Answered step by step

Verified Expert Solution

Question

1 Approved Answer

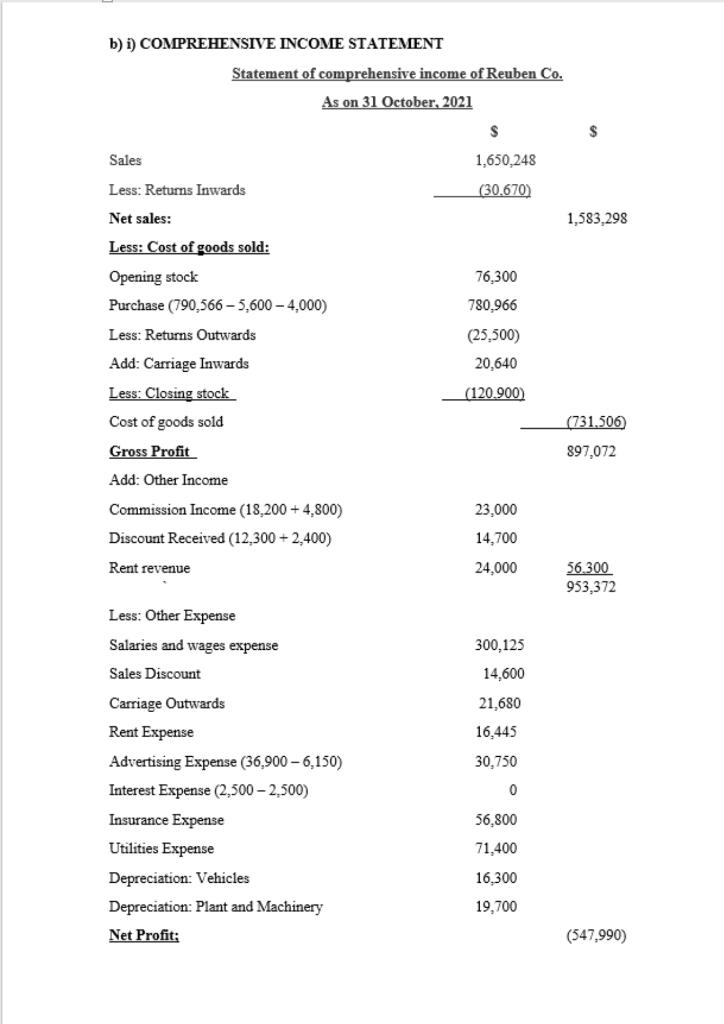

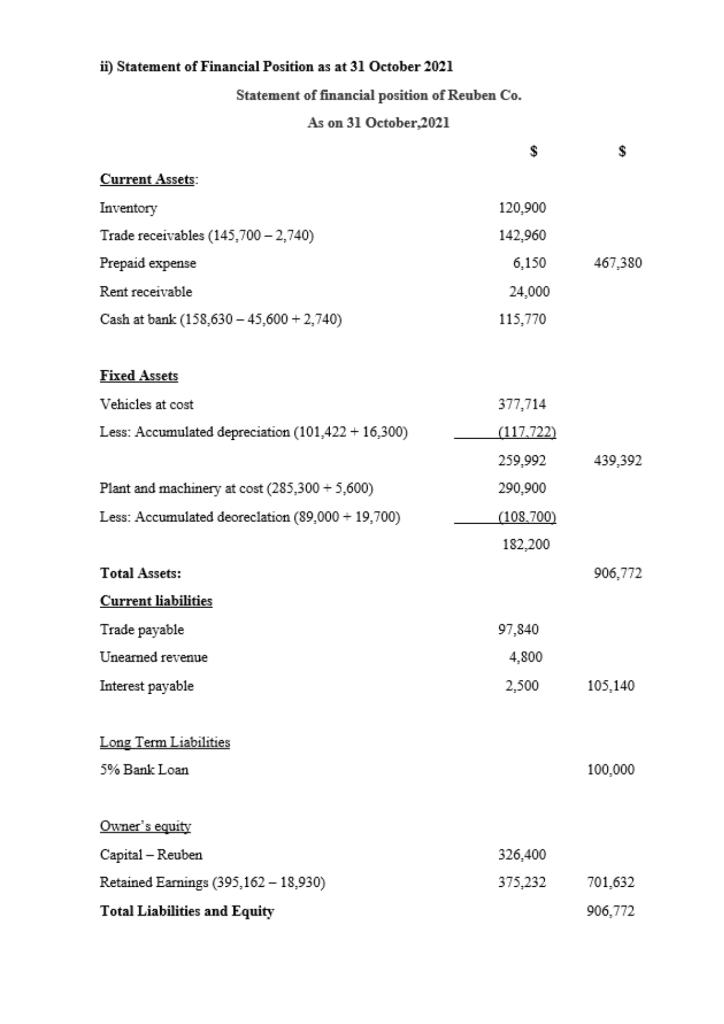

Please explain in detail part B like the example below thanks! David, the owner of Dee Trading, started his business in 2021. His accountant has

Please explain in detail part B like the example below thanks!

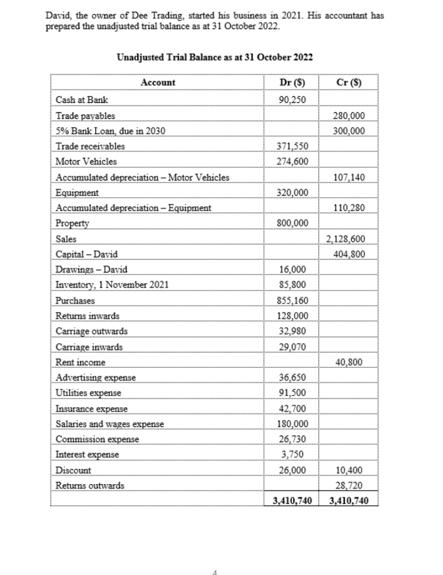

David, the owner of Dee Trading, started his business in 2021. His accountant has prepared the unadjusted trial balance as at 31 October 2022. Unadjusted Trial Balance as at 31 October 2022 Cash at Bank Trade payables 5% Bank Loan, due in 2030 Trade receivables Motor Vehicles Account Accumulated depreciation - Motor Vehicles Equipment Accumulated depreciation - Equipment Property Sales Capital-David Drawings-David Inventory, 1 November 2021 Purchases Returns inwards Carriage outwards Carriage inwards Rent income Advertising expense Utilities expense Insurance expense Salaries and wages expense Commission expense Interest expense Discount Returns outwards Dr ($) 90,250 371,550 274,600 320,000 800,000 16,000 85,800 855,160 128,000 32,980 29,070 36,650 91,500 42,700 180,000 26,730 3,750 26,000 3,410,740 Cr ($) 280,000 300,000 107,140 110,280 2,128,600 404,800 40,800 10,400 28,720 3,410,740

Step by Step Solution

★★★★★

3.32 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started