurnber of units sold by 80% if it reduces the selling price by 20% and upgrades the packaging. This change would increase variable packaging costs by 20%. Increased sales would allow the company to take advantage of a 25% quantity purchase discount on the cost of the bulk product. Neither the packaging change nor the volume discount would affect fixed costs, which provide an annual output capacity of 200,000 units. Required 1. Compute the break-even point in dollar sales under the (a) existing business strategy and (b) new strat- egy that alters both unit selling price and variable costs. (Round answers to the next whole dollar.) 2. Prepare a forecasted contribution margin income statement with two columns showing the ex- pected results of (a) the existing strategy and (b) changing to the new strategy. The statements should report sales, total variable costs (unit and packaging), contribution margin, fixed costs, in- come before taxes, income taxes, and net income. Also determine the after-tax return on salcs for these two strategies

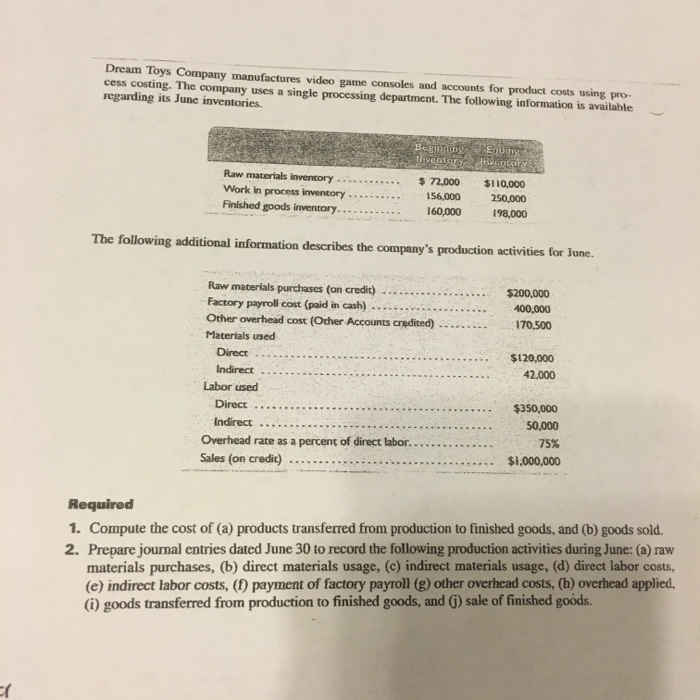

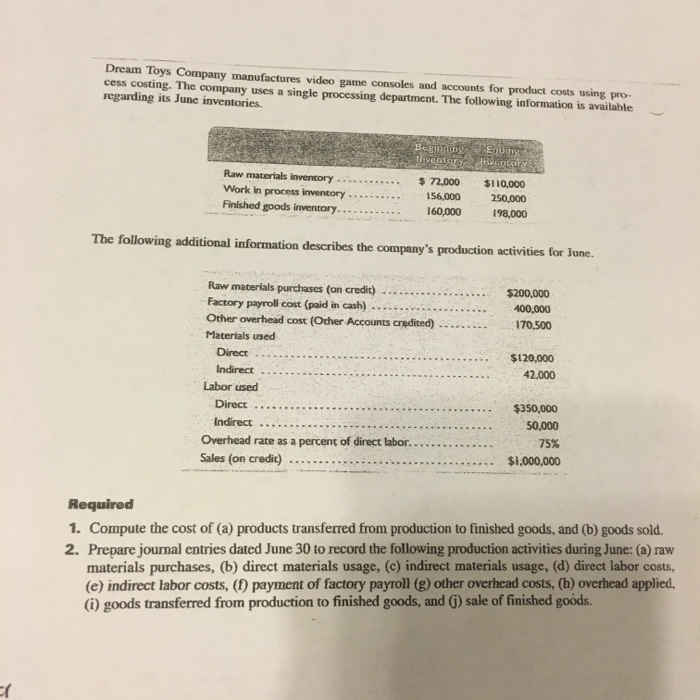

Please explain how you got your answer thanks.

Please explain how you got your answer thanks.