Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain in a paragraph why the highlighted answer is the correct answer. For each incorrect answer please explain in a paragraph why it is

Please explain in a paragraph why the highlighted answer is the correct answer. For each incorrect answer please explain in a paragraph why it is incorrect.

I'm trying to get a better understanding. Thanks

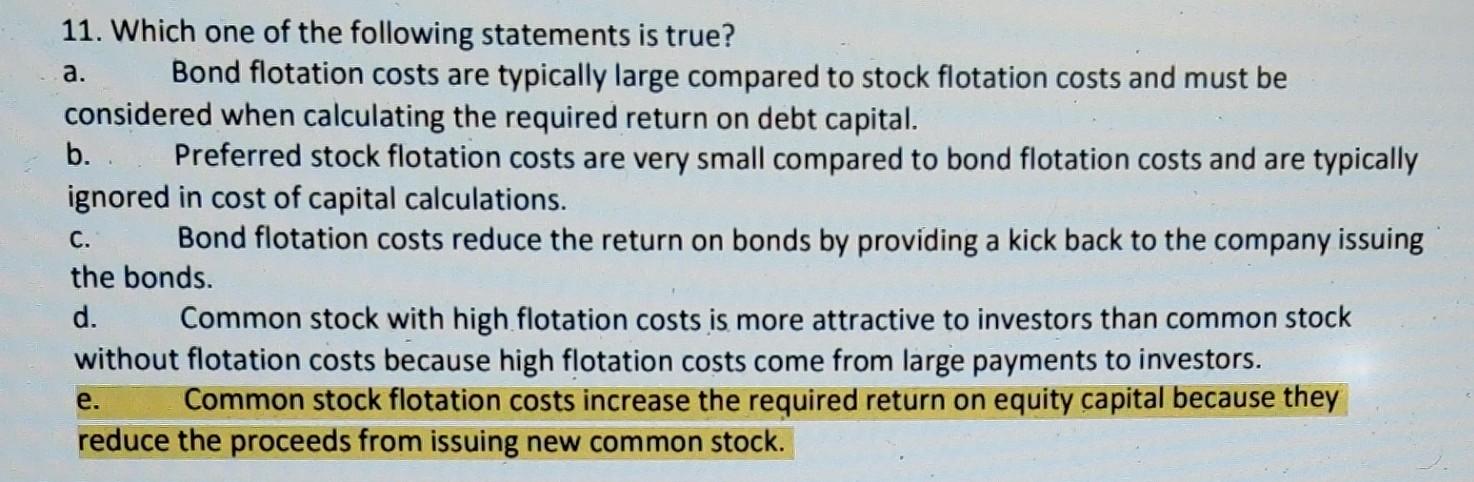

11. Which one of the following statements is true? a. Bond flotation costs are typically large compared to stock flotation costs and must be considered when calculating the required return on debt capital. b. . Preferred stock flotation costs are very small compared to bond flotation costs and are typically ignored in cost of capital calculations. c. Bond flotation costs reduce the return on bonds by providing a kick back to the company issuing the bonds. d. Common stock with high flotation costs is more attractive to investors than common stock without flotation costs because high flotation costs come from large payments to investors. e. Common stock flotation costs increase the required return on equity capital because they reduce the proceeds from issuing new common stockStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started