Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please explain or show me the calculations how they got share dividend $425,000. Thanks! Sactions and the closing entries for net income and dividends. b.

please explain or show me the calculations how they got share dividend $425,000. Thanks!

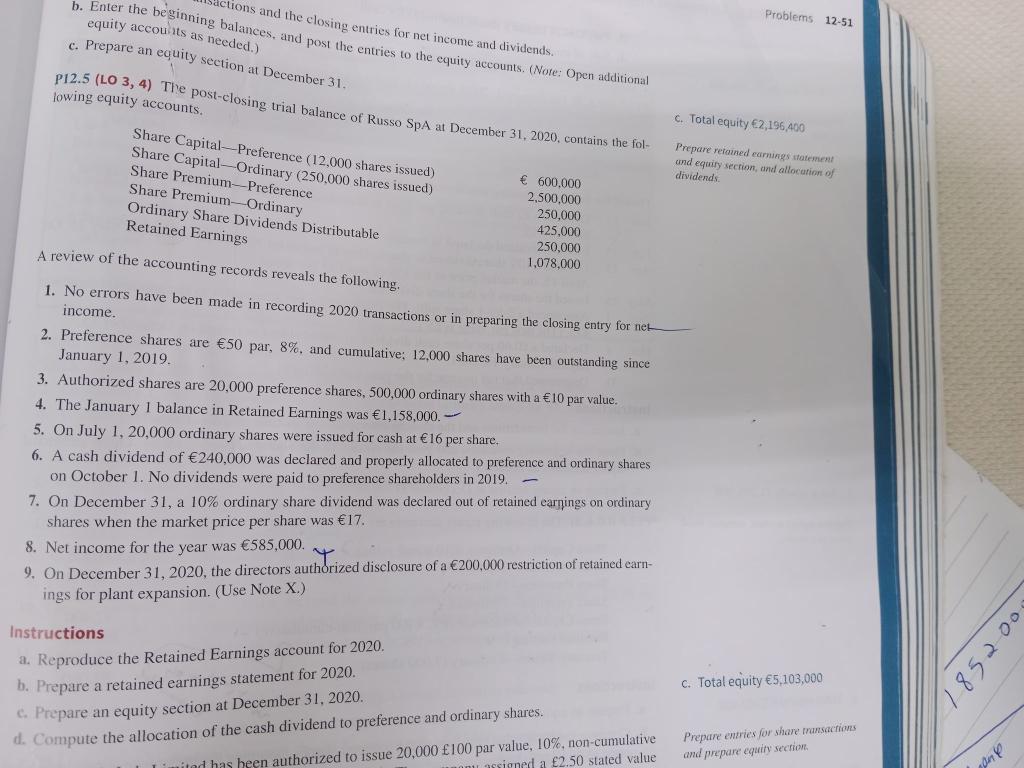

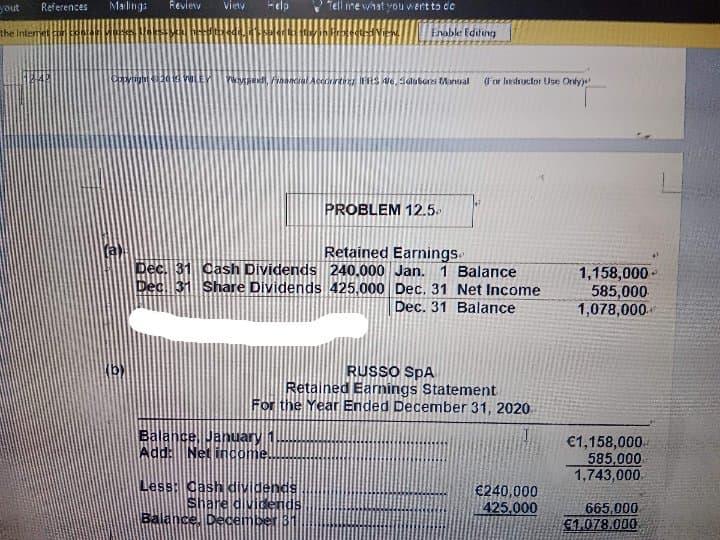

Sactions and the closing entries for net income and dividends. b. Enter the beginning balances, and post the entries to the equity accounts. (Note: Open additional equity accounts as needed.) c. Prepare an equity section at December 31. P12.5 (LO 3, 4) The post-closing trial balance of Russo SpA at December 31, 2020, contains the fol- lowing equity accounts. Share Capital-Preference (12,000 shares issued) Share Capital-Ordinary (250,000 shares issued) Share Premium-Preference 600.000 2,500,000 Share Premium-Ordinary 250,000 Ordinary Share Dividends Distributable Retained Earnings 425,000 250,000 1,078,000 A review of the accounting records reveals the following. 1. No errors have been made in recording 2020 transactions or in preparing the closing entry for net income. 2. Preference shares are 50 par, 8%, and cumulative; 12,000 shares have been outstanding since January 1, 2019. 3. Authorized shares are 20,000 preference shares, 500,000 ordinary shares with a 10 par value. 4. The January 1 balance in Retained Earnings was 1,158,000. 5. On July 1, 20,000 ordinary shares were issued for cash at 16 per share. 6. A cash dividend of 240,000 was declared and prop allocated preference and ordinary shares - on October 1. No dividends were paid to preference shareholders in 2019. 7. On December 31, a 10% ordinary share dividend was declared out of retained earnings on ordinary shares when the market price per share was 17. 8. Net income for the year was 585,000. 9. On December 31, 2020, the directors authorized disclosure of a 200,000 restriction of retained earn- ings for plant expansion. (Use Note X.) Instructions a. Reproduce the Retained Earnings account for 2020. b. Prepare a retained earnings statement for 2020. c. Prepare an equity section at December 31, 2020. d. Compute the allocation of the cash dividend to preference and ordinary shares. Limited has been authorized to issue 20,000 100 par value, 10%, non-cumulative nu assigned a 2.50 stated value Problems 12-51 c. Total equity 2,196,400 Prepare retained earnings statement and equity section, and allocation of dividends. c. Total equity 5,103,000 Prepare entries for share transactions and prepare equity section. dud 852000 Viety Help yout References Mailings Review the Internet de Marken Hotel beredd a fost View Tell me what you want to co Enable Editing CEBDght 4124 VOLEN Pend, Francial Accounters We Salubores Manual (For Instructor Use Only) PROBLEM 12.5 Dec. 31 Cash Dividends Dec 31 Share Dividends Retained Earnings 240,000 Jan. 1 Balance 425,000 Dec. 31 Net Income Dec. 31 Balance RUSSO SPA Retained Earnings Statement For the Year Ended December 31, 2020 I Balance, January Add: Net income. 240,000 Less: Cash dividends Share dividends 425,000 Balance, December 31 1,158,000 585,000 1,078,000. 1,158,000. 585,000 1,743,000 665,000 1.078.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started