Please explain in details for each of the questions

Please explain in details for each of the questions

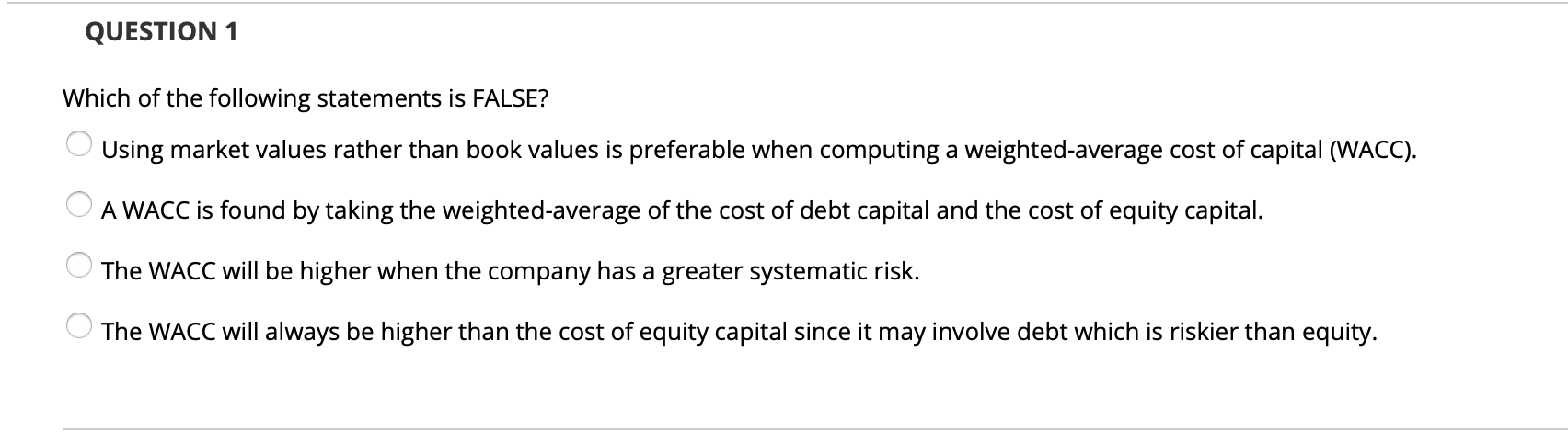

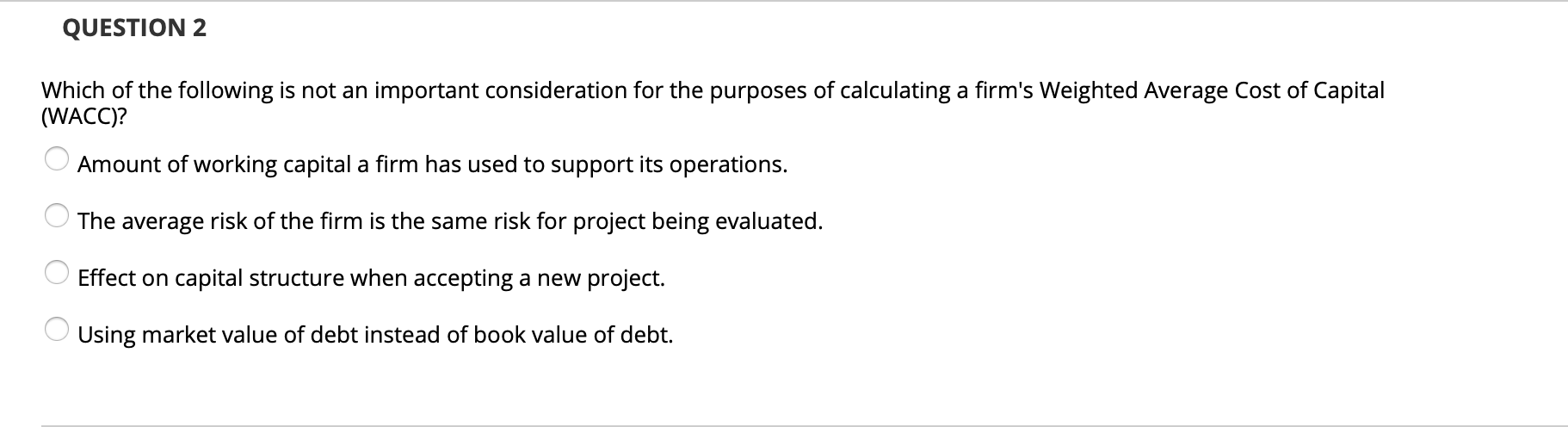

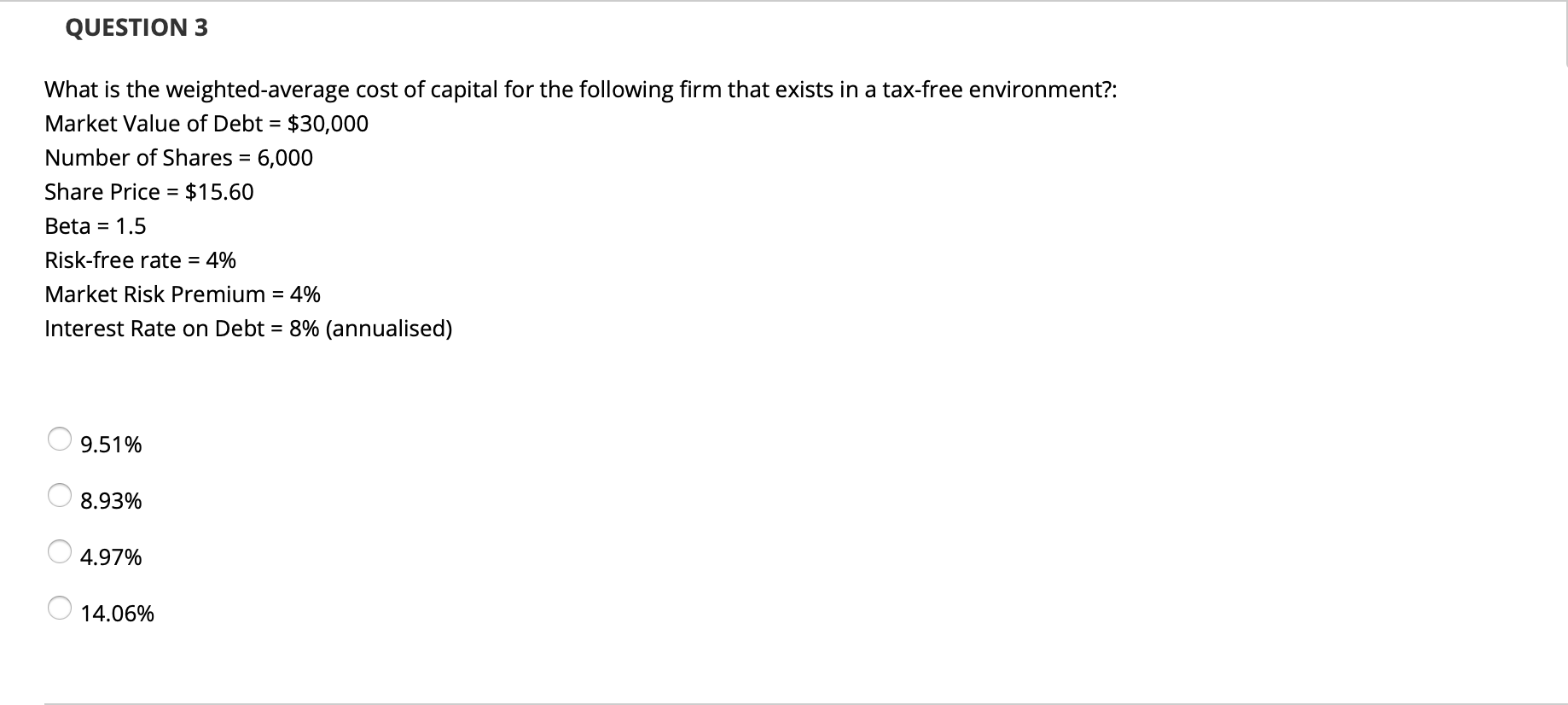

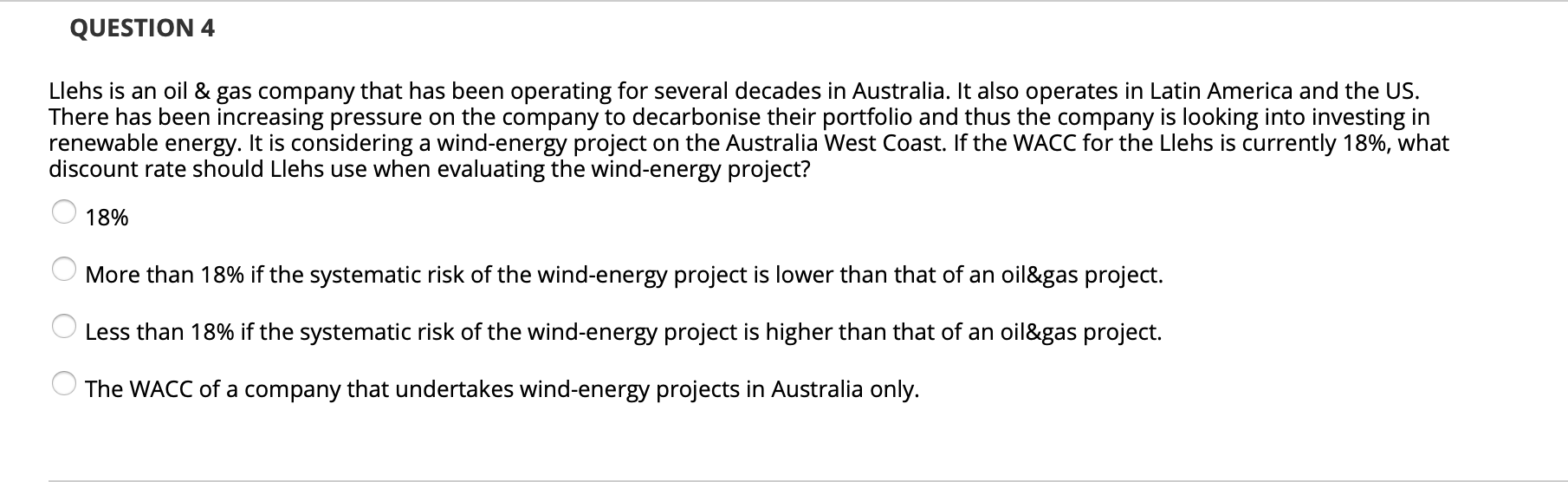

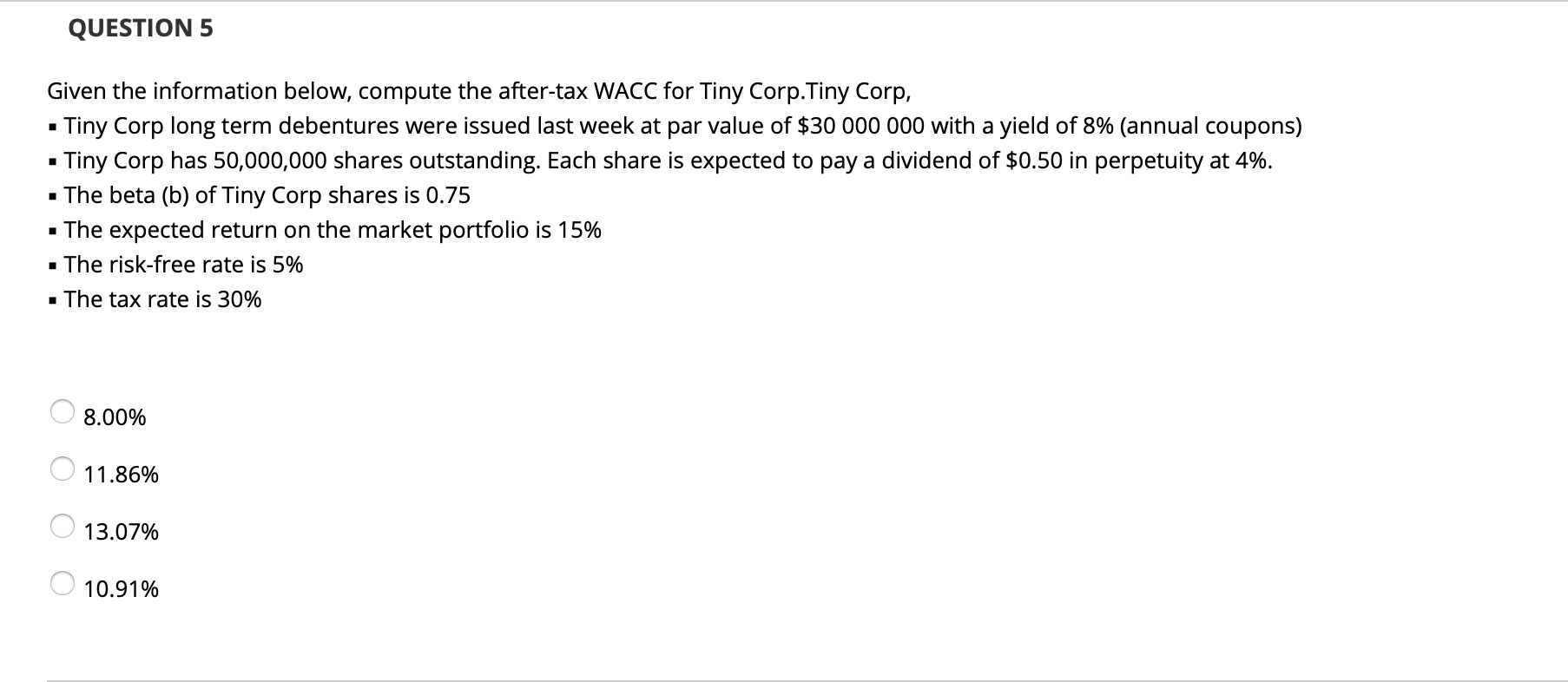

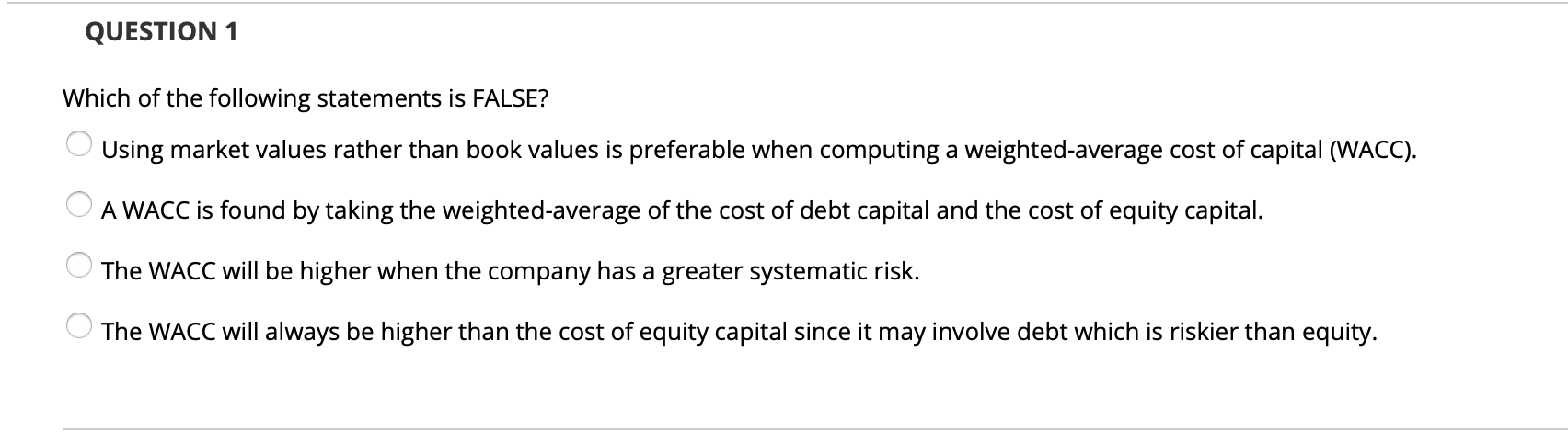

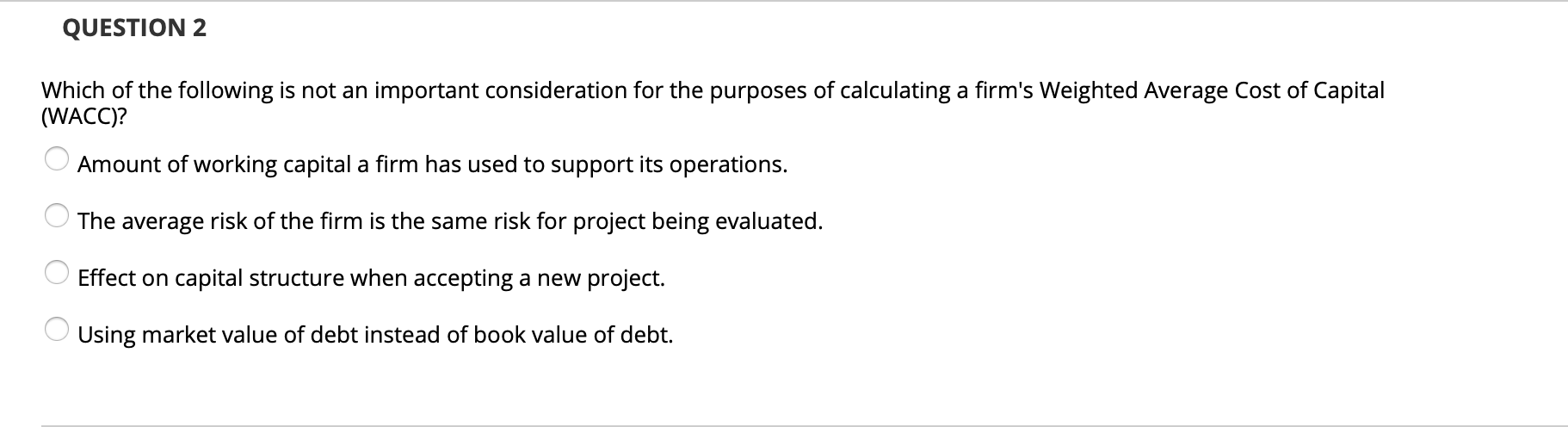

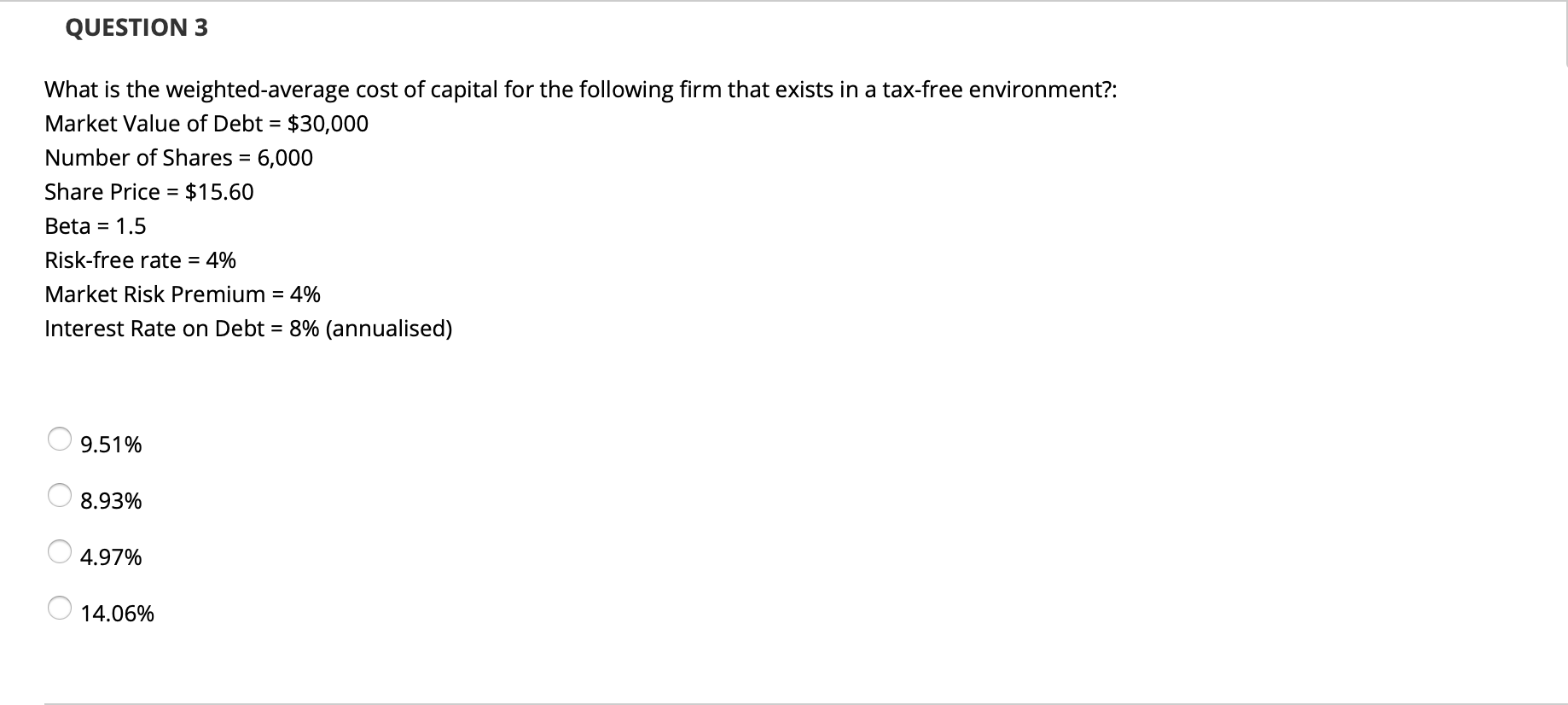

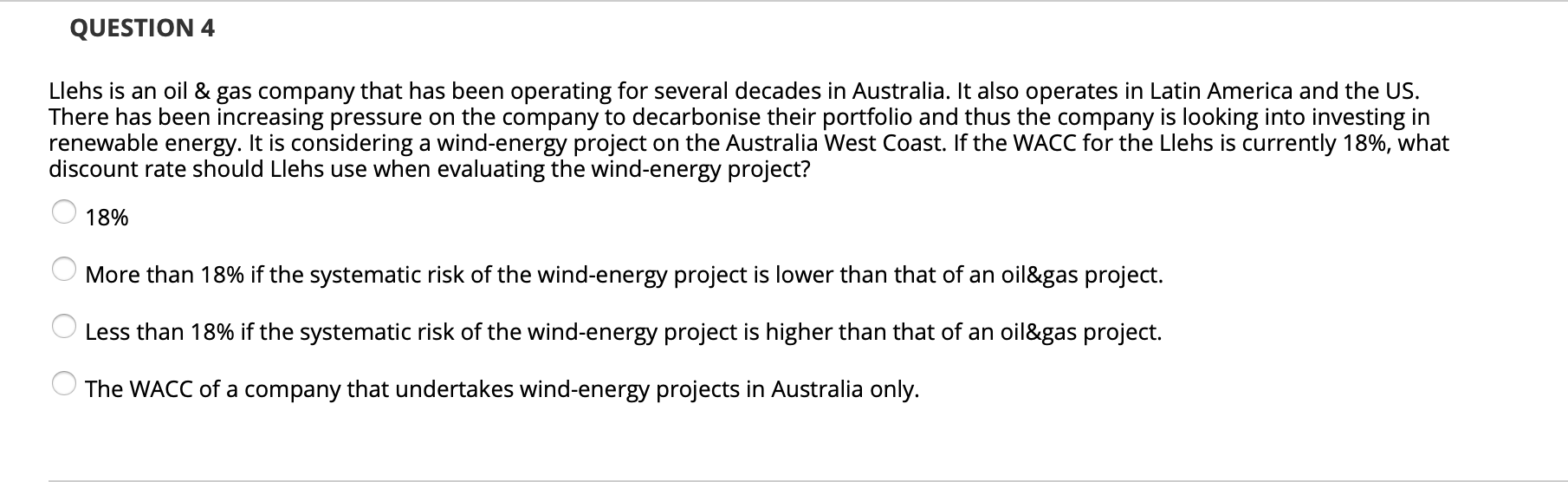

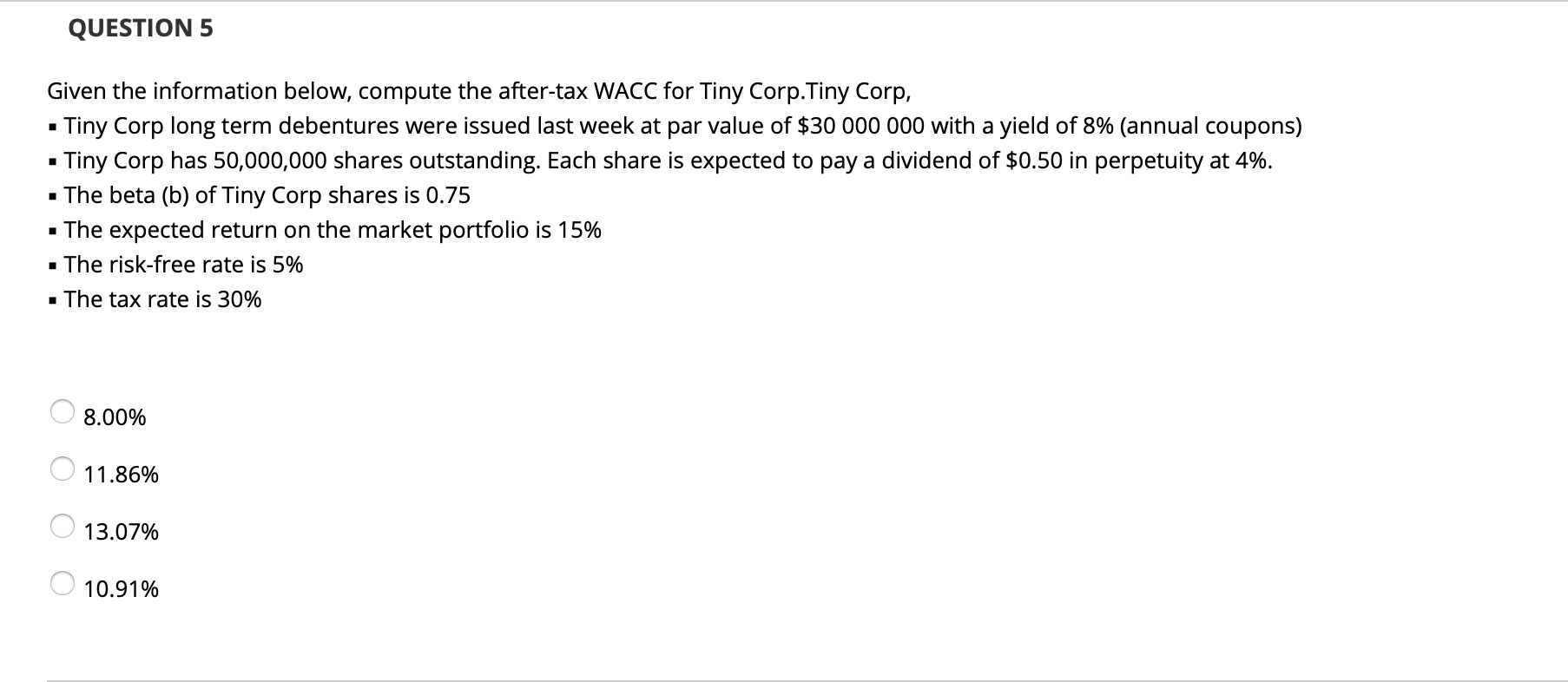

QUESTION 1 Which of the following statements is FALSE? Using market values rather than book values is preferable when computing a weighted-average cost of capital (WACC). O O A WACC is found by taking the weighted-average of the cost of debt capital and the cost of equity capital. The WACC will be higher when the company has a greater systematic risk. The WACC will always be higher than the cost of equity capital since it may involve debt which is riskier than equity. QUESTION 2 Which of the following is not an important consideration for the purposes of calculating a firm's Weighted Average Cost of Capital (WACC)? Amount of working capital a firm has used to support its operations. The average risk of the firm is the same risk for project being evaluated. Effect on capital structure when accepting a new project. Using market value of debt instead of book value of debt. QUESTION 3 What is the weighted-average cost of capital for the following firm that exists in a tax-free environment?: Market Value of Debt = $30,000 Number of Shares = 6,000 Share Price = $15.60 Beta = 1.5 Risk-free rate = 4% Market Risk Premium = 4% Interest Rate on Debt = 8% (annualised) 9.51% 8.93% 4.97% 14.06% QUESTION 4 Llehs is an oil & gas company that has been operating for several decades in Australia. It also operates in Latin America and the US. There has been increasing pressure on the company to decarbonise their portfolio and thus the company is looking into investing in renewable energy. It is considering a wind-energy project on the Australia West Coast. If the WACC for the Llehs is currently 18%, what discount rate should Llehs use when evaluating the wind-energy project? 18% More than 18% if the systematic risk of the wind-energy project is lower than that of an oil&gas project. Less than 18% if the systematic risk of the wind-energy project is higher than that of an oil&gas project. The WACC of a company that undertakes wind-energy projects in Australia only. QUESTION 5 Given the information below, compute the after-tax WACC for Tiny Corp.Tiny Corp, Tiny Corp long term debentures were issued last week at par value of $30 000 000 with a yield of 8% (annual coupons) Tiny Corp has 50,000,000 shares outstanding. Each share is expected to pay a dividend of $0.50 in perpetuity at 4%. The beta (b) of Tiny Corp shares is 0.75 The expected return on the market portfolio is 15% The risk-free rate is 5% The tax rate is 30% 8.00% 11.86% 13.07% 10.91%

Please explain in details for each of the questions

Please explain in details for each of the questions