Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain in detail to me. Thank you so much!! QUESTION 1 An investor is considering two assets A and B to build a portfolio.

Please explain in detail to me. Thank you so much!!

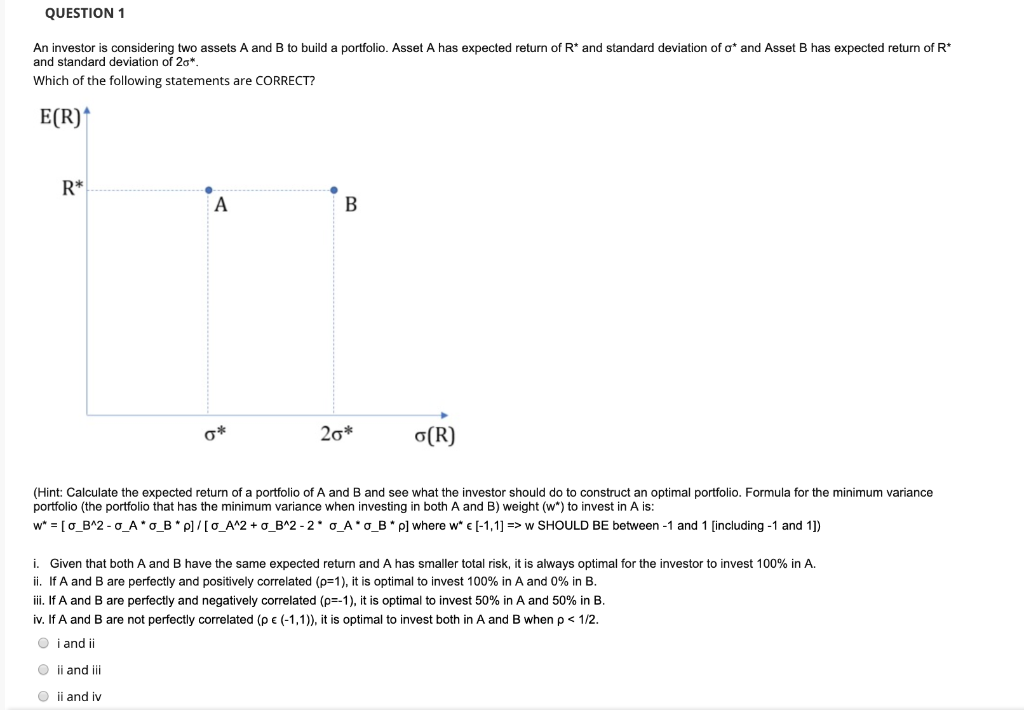

QUESTION 1 An investor is considering two assets A and B to build a portfolio. Asset A has expected return of R* and standard deviation of o* and Asset B has expected return of R* and standard deviation of 20* Which of the following statements are CORRECT? E(R) R* o* 20* (R) (Hint: Calculate the expected return of a portfolio of A and B and see what the investor should do to construct an optimal portfolio. Formula for the minimum variance portfolio (the portfolio that has the minimum variance when investing in both A and B) weight (w*) to invest in A is: w* = [O_B^2-O_A* q_B*p] /[o_A^2 + o_B^2-2 o_A _B* p] where w* (-1,1] => W SHOULD BE between-1 and 1 [including -1 and 11) i. Given that both A and B have the same expected return and A has smaller total risk, it is always optimal for the investor to invest 100% in A. ii. If A and B are perfectly and positively correlated (p=1), it is optimal to invest 100% in A and 0% in B. iii. If A and B are perfectly and negatively correlated (p=-1), it is optimal to invest 50% in A and 50% in B. iv. If A and B are not perfectly correlated (P E (-1,1)), it is optimal to invest both in A and B when p W SHOULD BE between-1 and 1 [including -1 and 11) i. Given that both A and B have the same expected return and A has smaller total risk, it is always optimal for the investor to invest 100% in A. ii. If A and B are perfectly and positively correlated (p=1), it is optimal to invest 100% in A and 0% in B. iii. If A and B are perfectly and negatively correlated (p=-1), it is optimal to invest 50% in A and 50% in B. iv. If A and B are not perfectly correlated (P E (-1,1)), it is optimal to invest both in A and B when pStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started