Answered step by step

Verified Expert Solution

Question

1 Approved Answer

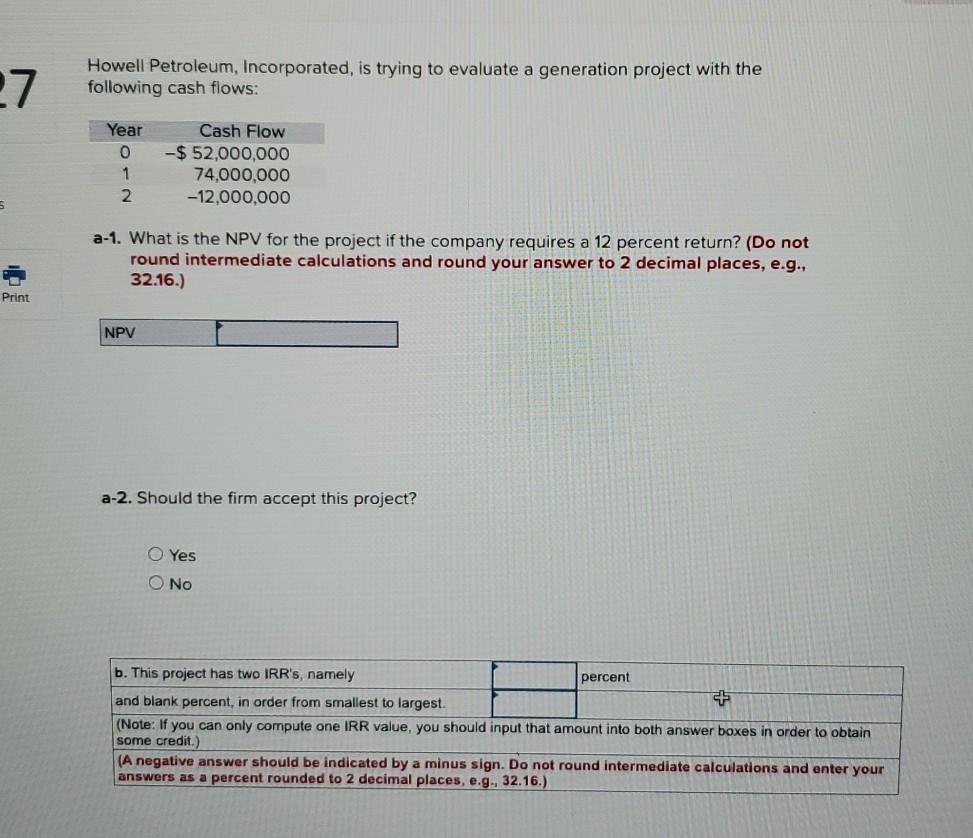

please explain in excel 27 Howell Petroleum, Incorporated, is trying to evaluate a generation project with the following cash flows: Year 0 1 2. Cash

please explain in excel

27 Howell Petroleum, Incorporated, is trying to evaluate a generation project with the following cash flows: Year 0 1 2. Cash Flow -$ 52,000,000 74,000,000 -12,000,000 5 a-1. What is the NPV for the project if the company requires a 12 percent return? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g.. 32.16.) Print NPV a-2. Should the firm accept this project? O Yes O No + b. This project has two IRR's, namely percent and blank percent, in order from smallest to largest. (Note: If you can only compute one IRR value, you should input that amount into both answer boxes in order to obtain some credit.) (A negative answer should be indicated by a minus sign. Do not round Intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started