Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please explain step by step with formulas Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appeer below. The

please explain step by step with formulas

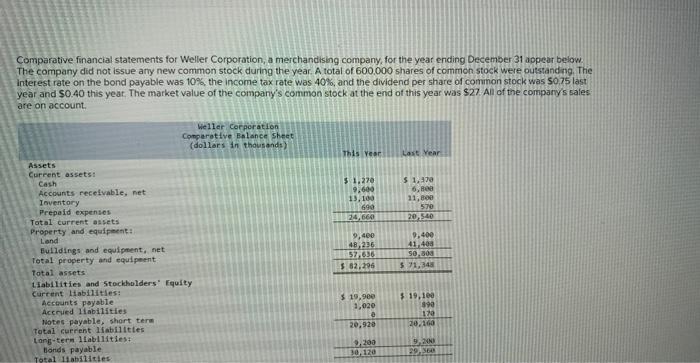

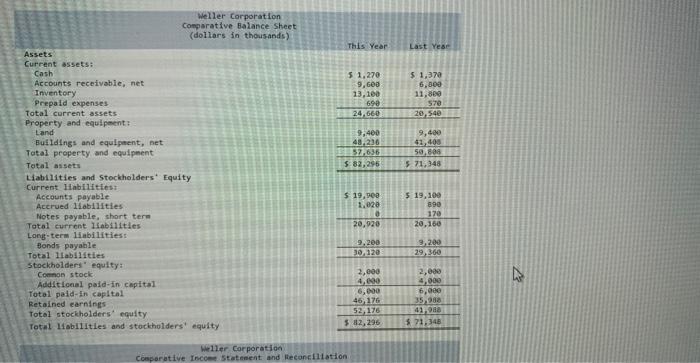

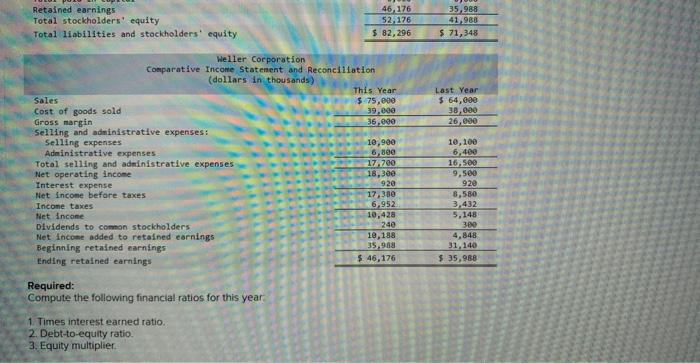

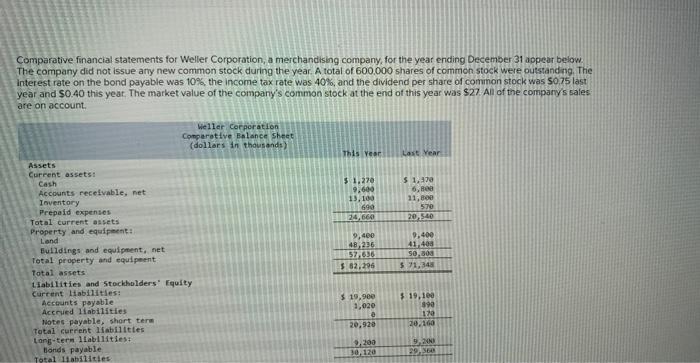

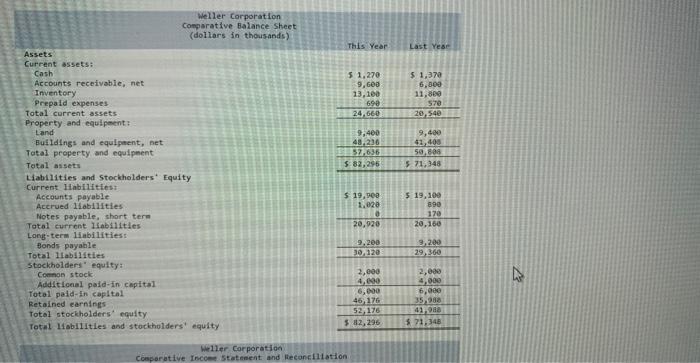

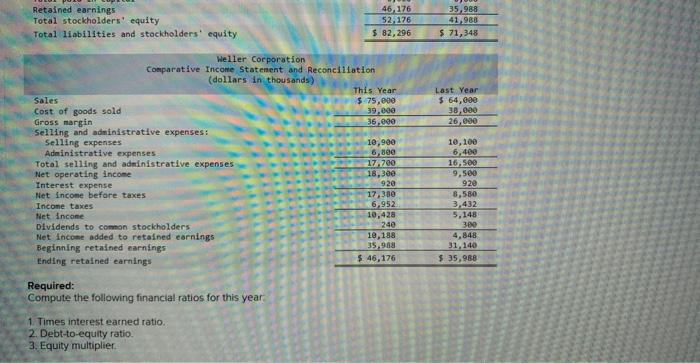

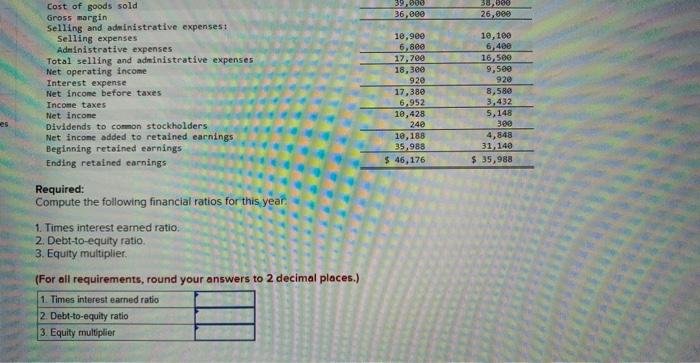

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appeer below. The company did not issue any new common stock during the year. A total of 600.000 shares of common stock were outstanding The interest rate on the bond payable was 10%, the income tax rate was 40%, and the dividend per share of cominon stock was 50.75 last year and $0.40 this year. The market value of the company's common stock at the end of this year was $27. All of the comparys sales are on account. Meller corporation Comprative Balance sheet (dollars in thousands) This Year Last Yese Assets Curcent assets: Cash Arcounts receivable, net Inventory Prepald expenses Total current assets Property and equipent: Land Buildings and equlpent, net Total property and equipnent Tetal assets \begin{tabular}{|rr} 51,270 & 51,370 \\ 9,600 & 6,309 \\ 13,160 & 11,369 \\ 690 & 570 \\ \hline 24,660 & 26,549 \\ \hline 9,400 & 9,400 \\ 48,236 & 41,409 \\ \hline 57,636 & 59,899 \\ \hline 582,256 & 57,348 \\ \hline \end{tabular} Liablities and Stockholders' Equity current Habilitiest Accounts payable Accrued Hobliitles Notes payable, short tern Total current liabilitles \begin{tabular}{rr} 519,909 & 519,109 \\ 1,020 & 890 \\ 0 & 170 \\ \hline 20,920 & 20,160 \end{tabular} Long-term liabilities: onds payable Total Hab1ities stockholders" equity: Comnon stock Additional paid-in capital Total paid-in capltal Retained earnines Totol stockholders' equity rotal liablittes and stockholders' equity We1ler Corporation coaparative Incoes statenent and kecanchlation Required: Compute the following financial ratios for this year: 1. Times interest earned ratio. 2. Debt-to-equity ratio. 3. Equity multiplier. Required: Compute the following financial ratios for this year. 1. Times interest eamed ratio. 2. Debt-to-equity ratio. 3. Equity multiplier. (For all requirements, round your answers to 2 decimal places.) Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appeer below. The company did not issue any new common stock during the year. A total of 600.000 shares of common stock were outstanding The interest rate on the bond payable was 10%, the income tax rate was 40%, and the dividend per share of cominon stock was 50.75 last year and $0.40 this year. The market value of the company's common stock at the end of this year was $27. All of the comparys sales are on account. Meller corporation Comprative Balance sheet (dollars in thousands) This Year Last Yese Assets Curcent assets: Cash Arcounts receivable, net Inventory Prepald expenses Total current assets Property and equipent: Land Buildings and equlpent, net Total property and equipnent Tetal assets \begin{tabular}{|rr} 51,270 & 51,370 \\ 9,600 & 6,309 \\ 13,160 & 11,369 \\ 690 & 570 \\ \hline 24,660 & 26,549 \\ \hline 9,400 & 9,400 \\ 48,236 & 41,409 \\ \hline 57,636 & 59,899 \\ \hline 582,256 & 57,348 \\ \hline \end{tabular} Liablities and Stockholders' Equity current Habilitiest Accounts payable Accrued Hobliitles Notes payable, short tern Total current liabilitles \begin{tabular}{rr} 519,909 & 519,109 \\ 1,020 & 890 \\ 0 & 170 \\ \hline 20,920 & 20,160 \end{tabular} Long-term liabilities: onds payable Total Hab1ities stockholders" equity: Comnon stock Additional paid-in capital Total paid-in capltal Retained earnines Totol stockholders' equity rotal liablittes and stockholders' equity We1ler Corporation coaparative Incoes statenent and kecanchlation Required: Compute the following financial ratios for this year: 1. Times interest earned ratio. 2. Debt-to-equity ratio. 3. Equity multiplier. Required: Compute the following financial ratios for this year. 1. Times interest eamed ratio. 2. Debt-to-equity ratio. 3. Equity multiplier. (For all requirements, round your answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started