Answered step by step

Verified Expert Solution

Question

1 Approved Answer

-Please explain in words how the solution was gotten from the Calculation of Weighted Average Cost of Capital Using Book Value - Please explain in

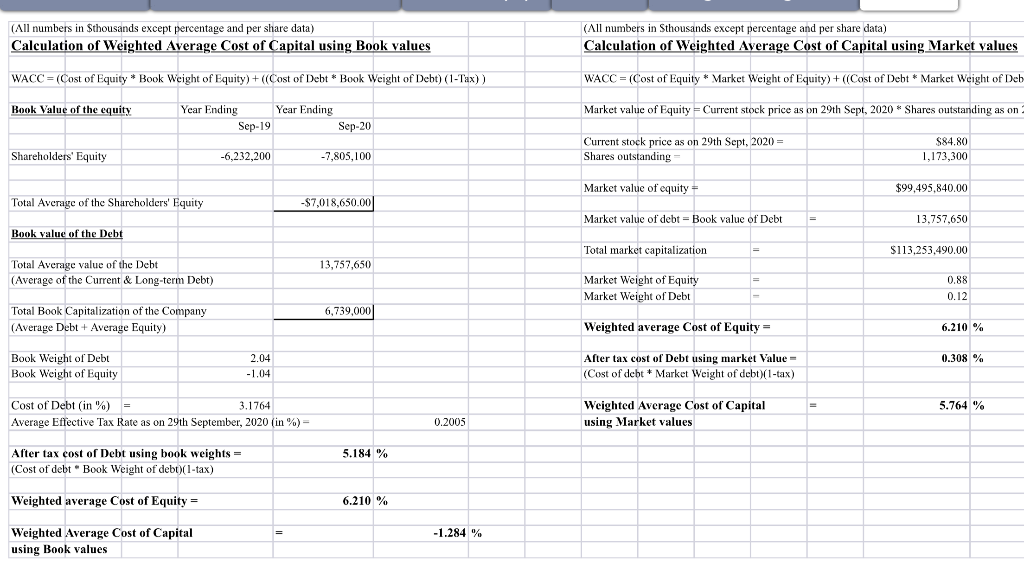

-Please explain in words how the solution was gotten from the "Calculation of Weighted Average Cost of Capital Using Book Value"

-Please explain in words how the solution was gotten from the "Calculation of Weighted Average Cost of Capital Using Market Value"

(All numbers in Sthousands except percentage and per share data) Calculation of Weighted Average Cost of Capital using Book values (All numbers in Sthousands except percentage and per share data) Calculation of Weighted Average Cost of Capital using Market values WACC = (Cost of Equity * Book Weight of Equity) + ((Cost of Debt * Book Weight of Debt) (1-Tax) ) WACC = (Cost of Equity * Market Weight of Equity) + ((Cost of Debt * Market Weight of Deb Book Value of the equity Year Ending Market value of Equity = Current stock price as on 29th Sept, 2020 * Shares outstanding as on Year Ending Sep-19 Sep-20 Shareholders' Equity $ $84.80 1,173,300 -6,232,200 Current stock price as on 29th Sept, 2020 = Shares outstanding - -7,805,100 Market value of equity = $99,495,840.00 Total Average of the Shareholders' Equity -$7,018,650.00 Market value of debt = Book value of Debt 13,757,650 Book value of the Debt Total market capitalization $113,253,490.00 13,757,650 Total Average value of the Debt (Average of the Current & Long-term Debt) Market Weight of Equity Market Weight of Debt 0.88 0.12 6,739,000 Total Book Capitalization of the Company (Average Debt + Average Equity) Weighted average Cost of Equity = 6.210 % 0.308 % Book Weight of Debt Book Weight of Equity 2.04 -1.04 After tax cost of Debt using market Value = (Cost of debt * Market Weight of debt(1-tax) Cost of Debt (in %) = 3.1764 Average Effective Tax Rate as on 29th September, 2020 (in %) = 5.764 % Weighted Average Cost of Capital using Market values 5.764% 0.2005 5.184 % After tax cost of Debt using book weights = (Cost of debt * Book Weight of debt)(1-tax) Weighted average Cost of Equity = 6.210 % -1.284 % Weighted Average Cost of Capital using Book valuesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started