Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please explain it in detail with AED analysis.... I'll give you up thumb definitely HAPPY is an multinational group company with presence in several countries.

please explain it in detail with AED analysis.... I'll give you up thumb definitely

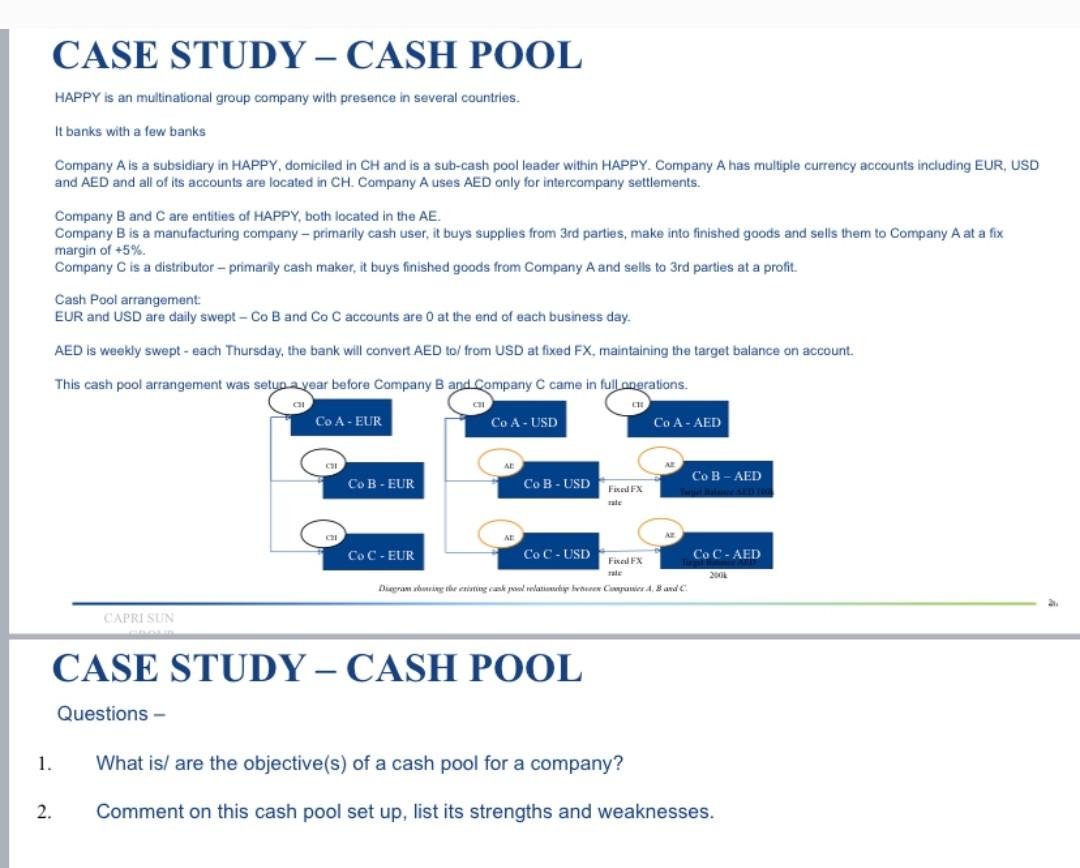

HAPPY is an multinational group company with presence in several countries. It banks with a few banks Company A is a subsidiary in HAPPY, domiciled in CH and is a sub-cash pool leader within HAPPY. Company A has multiple currency accounts including EUR, USD and AED and all of its accounts are located in CH. Company A uses AED only for intercompany settlements. Company B and C are entities of HAPPY, both located in the AE. Company B is a manufacturing company - primarily cash user, it buys supplies from 3rd parties, make into finished goods and sells them to Company A at a fix margin of 45%. Company C is a distributor - primarily cash maker, it buys finished goods from Company A and sells to 3 rd parties at a profit. Cash Pool arrangement: EUR and USD are daily swept - Co B and Co C accounts are 0 at the end of each business day. AED is weekly swept - each Thursday, the bank will convert AED tol from USD at fixed FX, maintaining the target balance on account. This cash pool arrangement was setupayear before Company B and Company C came in fullonerations. CAPRI SIN CASE STUDY - CASH POOL Questions - 1. What is/ are the objective(s) of a cash pool for a company? 2. Comment on this cash pool set up, list its strengths and weaknessesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started