Answered step by step

Verified Expert Solution

Question

1 Approved Answer

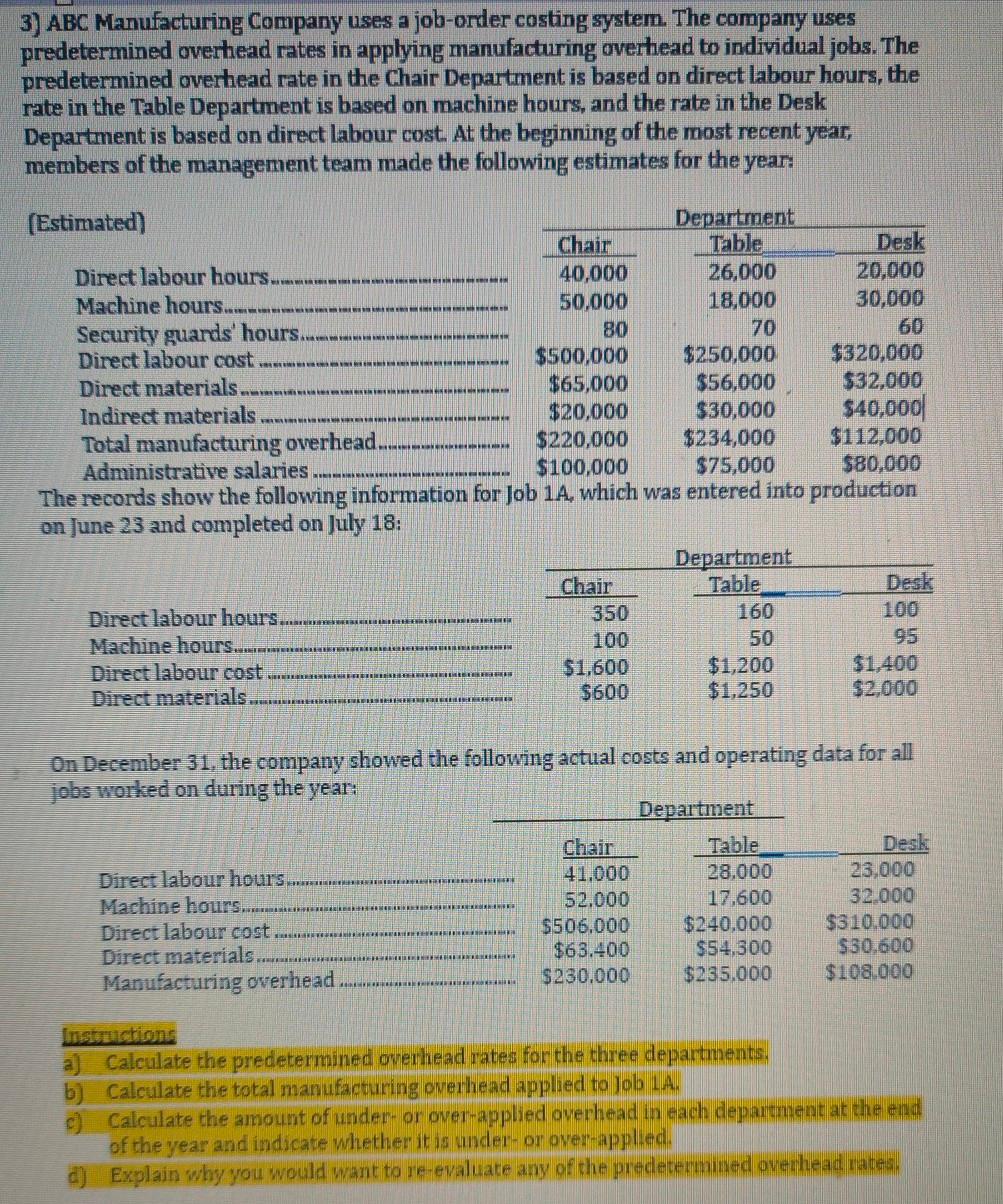

please explain in format.. test ques it is 3) ABC Manufacturing Company uses a job-order costing system. The company uses predetermined overhead rates in applying

please explain in format.. test ques it is

3) ABC Manufacturing Company uses a job-order costing system. The company uses predetermined overhead rates in applying manufacturing overhead to individual jobs. The predetermined overhead rate in the Chair Department is based on direct labour hours, the rate in the Table Department is based on machine hours, and the rate in the Desk Department is based on direct labour cost. At the beginning of the most recent year, members of the management team made the following estimates for the year. (Estimated) Department Chair Table Desk Direct labour hours....... 40,000 26,000 20,000 Machine hours... 50,000 18,000 30,000 Security guards' hours. 80 70 60 Direct labour cost. $500,000 $250,000 $320,000 Direct materials. $65,000 $56,000 $32,000 Indirect materials .... $20,000 $30,000 $40,000 Total manufacturing overhead. $220,000 $234,000 $112,000 Administrative salaries $100,000 $75,000 $80,000 The records show the following information for Job 1A, which was entered into production on June 23 and completed on July 18: Department Chair Table Desk Direct labour hours. 350 160 100 Machine hours. 100 50 95 Direct labour cost $1,600 $1,200 $1,400 Direct materials. $600 $1,250 $2,000 On December 31, the company showed the following actual costs and operating data for all jobs worked on during the year: Department Chair Table Desk Direct labour hours.. 41.000 28.000 23,000 Machine hours. 52.000 17,600 32.000 Direct labour cost. $506.000 $240.000 $310.000 Direct materials $63.400 $54,300 $50.600 Manufacturing overhead $ 230.000 $235.000 $108.000 Calculate the predetermined overhead rates for the three departments, b) Calculate the total manufacturing overhead applied to Job 1A. Calculate the amount of under- or over-applied overhead in each department at the end of the year and indicate whether it is under-or over-applied. d) Explain why you would want to re-evaluate any of the predetermined overhead ratesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started