Please explain part 2, I received help for part one already.

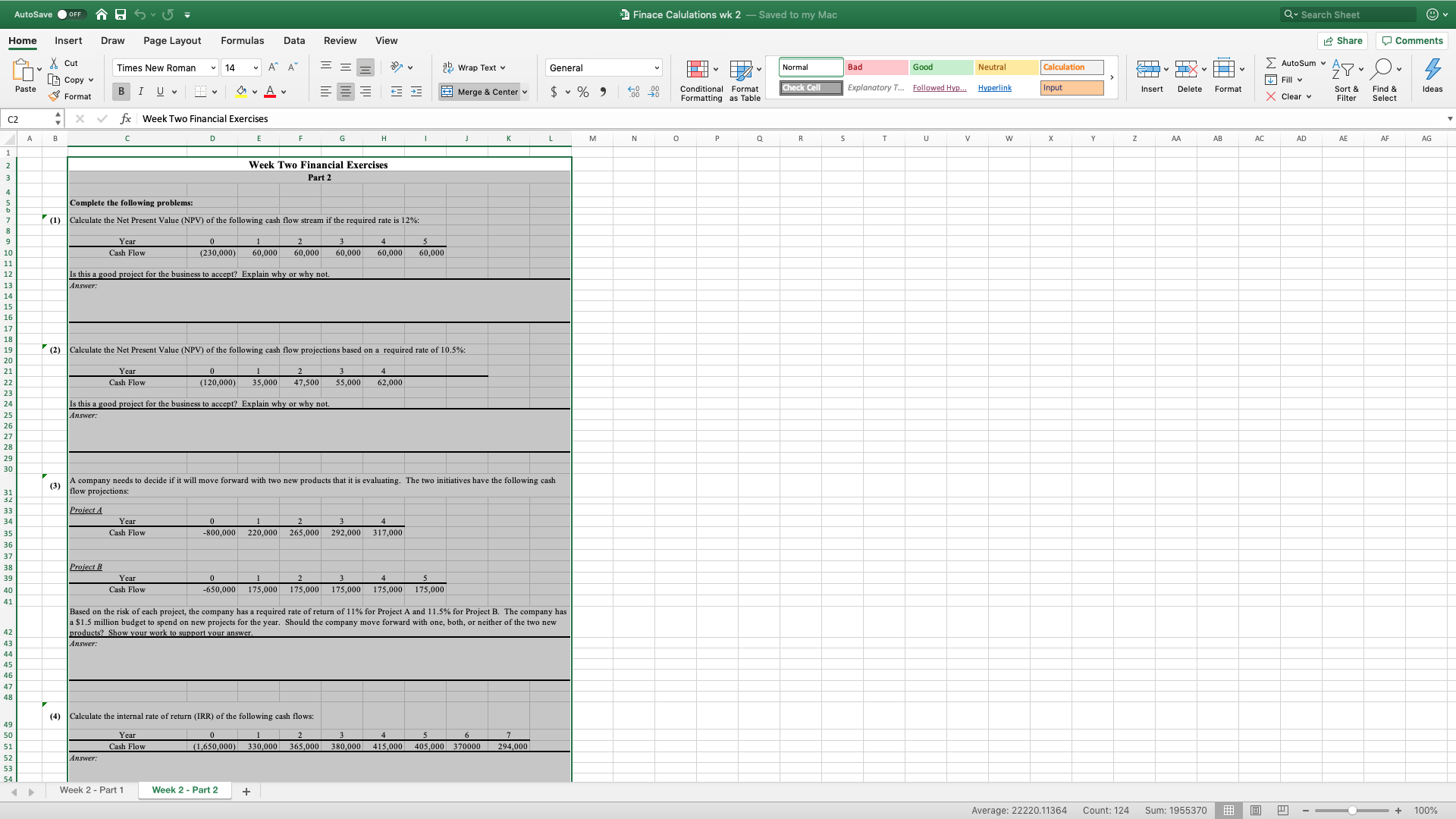

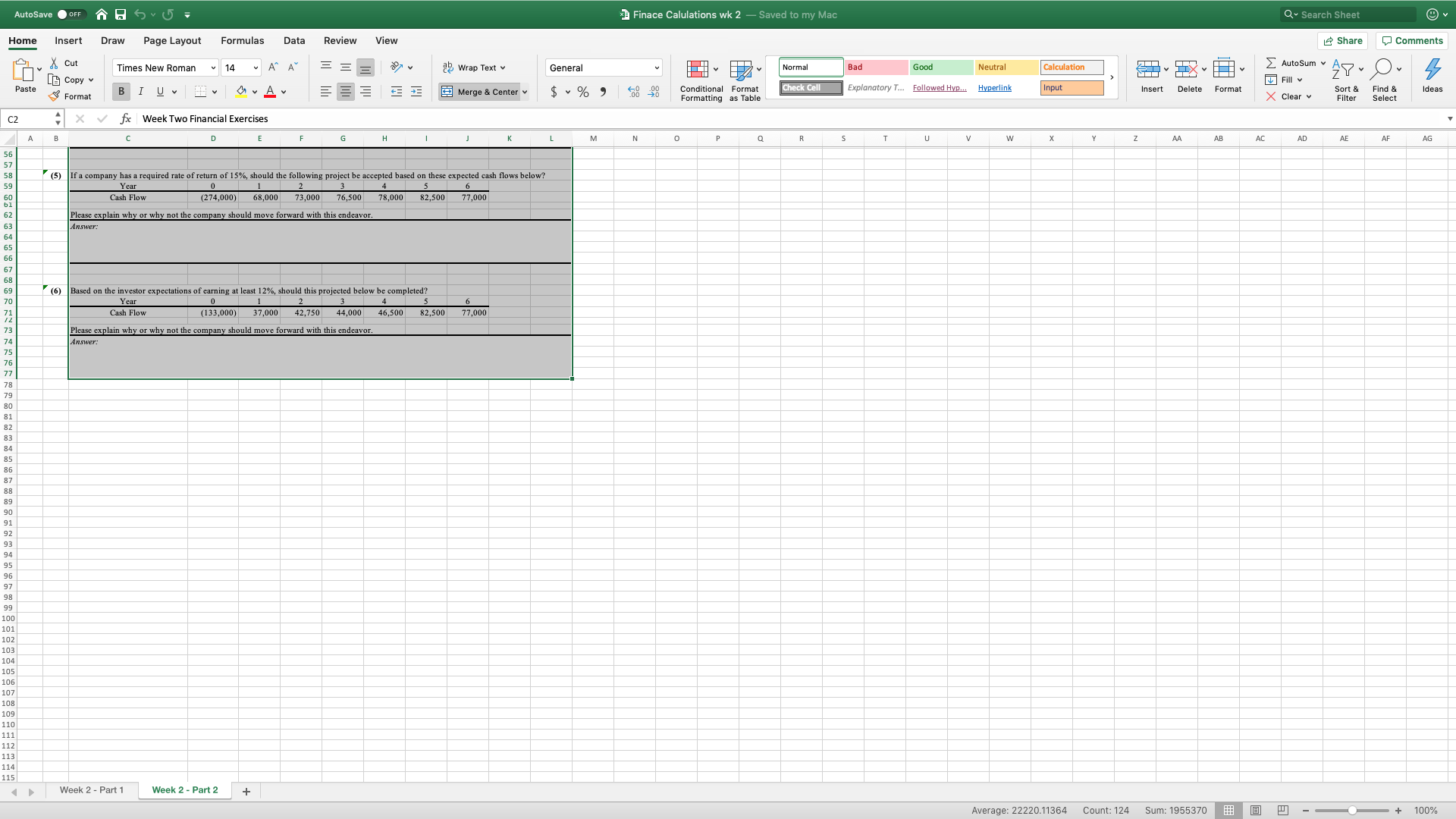

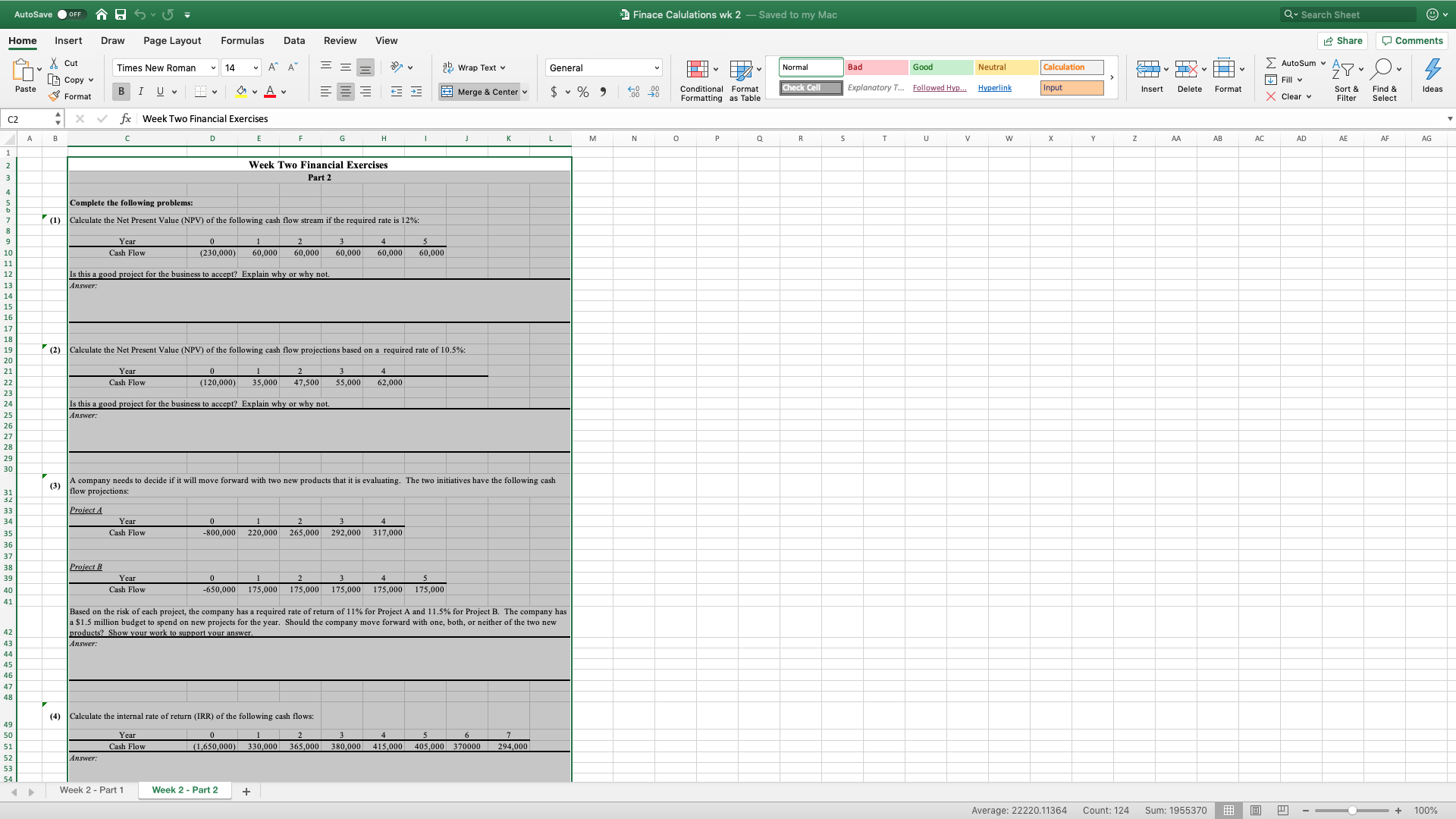

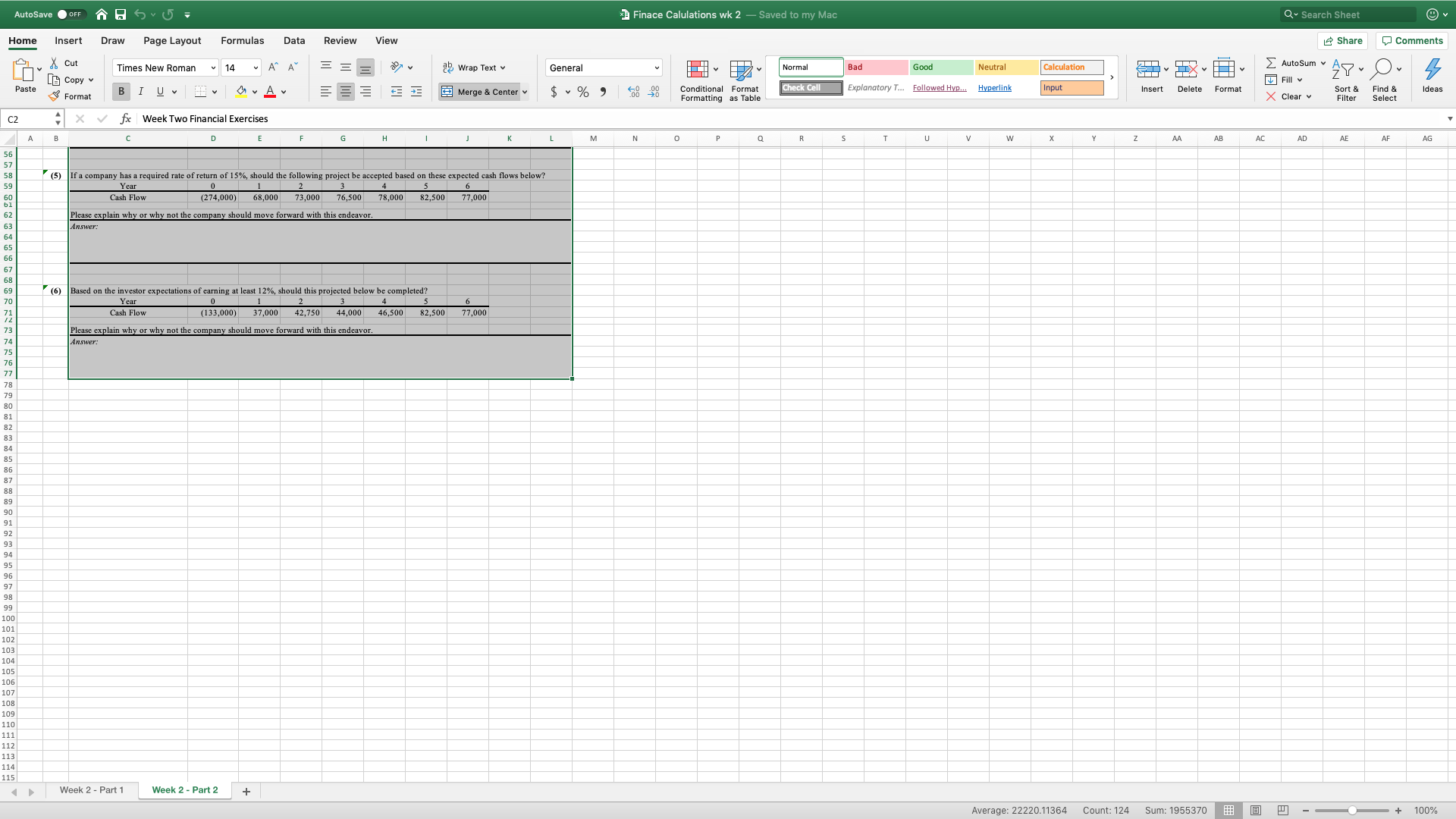

AutoSave . OFF ~ . 5 1 Finace Calulations wk 2 - Saved to my Mac Q ~ Search Sheet @ v Home Insert Draw Page Layout Formulas Data Review View Share Comments & Cut Times New Roman v 14 AA [ Copy = ap Wrap Text v General Normal Bad Good Neutral Calculation 2 AutoSum Paste Check Cell Explanatory T... Followed Hyp.. Hyperlink Input Insert Delete Format Fill Format BIUV UvAv Merge & Center $ ~ % " Conditional Format Sort & Find Ideas Formatting as Table X Clear v Filter Select C2 X V fx Week Two Financial Exercises G H K M 0 Q R S T U v w X Y Z AA AB AC AD AE AF AG W N Week Two Financial Exercises Part 2 Complete the following problems: (1) Calculate the Net Present Value (NPV) of the following cash flow stream if the required rate is 12%: 10 Year Cash Flow (230,000) 60,000 60,000 60,000 60,000 60,000 12 13 Is this a good project for the business to accept? Explain why or why not. 14 Answer: 15 16 17 18 19 20 (2) Calculate the Net Present Value (NPV) of the following cash flow projections based on a required rate of 10.5%: 21 22 Year 23 Cash Flow (120,000) 35,000 47,500 55,000 62,000 24 Is this a good project for the business to accept? Explain why or why not. Answer: 29 30 (3) flow projections A company needs to decide if it will move forward with two new products that it is evaluating. The two initiatives have the following cash Project A Year 0 Cash Flow 800,000 220,000 265,000 292,000 317,000 37 Project B Year Cash Flow -650,000 175,000 175,000 175,000 175,000 175,000 Based on the risk of each project, the company has a required rate of return of 11% for Project A and 11.5% for Project B. The company has a $1.5 million budget to spend on new projects for the year. Should the company move forward with one, both, or neither of the two new products? Show your work to support your answer. Answer: (4) Calculate the internal rate of return (IRR) of the following cash flows: 50 Year Cash Flow (1,650,000) 330,000 365,000 380.000 415,000 405,000 370000 294.000 53 Answer: SA Week 2 - Part 1 Week 2 - Part 2 + Average: 22220.11364 Count: 124 Sum: 1955370 - 100%@ v AutoSave . OFF . 5 1 Finace Calulations wk 2 - Saved to my Mac Q ~ Search Sheet Data Comments Insert Draw Page Layout Formulas Review View Share Home 2 AutoSum & Cut Times New Roman v 14 AA = 27 v ap Wrap Text v General Normal Bad Good Neutral Calculation CE Copy Conditional Format Explanatory T... Followed Hyp.. Hyperlink Input Insert Delete Format Fill Check Cell X Clear Sort & Find Select Ideas Paste Format BIUV UVAv Merge & Center v $ ~ % " Formatting as Table Filter C2 X V fx Week Two Financial Exercises B F G H 1 K L M Q R S U v w Z AA AB AC AD AE AF AG 57 58 59 (5) If a company has a required rate of return of 15%, should the following project be accepted based on these expected cash flows below? Year Cash Flow (274,060) 68,000 73,000 76,500 78,000 82,500 77,000 Please explain why or why not the company should move forward with this endeavor. Answer : 66 67 (6) Based on the investor expectations of earning at least 12%, should this projected below be completed? Year Cash Flow (133,000) 37,000 42,750 44,000 46,500 82,500 77,000 73 74 Please explain why or why not the company should move forward with this endeavor. 75 Answer: 76 77 78 79 80 81 82 83 84 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 107 108 109 110 111 112 113 114 115 Week 2 - Part 1 Week 2 - Part 2 + Average: 22220.11364 Count: 124 Sum: 1955370 - 100%